How unconstrained fixed income helps navigate uncertainty

- 01 September 2020 (5 min read)

Key points

- In crisis phases investors expect their bond allocation to provide a degree of portfolio protection, but there’s more to fixed income than that

- An unconstrained approach can access a broad spectrum of opportunities with the potential to deliver outcomes ranging from capital protection to income and capital growth

- Investors should seek unconstrained fixed income strategies which are designed to navigate the whole market cycle. That means participating in recovery phases is as important as resilience against volatility.

Striking the right balance

It is at the height of crisis periods such as the one experienced earlier this year that investors expect fixed income to prove its worth by providing the resilience needed to weather the storm. However, that is not all today’s diverse global fixed income universe has to offer.

In our view, unconstrained total return-focused fixed income strategies should be designed to use their flexibility to navigate the changing macro and market environment. That is not to say they will always be in positive territory, but the broad idea is a strategy which has the potential to deliver attractive risk-adjusted returns through an economic cycle.

Striking the right balance of different risk factors and potential opportunities is key to how we manage our Global Strategic Bond strategy. We want to ensure that we have enough ammunition, both to provide a degree of resilience when required, but also to participate as much as possible in recovery markets that inevitably follow market downturns.

For much of 2019 and 2020, we have positioned ourselves across three main themes: own duration, be selectively long credit and maintain portfolio hedges. As markets now evolve from crisis period to recovery, the relative emphasis that we place on each of these themes may be shifting, but our convictions remain steadfast.

Responding to the downside and the upside

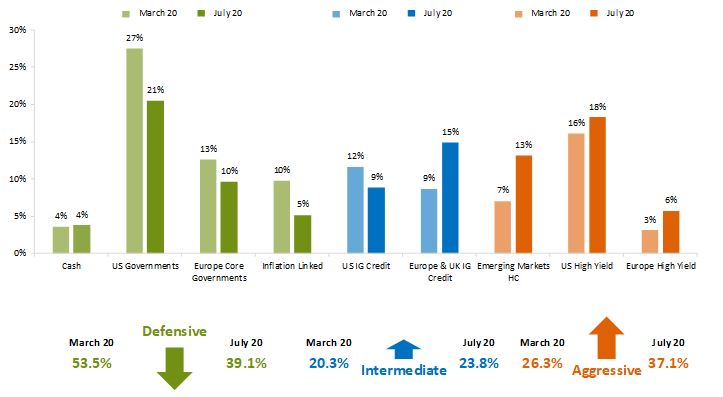

The foundation of our unconstrained strategy is a simple, transparent framework which breaks the fixed income universe down into three categories: Defensive, Intermediate and Aggressive. Figure 1 shows the split between these categories as at the end of July 2020, in comparison to March 2020, highlighting how we are now shifting the strategy to focus on the recovery.

Fig. 1: Current portfolio positioning: March vs. July 2020

Source: AXA IM as at 31/07/2020. Data is unaudited and sourced from our front office portfolio management system.

Figure 1 shows that our strategy came into 2020 relatively defensively positioned based on our observations indicating that we were approaching the end of the investment cycle. It also shows that by the summer we had meaningfully rotated the portfolio more towards the intermediate and aggressive assets which have been benefitting from the recovery.

The shift in relative emphasis of our three key themes is explained below:

- Carrying quality duration: Coming into 2020, mainstream government bonds yields were low, but we believed they could go even lower with the end of the cycle approaching. Although we have brought exposure down quite a bit since March, we still think that always maintaining some portion of the portfolio at the more defensive end of the spectrum to offset some of the more ‘exciting’ assets provides the best means of delivering the potential profile investors expect from their core fixed income allocation.

- Selectively long credit: With that said, an unconstrained total return strategy attracts investors seeking to use fixed income as a growth asset, so whilst capital preservation is key, it is equally vital to have exposure to a diverse pool of return-seeking assets. We had been cautious on spread risk for much of 2019 and the early part of 2020, preferring to own smaller pockets of value. Post crisis, we are now starting to turn more opportunistic on cheaper valuations in developed market credit and emerging markets. Since March we have also participated in some new issuance in investment grade credit at attractive spreads.

- Portfolio hedges: We believe having elevated levels of cash is important in periods of uncertainty. While there is no yield, there is also no risk. Cash levels have come down somewhat during the recovery as we rotate the portfolio towards higher beta opportunities. We continue to use Credit Default Swaps to tactically dial risk up and down in high yield, which we believe will remain an important feature as we do not expect the recovery to occur in a straight line.

Although the strategy lost value when the crisis hit its peak in March, we were able to mitigate the drawdown compared to both peers and the market, recovering our losses relatively swiftly. Equally important is that strategy performance has turned materially positive, returning over 4.5% for the year-to-date1 . It is worth re-emphasising that, generally speaking, investors in total return strategies do have some appetite for drawdown, in the knowledge that risk assets are typically the first to recover following a crisis and any recovery has the potential to be highly profitable.

This focus on flexibly rotating the portfolio to position as appropriate for resilience or recovery is at the heart of the strategy’s approach. It is interesting to highlight the strategy’s performance during past turbulent periods over the last three years, to demonstrate how we aim to participate as much as possible in both resilience and recovery periods.

Fig. 2: 2018/2019 market sell-off

Source: AXA IM and Morningstar. Performance is shown on a net of fee basis for a representative account from the Global Strategic Bond strategy (base currency USD), compared to its Morningstar Peer Group, the EAA Fund Global Flexible Bond – USD Hedged. Past performance is not a guide to future performance.

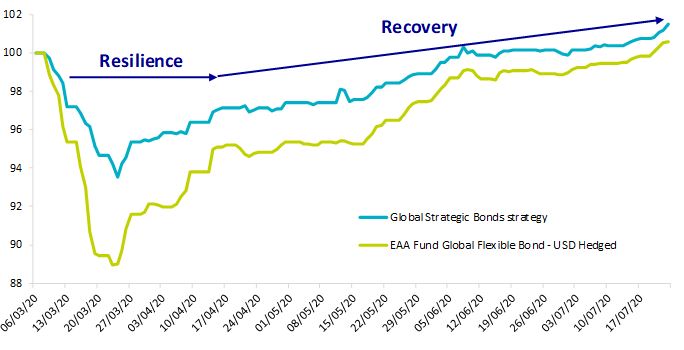

Fig. 3: COVID-19 crisis

Source: AXA IM and Morningstar. Performance is shown on a net of fee basis for a representative account from the Global Strategic Bond strategy (base currency USD), compared to its Morningstar Peer Group, the EAA Fund Global Flexible Bond – USD Hedged. Past performance is not a guide to future performance.

Figure 2 shows the strategy’s performance during 2018 in a turbulent year for markets, stoked by fears of slowing global growth and tightening monetary policy, followed by the market recovery in the first half of 2019. During the “resilience” phase (01/05/2019 – 31/12/2019), the strategy generated a total return of +0.68%, outperforming its Morningstar Peer Group which returned -1.13% over the same period. In the ensuing “recovery” phase which occurred in the first half of 2019 (01/01/2019 – 30/06/2019), the strategy also managed to outperform its Peer Group, returning +6.95% and +6.37% respectively.

However, Figure 3 teaches us that outperforming in both “resilience” and “recovery” phases is not straightforward, based on the fact that strategies which suffer greater drawdowns are more likely to rebound quicker. The ongoing COVID-19 fallout demonstrates this well: during the real crisis period of March and early April (when central bank stimulus stepped in), our strategy suffered a drawdown of -6.45%, compared to -11.02% for the Peer Group – thereby significantly outperforming during the “resilience” phase. That said, as demonstrated in Figure 3, since early April the recovery has so far been sharper in the Peer Group, given that the bottom reached in March was that much greater – most likely due to the greater average concentration of credit risk held by the Peer Group. Most importantly, however, taking both “resilience” and “recovery” phases (09/03/2020 – 23/07/2020), our strategy has returned +1.51% compared to +0.59% for the Peer Group.

While past performance is not a guide to future performance, it is helpful to view performance during the first half of 2020 in this context – in other words to consider not only the relative resilience at the height of the crisis, but the potential to participate in the recovery over the period ahead, to which we are now turning our attention.

Outlook

Covid-19 has been a huge shock to the world and a huge amount of uncertainty remains around the virus itself and the ongoing economic and market impact. For us, it will be as important as ever to stick to positioning the portfolio with the potential to deliver the sort of outcomes our investors expect.

In terms of what we can observe today, we see an ongoing battle between fundamentals and technicals. We expect a weak fundamental macroeconomic backdrop for some time, but this is so far being outweighed by strong technicals supported by policy around the world. Against this background, sentiment and valuations are mixed.

Parts of high yield credit and emerging markets are attractively-priced but we expect defaults to rise. So, we see opportunities to go yield-hunting but we would not be maximum bullish on credit in this environment and still see merit in balancing the risks with mainstream government bonds which even at low levels of yield offer potential defensive properties. Especially considering what profile a strategy like ours should offer investors.

Importantly, we do not believe the recovery will come in a straight line and volatility will persist. We intend to play that by employing our strategy’s flexibility to pick up assets which become priced to offer potentially good returns over the next 12 months. However, we will still use cash and portfolio hedges to do so cautiously.

Overall, we believe a low yield/high volatility environment calls for unconstrained, flexible strategies. It will be important to maintain focus on transparency and risk management as global fixed income is a broad spectrum with plenty of pitfalls. In our view, the key to navigating whatever comes next is actively managed and diversified asset allocation combined with high conviction security selection, ultimately aiming to deliver attractive risk-adjusted returns.

- U291cmNlOiBBWEEgSU0gYW5kIE1vcm5pbmdzdGFyLiBQZXJmb3JtYW5jZSBpcyBzaG93biBvbiBhIG5ldCBvZiBmZWUgYmFzaXMgZm9yIGEgcmVwcmVzZW50YXRpdmUgYWNjb3VudCBmcm9tIHRoZSBHbG9iYWwgU3RyYXRlZ2ljIEJvbmQgc3RyYXRlZ3kgKGJhc2UgY3VycmVuY3kgVVNEKS4=

Risks

Counterparty Risk: Risk of bankruptcy, insolvency, or payment or delivery failure of any of the Sub-Fund's counterparties, leading to a payment or delivery default.

Operational Risk: Risk that operational processes, including those related to the safekeeping of assets may fail, resulting in losses.

Liquidity Risk: risk of low liquidity level in certain market conditions that might lead the Sub-Fund to face difficulties valuing, purchasing or selling all/part of its assets and resulting in potential impact on its net asset value.

Credit Risk: Risk that issuers of debt securities held in the Sub-Fund may default on their obligations or have their credit rating downgraded, resulting in a decrease in the Net Asset Value.

Impact of any techniques such as derivatives: Certain management strategies involve specific risks, such as liquidity risk, credit risk, counterparty risk, legal risk, valuation risk, operational risk and risks related to the underlying assets.

The use of such strategies may also involve leverage, which may increase the effect of market movements on the Sub-Fund and may result in significant risk of losses

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.