Can electric vehicles help drive a green recovery?

The Impact of Covid-19 on Air Pollution

Our world is increasingly urban. The U.N. calculates that more than one-quarter of the world’s population live in cities with more than 1 million inhabitants. But while city populations are growing quickly, their transport systems can’t keep up. According to McKinsey

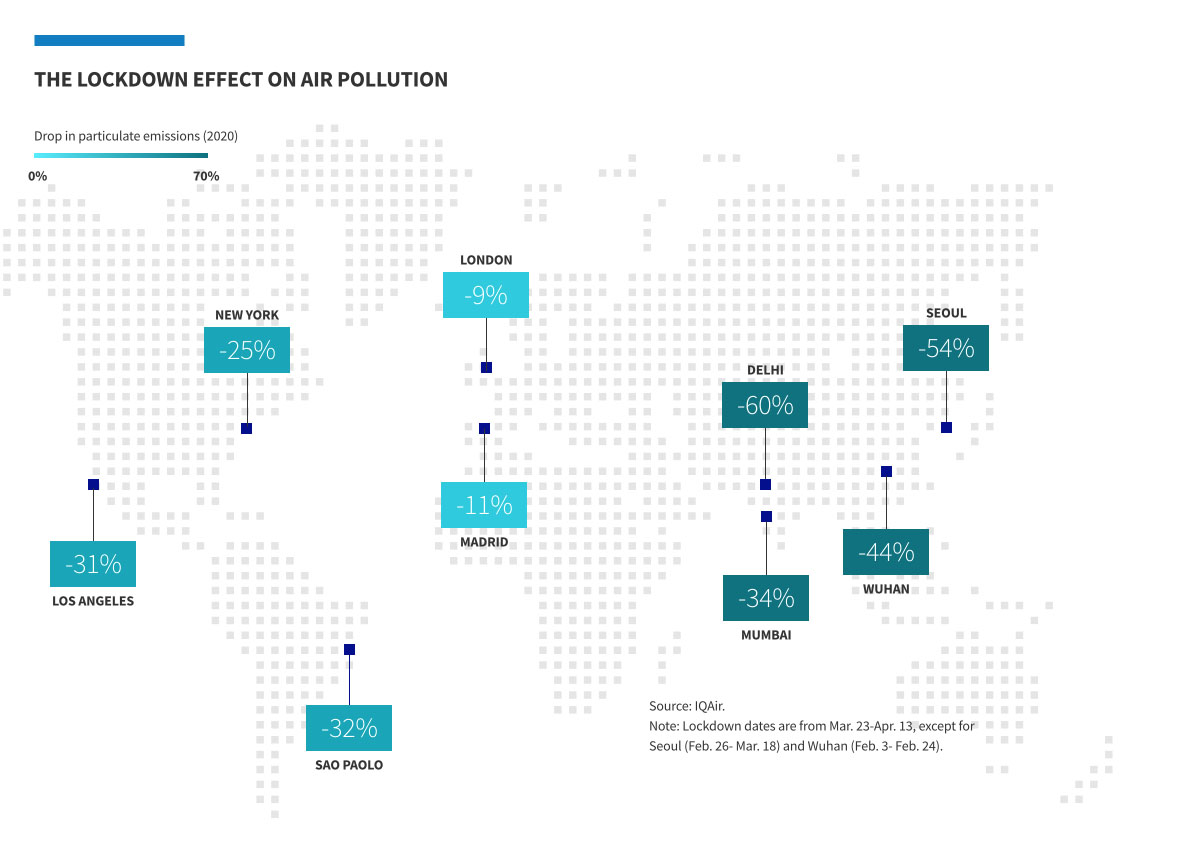

Increasing population density and slow-moving traffic mean unhealthy environments for citizens. The dramatic drop in air pollution during the coronavirus lockdown offered the world a stark reminder of the damage regular traffic volumes have on air quality. As an estimated one-third of the world’s population

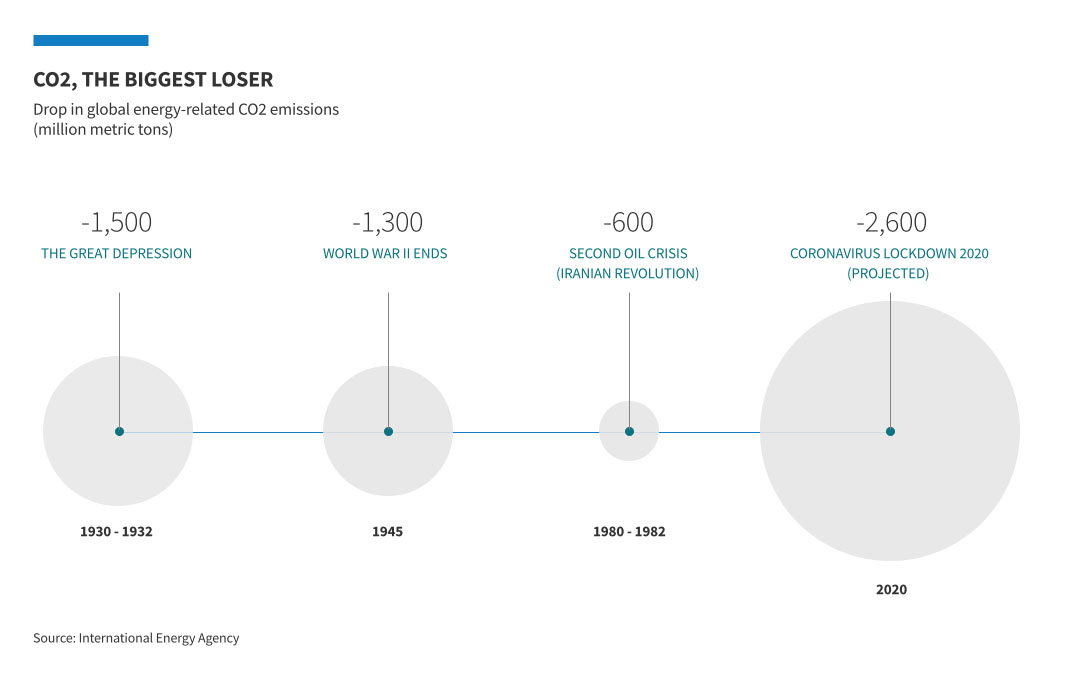

"Coronavirus looks set to cause the largest-ever annual fall in CO2 emissions." Dr. Simon Evans, Deputy Editor and Policy Editor, Carbon Brief

Transport is the second-largest contributor to air pollution, after industrial processes; BloombergNEF (BNEF) calculates that it accounts for one-quarter of the world’s total CO2 emissions. When that figure is broken down, road vehicles—cars, trucks, buses, two- and three-wheelers—account for nearly three-quarters

With an estimated 64 million passenger cars

Cities Changing Their Travel Plans

As cities begin to emerge from their respective lockdowns, people are on the move once again, and traffic figures are rising once more

Many commuters have sought their own solutions to socially distanced, less-polluting methods of personal transport, notably in Europe

In London, the need to help commuters get back to work in one of Europe’s most congested cities has seen the ban on rented electric scooters on public roads lifted

Paris Mayor Anne Hidalgo has proposed dedicating a lane of the inner city’s highway road—the Boulevard Périphérique—to public transit, zero-emission vehicles and carpoolers. Diesel vehicles will be banned from the highway by 2024, and only low-emission vehicles will be granted access by 2030.

"Globally, there’s a huge regulatory push to deliver on the Paris Agreement. Ultimately, the long-term goal is to tackle climate change and achieve greater levels of responsible investing." Yo Takatsuki, Head of ESG Research and Active Ownership, AXA Investment Managers (AXA IM)

"Covid-19 is a terrible health crisis, but the lockdown and the recovery should not be achieved at the expense of the fight against climate change and pollution in our cities." Anne Hidalgo, Paris Mayor

"Air pollution is the fourth-largest risk factor to human health on the planet." World Health Organization

The Outlook for EVs: EVs Driving Change

The U.N. has designated 2020 as the start of the Decade of Action

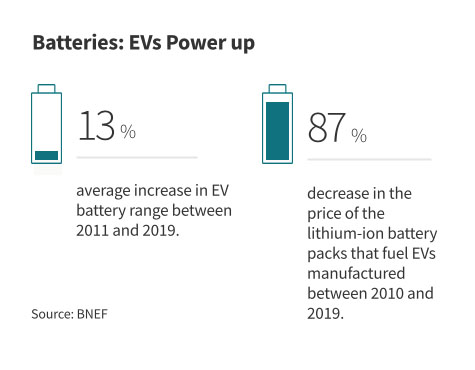

In recent years, the EV industry has worked hard at overcoming the challenges of cost competitiveness, achievable mileage and an adequate charging network to make EVs a viable alternative to combustion engine-powered vehicles.

However, there is still some ways to go. The average retail price of the gasoline and diesel cars sold through September 2019 was $35,970, while the electric counterpart cost $51,691, according to JATO Dynamics, a supplier of automotive business intelligence.

"Automakers are increasingly recognizing that they need to start to invest in products that are viable going forward. Clearly, that means electric." Amanda O’Toole, Portfolio Manager, Clean Economy strategy, AXA IM

The current unique selling point for EVs is their overall lowering running costs, but a number of automakers appear to be addressing the gap by lowering prices

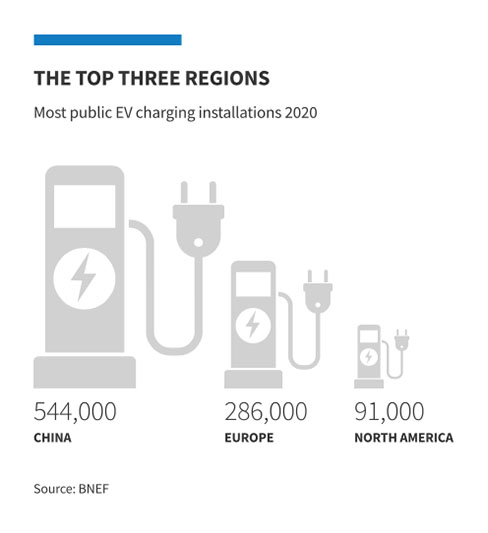

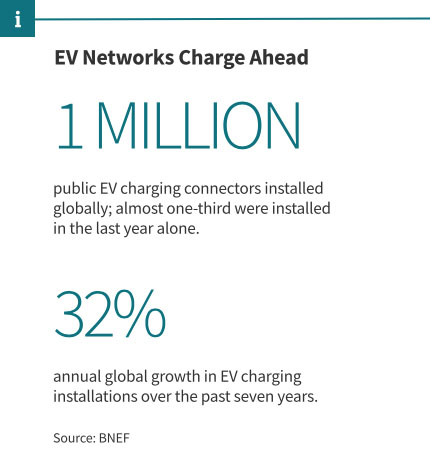

In addition to making EVs more affordable, the charging networks will also need to attract significant levels of investment. BNEF projects that within Europe, the need for expanding EV infrastructure, will create an investment opportunity worth $750 million every year until 2025, and more than $1 billion per year through the decade after that. This could create a myriad of opportunities for active thematic investors.

The Million-Mile Battery: In June, Chinese battery maker Contemporary Amperex Technology crossed a major threshold—the development of an EV battery that lasts more than a million miles. The company, which supplies the batteries for Tesla’s and Volkswagen’s EV power units, announced

*Stocks shown for illustrative purposes only and should not be considered as advice or a recommendation for an investment strategy.

Are Trends Electric? A Helping Hand for EVs

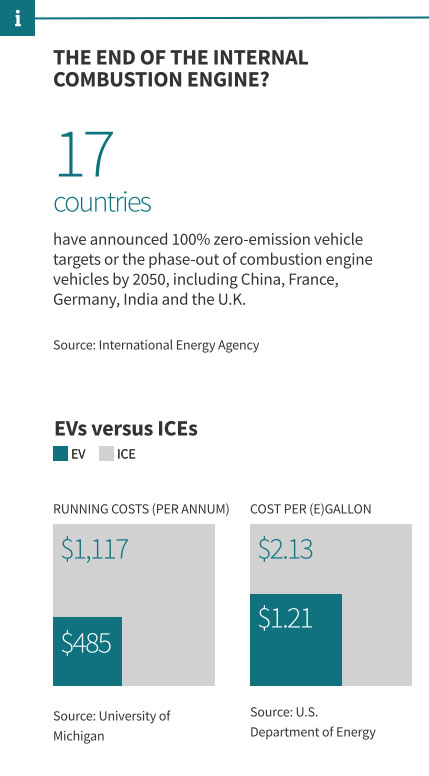

As part of the overall global transport picture, EV numbers remain comparatively small, despite the rapid growth. In its latest Long-Term Electric Vehicle Outlook

In spite of ongoing technological advancements, EVs remain reliant on incentives to make a dent in the market dominance of combustion engine vehicles. According to AXA IM’s Amanda O’Toole: “The sort of schemes like the European Union (E.U.) Green Recovery help to support the market and are clearly positive, but I still think there's a lot left to do.”

A number of governments have been keen to bolster the adoption of EVs through subsidies and tax incentives. In 2020, direct purchase subsidies for EVs ranged from over $2,100 in India to a maximum of $14,700 in Singapore, while in some countries EVs can cost as little as a mobile-phone contract

Keen to secure a greener future for Europe, Ursula von der Leyen, President of the European Commission, described the plan to make the E.U. the world’s first carbon-neutral continent by 2050 as a “man on the moon moment.”

“The [younger] generations have forced governments to recognize that it has to be a stimulus package that is palatable to them,” O’Toole says. “They would consider it unforgivable for governments to be seen propping up some of the old-world industries that they don’t view as being relevant for the future.

BNEF expects a 23% decline in sales of internal combustion engine (ICE) vehicles this year compared with 2019. However, EVs are not immune to the pandemic-driven global economic slowdown either. BNEF research shows that EV sales will shrink this year, falling 18% to about 1.7 million units, but they are likely to return to growth over the next four years, topping 6.9 million by 2024.

“I think in the short term, what we’re seeing is a fairly cyclical drop in demand for autos,” says O’Toole. “Some people are worried about the economic future and are not out buying a new car. But I’m more optimistic about the medium term, and certainly optimistic about the longer term.”

EVs Offer Asia a Chance to Clear the Air

In China, support for the EV industry is an official priority. In addition to a $30 billion plan to create a series of EV towns

Air pollution problems in Asia’s cities are particularly acute. The drive to quickly expand the economies of China and India, in particular, means that the region is home to many of the world’s most polluted cities

China’s air pollution is so extreme that in 2015, independent research group Berkeley Earth estimated that it contributed to 1.6 million deaths per year in the country. In India, a report on the effect of the Janta Curfew

With a growing and increasingly affluent urban population, India is also looking toward EVs as a solution to tackle its transport pollution problems. Last year, a mix of corporate and private equity investors were responsible for $397 million invested

Elsewhere in Asia, Singapore

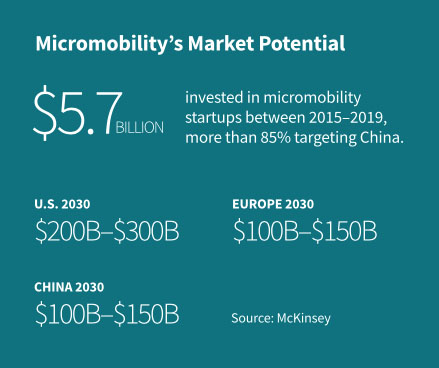

The Market for Micromobility: In 2020, the smaller, micromobility EVs, with two or three wheels, are leading the way. Almost 250 million of these electric vehicles are on the road today. Chinese consumers will buy an estimated 18.2 million electric two-wheelers this year and by 2040, BNEF expects the world will buy 70 million of them annually. However, this is not the first time the prospect of a micromobility revolution has ridden into view. In 2018, early success in bike rental and sharing led to oversupply in the market and bike “graveyards,” as the trend for two-wheeled transport turned sour. It does appear that the next generation of bike-sharing businesses are taking a more measured approach. In China, for example, bikes will be connected to the domestic BeiDou

The Environmental Impact of EVs: How to Keep the Skies Blue

In a world weaning itself off the internal combustion engine, the need for gasoline will be overtaken by a growing demand for renewable electricity. By 2040, EVs will account for 9% of the world’s total electricity demand, and for air quality to improve (without drastic global lockdowns), the energy that powers the EV revolution needs to be equally clean.

Yo Takatsuki of AXA IM points out that in Australia “public transport networks are being fuelled by electricity generated by coal fired power stations. You need to be mindful that ultimately the source of energy is really what we need to be questioning first and foremost. And then the demand side of how we're using it.”

Through initiatives such as the E.U. Green Deal, along with improving technology and increasing investment

“When it comes to energy generation, it’s clear that some countries are already considering whether to turn back on the most polluting forms of energy generation, which are inevitably coal, first, and then other types of fossil fuels,” observes Takatsuki. “But the U.K. has accelerated its reliance on renewable energy as the base energy [source]. That’s been a big miracle that’s happened in the U.K., and we may see similar patterns replicated elsewhere.”

The Investment Outlook for EVs

Through subsidies, incentives and regulation, governments are keen to see an end to combustion-powered vehicles. Automakers are responding, with ambitious plans to transition to EVs

With 10 years left to meet the Paris Agreement that aims to limit the Earth’s temperature rise to less than 2C, investors are looking to industries that offer sustainable returns

The era of the EV isn’t here just yet, but if the last century was driven by the combustion engine, this one will be battery-powered. As the world looks for sustainable solutions that help it deal with the wide-ranging effects of the pandemic and the urgent challenge of climate change, EVs offer an opportunity to invest in both.

Our responsible investing approach

We actively invest for the long-term prosperity of our clients and to secure a sustainable future for the planet.

Find out moreDisclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial, and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee that forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document are provided based on our state of knowledge at the time of creation of this document. While every care is taken, no representation or warranty (including liability toward third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision. Issued in the U.K. by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the U.K. Registered in England and Wales, No: 01431068. Registered Office: 155 Bishopsgate, London, EC2M 3YD (until 31 Dec 2020); 22 Bishopsgate, London, EC2N 4BQ (from 1 Jan 2021).

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.