How a volatile environment offers new routes to active ETFs

KEY POINTS

In recent years, ETF investors have increasingly demanded more choice in how to build well-balanced portfolios through their vehicle of choice. Now they can enjoy access to a plethora of areas across the investment spectrum, while still maintaining the benefits of an ETF structure. Active ETFs are at the forefront of these exciting innovations and combine ETF features such as ease of access, cost efficiency, and liquidity, with the potential benefits of active risk management and alpha opportunities.

Most investors have historically used ETFs as equity-index trackers. This can provide a cost-effective way to gain exposure to financial markets through a simpler process than the often highly intermediated routes of investing in mutual funds. However, an ETF is only a ‘wrapper’, and all kinds of investment strategies can be used in the vehicle. As such, active ETFs have the potential to offer the best of both the ETF and mutual fund worlds by combining active management with the inherent ETF characteristics that make them popular among investors.

In 2024, actively managed ETFs enjoyed surging popularity with $18bn of inflows. So, even if 90% of flows were into passive vehicles, active ETFs are a rapidly growing area. The advantages of active management can be particularly helpful in navigating the complexity of fixed income markets, and this is an area that has opened up to ETF investors through the growth of active ETFs. In 2024, European active fixed income ETFs gathered $2.4bn in inflows – a huge increase from $745m in 2023. And with $4.5bn of flows so far this year, 2025 is shaping up to be another record year for active fixed income ETFs

New strategies to meet current market conditions

Active approaches can exploit different macroeconomic conditions, across market cycles, and across countries. In times of economic uncertainty and market volatility, when there is an increased demand for the flexibility of dynamic management to navigate challenging market conditions, active ETFs could offer potential solutions for investors due to their ability to respond to market events.

For example, during the dramatic market volatility between 2 April and 9 April - immediately following US President Donald Trump’s ‘Liberation Day’ announcement, actively managed UCITS ETFs experienced positive inflows, with a net inflow of $20m adding to the $7bn collected year-to-date, while their passive counterparts experienced net outflows

With that in mind, this year has seen an increase in interest in both short duration and inflation ETF solutions due to the falling rate environment and geopolitical uncertainty. However, UCITS ETF universe, particularly on the passive side, doesn’t have the breadth of options in either of these asset classes compared to mutual funds.

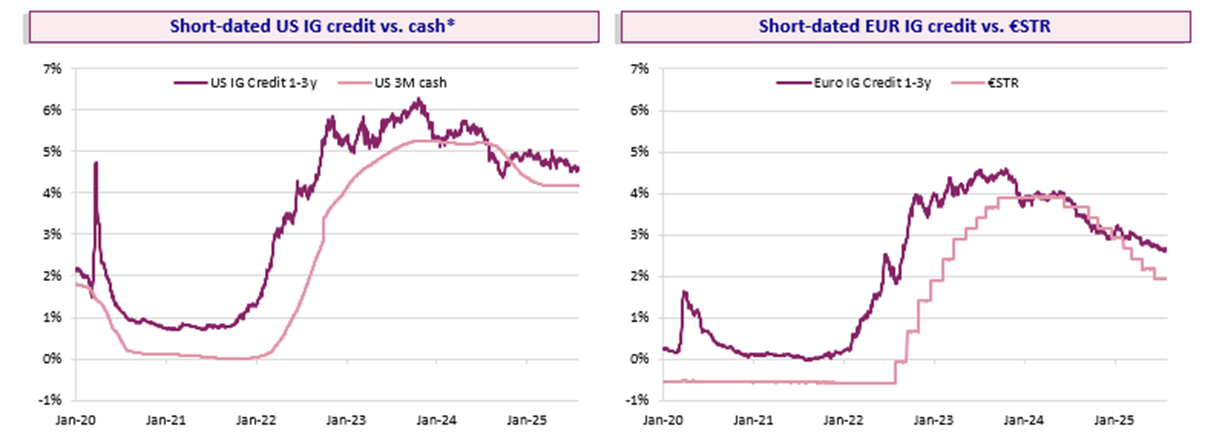

While there are over 140 UCITS ETFs available in the short duration space, only a few active strategies exist- especially in corporate short duration - and even fewer active ETFs provide global exposure. At a time when central banks across the globe are pausing or reversing their interest rate hiking cycle, short duration may offer attractive yield versus cash. This is a trend which is expected to continue given anticipated further rate cuts from the European Central Bank, Federal Reserve, as well as the Bank of England. We can see this when comparing the short duration US investment grade (IG) credit (one-to-three year) vs. US cash level, and one-to-three year euro IG credit vs. euro short-term rate. With attractive yields and bond characteristics that should limit the exposure to interest rate risk, short duration credit may offer a potentially good alternative to cash.

Source: AXA IM, Bloomberg as of 31/07/2025. The graphic represents the short-dated IG corporate index and cash yields. *US Cash is represented by the ICE BofA US Dollar 3-Month Deposit Bid Rate Average Index (L5US). €STR = ESTRON index. The short-dated US Corporate index is represented by the ICE BofA 1-3 year US Corporate Index (C1A0). The short-dated Euro Corporate index is represented by the ICE BofA 1-3 year Euro Corporate Index (ER01). For illustrative purposes only.

Given this consideration across markets, active ETF global short duration strategies, we believe, should offer investors an opportunity to access a fixed income strategy that was previously only available through mutual funds.

ETF inflation market grows as inflation increases

As we start to see inflationary pressures mount due to factors such as geopolitical tensions, building a portfolio that can potentially mitigate inflation is becoming increasingly important for ETF investors. We believe a stagflation scenario - high, sticky inflation combined with slowing growth - is likely in the US, making inflation-linked bonds potentially particularly attractive.

In this environment, investors may still be able to earn a decent income from inflation indexation, which remains high. Additionally, real yields tend to catch up with growth prospects and can serve as a possible hedge, potentially providing positive returns on the real yield component as well.

Until recently, the only inflation-linked ETF option was through a passive vehicle. Indeed, in the UCITS space, inflation-linked ETFs have remained a very generic universe: all being pure passive solutions, tracking standard market cap indices and not bearing ESG credentials from SFDR.

Active global inflation linked bond ETF strategies are now being launched which should provide investors with greater choice, especially as ETFs in general offer a global perspective. Vehicles that also focus on the shorter end of the duration curve while providing geographic diversification are examples of this innovation that the active ETF market can offer; the majority of inflation-linked bond ETFS within the UCITS market belong to in the inflation-linked All-Term arena, with regional US and Europe dominating. Global only makes up 13% of the market offering.

Alongside these considerations, strategies that focus on one-to-10-year maturities should be less sensitive to long-term rates while seeking effective inflation mitigation, making them potentially more resilient during high inflation periods.

Investors are demanding greater innovation and choice to meet a world of uncertainty and volatility. Active ETFs, with their ability to provide a wider range of strategies, while still offering characteristics such as low costs and transparency, should be able to meet that demand.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.