1. Public Policy

Public policy forms the backdrop to the entire transition, and as the science becomes ever clearer on climate change, we will all face stricter rules that will not always be easy to navigate.

Governments are backing these policies with investment and regulation, as well as pushing private investors toward greener industries through carbon pricing, emissions trading and common standards that help define green investments.

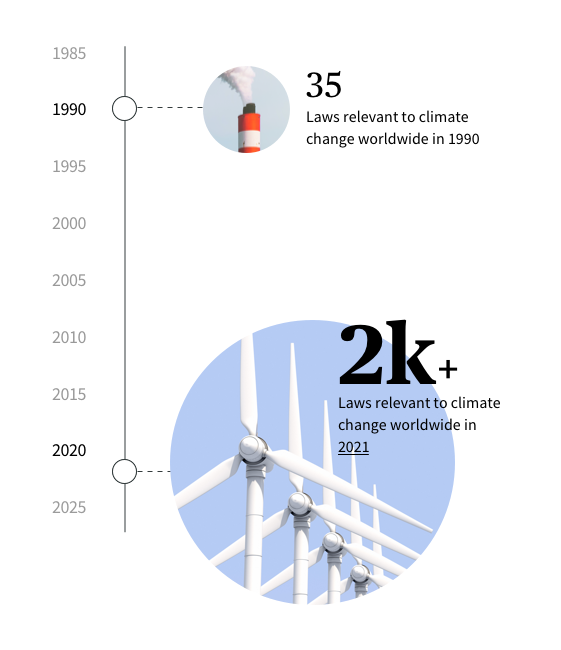

Expanding Legislation

Source: Grantham Research Institute on Climate Change and the Environment, London School of Economics, May 2021

If you invest in a high-carbon company that does not have a credible Paris Agreement-aligned pathway, it could find itself subject to carbon taxes, regulation or mandatory limits on the emissions it can produce, which work their way onto the bottom line.

2. Low-Carbon Transport

The end of the internal combustion engine is nigh. At the UN’s COP26 climate summit in November 2021, a coalition of countries, cities, carmakers and other organizations pledged to “accelerate the transition to 100% zero-emission cars and vans” globally by 2040. Signatories include some of the world’s biggest carmakers, including General Motors, Ford, Mercedes-Benz and Volvo.

Investment opportunities are growing in charging infrastructure, batteries, telemetry and chips as cars become ever more integrated into their environment and broader transport systems.

“You need to integrate all the different modes of transport through a joined-up approach,” says Chris Iggo, CIO Core Investments. “Cities need to adapt to be designed around electricity rather than petrol.”

A great deal of work is also going into decarbonizing heavier forms of transport such as trucking, shipping and aviation, where electrification is difficult.

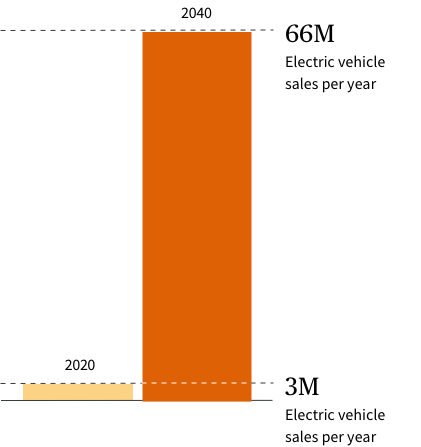

Accelerated EV Adoption

Sales of electric vehicles (EVs) are predicted to rise from 3 million in 2020 to 66 million in 2040.

Globally, EVs are forecast to represent more than two-thirds of passenger vehicle sales in 2040.

Source: BloombergNEF’s New Energy Outlook, August 2021

The information has been established on the basis of data, projections, forecasts, anticipations and hypotheses which are subjective. The analysis and conclusions are the expression of an opinion, based on the available data at a specific date.

3. Smart Energy

The rollout of renewable energy capacity continues at pace, but to reach its full potential, it needs digital as well as physical infrastructure. Battery storage coupled with digital technology is enabling clean energy to provide not just a greener power network, but a smarter one, too.

Hydrogen is an option attracting a lot of attention, not least because it can be produced emission-free using renewable energy. Global electrolyzer capacity in 2020 was just 250 MW; by 2030, capacity could reach 30 GW, enough to produce around 3 million metric tons of hydrogen a year, which—if all used to generate power at current levels of efficiency—would produce around 100 TWh of electricity, around a third of current U.K. demand.1 That growth will require a huge increase in investment in a sector that barely existed five years ago—and it’s likely that fixed-income products such as green bonds will be crucial in directing capital to where it is needed.

- Source: IEA Hydrogen Tracking Report, November 2021

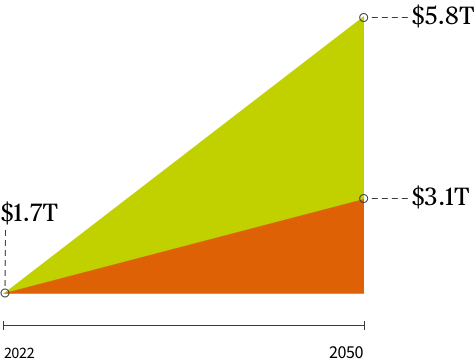

Investing for the Energy Transition

Annual investment in energy supply and infrastructure will need to more than double from around $1.7 trillion per year today to between $3.1 trillion and $5.8 trillion per year, on average, over the next three decades if we are to reach net zero.

Source: BloombergNEF’s New Energy Outlook, August 2021

The information has been established on the basis of data, projections, forecasts, anticipations and hypotheses which are subjective. The analysis and conclusions are the expression of an opinion, based on the available data at a specific date.

Net zero targets from governments, corporates and investors are materially changing how people invest. Green bonds are a $1 trillion market and a really good tool for directing capital to the right places.

4. Agriculture and Food Tech

People are becoming more concerned about the food they eat, where it comes from and its impact on the planet. As more people embrace plant-based, seasonal and local diets, there is a growing realization that the agriculture sector will play a crucial role in mitigating climate change. Deforestation due to land clearing to grow crops and rear cattle, carbon emissions from fertilizer and methane emissions from rice farming and livestock are all challenges for the sector.

The transition to a low-carbon world is creating opportunities for investors in areas ranging from more efficient use of water to vertical farming, lab-grown meats and plant-based diets. Agritech and precision farming are flourishing, along with the growing use of enzymes and bacteria to help preserve food longer and prevent food waste. Digital technologies are increasing transparency and access for both growers and consumers, and rapidly changing the way the industry works.

Greener Eating

The plant-based foods market could make up to 7.7% of the global protein market by 2030, with a value of over $162 billion, up from $29.4 billion in 2020.

Source: Bloomberg Intelligence, August 2021

The information has been established on the basis of data, projections, forecasts, anticipations and hypotheses which are subjective. The analysis and conclusions are the expression of an opinion, based on the available data at a specific date.

5. Resource Preservation

The circular approach is becoming more pertinent in many clean-tech sectors, and especially renewable energy and electric vehicles, as the first generations of solar panels and EV batteries come to the end of their life. Businesses are increasingly embracing circular economy techniques such as turning used cooking oil into biodiesel and maximizing material use through 3D printing. As companies seek to minimize their environmental impacts, it has become a priority to reduce the use of raw materials and decrease waste.

“Companies that come up with ways to use resources more efficiently or cut waste can add significant value,” says O’Toole. “There are many companies that take away someone else’s waste and convert it into a valuable product.”

“There are many, many businesses that I look at across the space that take a waste product that should go to landfill and, by virtue of some sophisticated technology, they can convert it into a valuable product,” she adds.

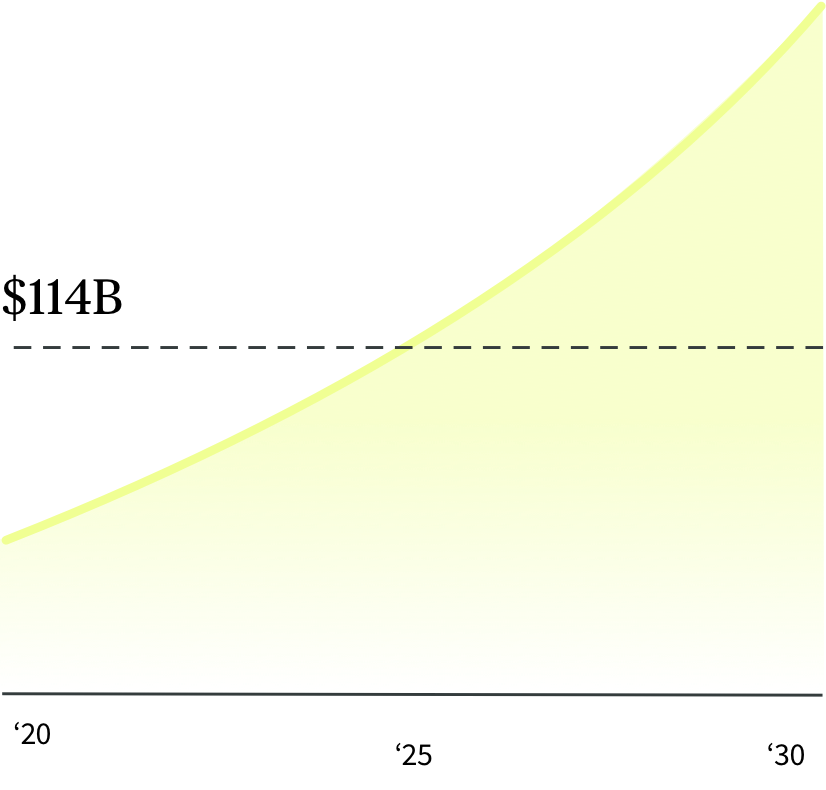

Cutting-edge Recycling

The global electronics recycling market is expected to grow at an average annual rate of more than 23% between now and 2025, exceeding more than $114 billion by the middle of the decade.

Source: Markets Research Engine, September 2021

The information has been established on the basis of data, projections, forecasts, anticipations and hypotheses which are subjective. The analysis and conclusions are the expression of an opinion, based on the available data at a specific date.

How to invest for a sustainable world?

We believe in empowering our clients to invest in the transition to a more sustainable planet and society.

Learn moreRisks

Investment involves risk including loss of capital.

Disclaimer

This promotional communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision. Due to its simplification, this document is partial, and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee that forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document are provided based on our state of knowledge at the time of creation of this document. While every care is taken, no representation or warranty (including liability toward third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.