Climate change: the economic cost of inaction

- 27 October 2021 (5 min read)

In November, the UK hosts the United Nations’ 26th annual Conference of the Parties (COP26), an event which its organisers have described as “the world’s best last chance to get runaway climate change under control”.

Climate change is the biggest threat facing humanity and the urgency for action has increased dramatically. Quite simply, if we don’t deal with this threat, we risk the future of the global economy and with it, sustainable long-term investment returns.

But time is not on our side, as the 2021 Intergovernmental Panel on Climate Change (IPCC) soberly asserted that it was “more likely than not” the 1.5˚C limit targeted in COP21 (Paris 2015) would be breached within the next 20 years.1

Critical action is required, and it is required right now. As UN Secretary General António Guterres said: “There is no time for delay and no room for excuses”.2

But the global community has begun to take heed. Both the US and China – the world’s largest CO₂ emitters – have committed to net zero emission targets this year, by 2050 and 2060 respectively, joining most other large economies which have already made similar pledges.

Costing the transition

The challenge of reducing greenhouse gas (GHG) emissions to net zero in the coming decades is staggering and its cost significant. It requires a realignment of the global economy from the ground up - this means changes in every household, office, factory, town, city and country on the planet.

As major countries have committed to more stringent emission targets, fresh estimates of the cost of tackling climate change have been put forward.

Princeton University estimates the US would need to invest $2.5trn (11% of GDP) by 2030 to deliver its net-zero-by-2050 goal. The European Commission forecast an even larger €3.5trn over the coming decade (25% of GDP) while Tsinghua University predicts that China’s plan would cost RMB 138trn (circa $21.6trn) and 122% of GDP over the coming four decades.3

Most recently, in its World Energy Outlook, the International Energy Agency warned that global warming is expected to breach the most conservative Paris Agreement target even if all current government pledges are met on time.

It called for faster progress in the energy transition as it predicted warming would hit 2.1°C by 2100 under the current scenario. According to its report, current pledges would achieve just 20% of the emissions cuts needed by 2030, to keep the goal of net zero by 2050 a possibility. It said to reach the net zero goal, up to $4trn in annual investment was needed over the next 10 years to close the gap – and most of that investment must be channelled into developing economies.4

Broader estimates exist for the investments required over the longer term. For example, Morgan Stanley estimated it would take $50trn to transform what it described as five key industries – renewables, electric vehicles, hydrogen, carbon capture and storage (CCS) and biofuels.5

Investment, not cost

Yet what is identified above are estimates of investment plans - not costs. Investment will deliver a positive boost to economic activity, directly bolstering demand. But beyond this direct boost to activity, we can expect additional potential benefits, all of which should be of interest to investors. They include:

- Cost reductions: Investment in solar panels, spurred by government subsidisation in many countries, has delivered a dramatic fall in costs over recent decades. Since 2010, the average price of solar panels has fallen by 82% in the US, to the equivalent of $0.068 per kilowatt hour (kWh), compared with coal at $0.32kWh, with solar and onshore wind now the cheapest sources of energy in the world. Future investment in other technologies is likely to lower other transitional costs6

- Productivity boosts: Investment in new technologies should also increase efficiencies, bolstering overall productivity and raising potential economic growth

- Overcoming underinvestment and positive externalities: Infrastructure is a public good and is often underprovided in market economies. Increased investment in key infrastructure may deliver additional positive externalities, for example increasing electricity grid resilience

- Health benefits: The reduction of coal-fired generation and a decisive move to electric vehicles will reduce particulate emissions that contribute to poor air quality, which create a myriad of associated health problems, for example asthma. Fewer health problems should reduce future healthcare costs, lowering the net cost of the initial investment.

Estimating the net cost of avoidance

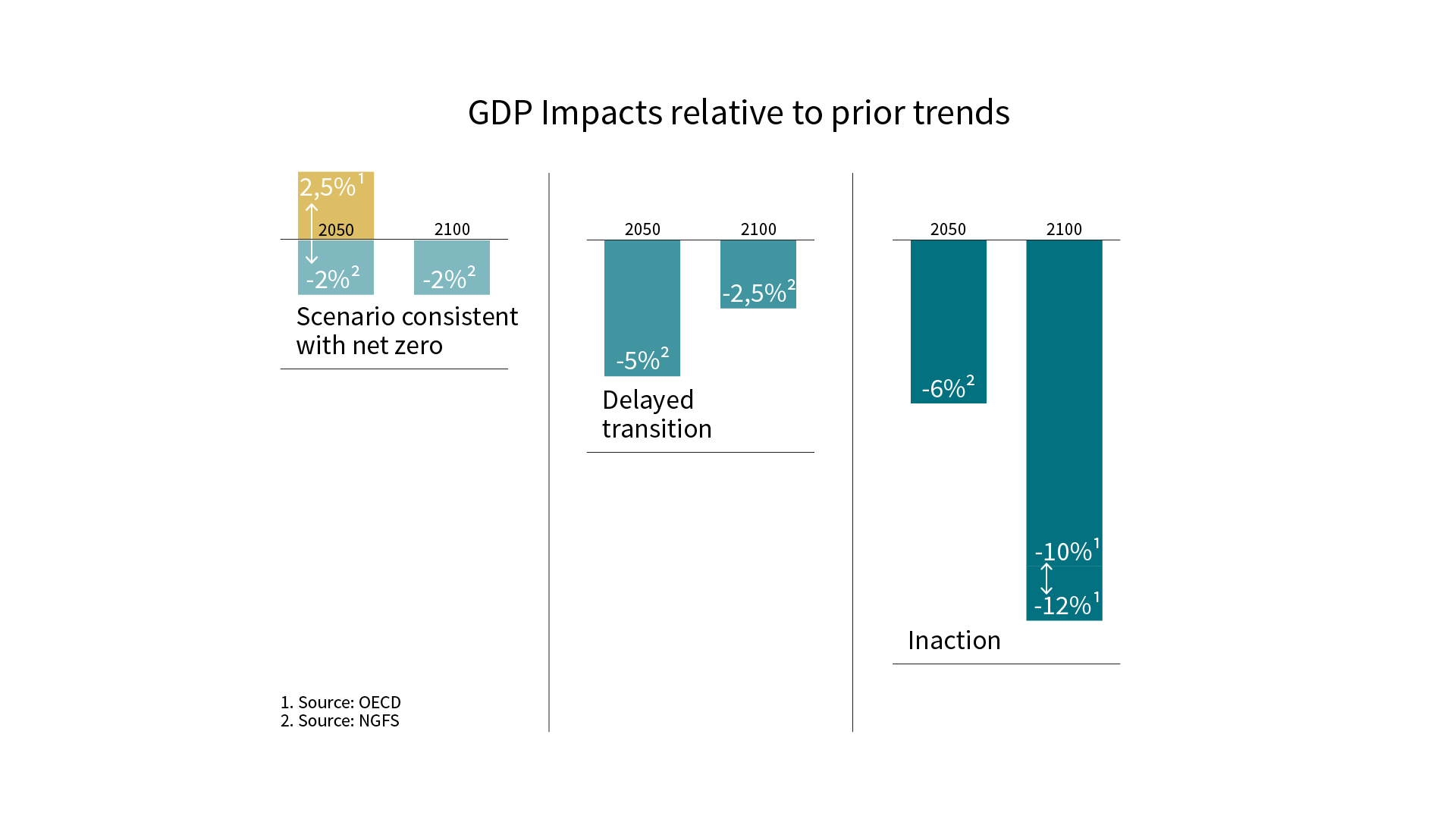

The assessment of the combined effects – the positive contribution of increased investment spending, offset by the loss of output - is naturally uncertain. The Organisation for Economic Co-operation and Development (OECD) concluded that a “decisive transition” could deliver a global GDP boost of 2.5% by 2050. Other institutions are less optimistic about the net impact of change. The International Monetary Fund (IMF), for example, estimates that in a scenario that would limit temperature increases to just 1.5˚C, global GDP would be 1% lower by 2050.7

The Network for Greening the Financial System (NGFS), a network of central banks and supervisors, considered multiple outcomes and estimates that a scenario consistent with net zero would likely reduce global GDP by around 2% by 2050 through to 2100. However, it also expects that a ‘delayed transition’, which gets off to a later start, could be markedly higher, reducing GDP by around 5% by 2050, before losses are reduced to around 2.5% by 2100.8

The price of unmitigated climate change

The most vital comparison is with the costs of unmitigated climate change. And although inevitably such estimates are highly uncertain, the present set of forecasts make for grim reading. The NGFS assessment of output losses assumes just the introduction of current policies and estimates a loss of output of around 5% of global GDP by 2050. For 2100, that figure jumps to 13%.9

Of course, going forward climate policies could easily be diluted or even thrown out altogether. On two occasions the US backtracked on its international climate policy agreements, failing to ratify the Kyoto Protocol and the Paris Agreement; fundamentally commitments to avoiding climate change from any nation cannot be guaranteed over the coming decades.

Several institutions have therefore produced estimates of losses to GDP from uninterrupted climate change. The NGFS forecasts that losses would exceed 6% of global GDP by 2050 while the OECD anticipates that by 2100, total losses would total 10% - 12% of GDP. The IMF’s current worst-case scenario forecasts an output loss of some 25%.10

A further complication in assessing the costs of avoiding climate change is that losses occur in the short term, but benefits accrue only over the much longer term. Further, costs will differ across different economies and geographies. Different areas will be subject to more or less of the loss of output from mitigating climate change and would be affected to a greater or lesser extent by climate change itself.

A brighter future

The cost for mitigating climate change is undoubtedly gargantuan. But if the world doesn’t come together to take on this emergency, the potential losses associated with unbridled climate change are estimated to be much higher given the potential for more extreme weather events, social disruption and the loss of economic activity.

Fundamentally, if we fail to transition to a low-carbon world, the overall integrity of the global economy is threatened. But by transitioning to a low-carbon world, we can foresee a stronger and more sustainable economic future. The transition should help new technologies and industries flourish. It can help deliver additional absolute economic growth, more sustainable investment returns and a better global environment for all.

- U2l4dGggQXNzZXNzbWVudCBSZXBvcnQgKGlwY2MuY2gp

- U2VjcmV0YXJ5LUdlbmVyYWwgQ2FsbHMgTGF0ZXN0IElQQ0MgQ2xpbWF0ZSBSZXBvcnQg4oCYQ29kZSBSZWQgZm9yIEh1bWFuaXR54oCZLCBTdHJlc3Npbmcg4oCYSXJyZWZ1dGFibGXigJkgRXZpZGVuY2Ugb2YgSHVtYW4gSW5mbHVlbmNlIHwgTWVldGluZ3MgQ292ZXJhZ2UgYW5kIFByZXNzIFJlbGVhc2VzICh1bi5vcmcp

- RXVyb3BlYW4gQ29tbWlzc2lvbiwgUHJpbmNldG9uIFVuaXZlcnNpdHksIFRzaW5naHVhIFVuaXZlcnNpdHkgYW5kIEFYQSBJTSBSZXNlYXJjaCwgU2VwdGVtYmVyIDIwMjE=

- V29ybGQgRW5lcmd5IE91dGxvb2sgMjAyMSDigJMgQW5hbHlzaXMgLSBJRUE=

- RGVjYXJib25pemF0aW9uOiBUaGUgUmFjZSB0byBaZXJvIEVtaXNzaW9ucywgTW9yZ2FuIFN0YW5sZXkgT2N0b2JlciAyMDE5

- SW50ZXJuYXRpb25hbCBSZW5ld2FibGUgRW5lcmd5IEFnZW5jeSAoSVJFTkEpIDIwMTk=

- T0VDRCwgSU1GIOKAkyBBWEEgSU0gVGhlIGNvc3Qgb2YgY2xpbWF0ZSBjaGFuZ2U6IEFjdGlvbiB2ZXJzdXMgaW5hY3Rpb24gfCBBWEEgSU0gQ29ycG9yYXRlIChheGEtaW0uY29tKQ==

- TkdGUyAvIEFYQSBJTSBUaGUgY29zdCBvZiBjbGltYXRlIGNoYW5nZTogQWN0aW9uIHZlcnN1cyBpbmFjdGlvbiB8IEFYQSBJTSBDb3Jwb3JhdGUgKGF4YS1pbS5jb20p

- TkdGUyAvIEFYQSBJTSBTZXB0ZW1iZXIgMjAyMQ==

- TkdGUyAvIElNRiAvIEFYQSBJTSBTZXB0ZW1iZXIgMjAyMQ==

Climate-aware investing

Our ACT range is designed to enable our clients to take action on global issues such as climate change through their investments.

Learn moreDisclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.