Expand Your TAM

Well, it must not be a bubble then. The dramatic fall in software companies’ share prices over the last few weeks (following declines that began last October) only make sense if the impact of artificial intelligence is significant. The latest AI tools threaten the business models of many IT software companies, as well as those of video game developers, online travel agencies and others.

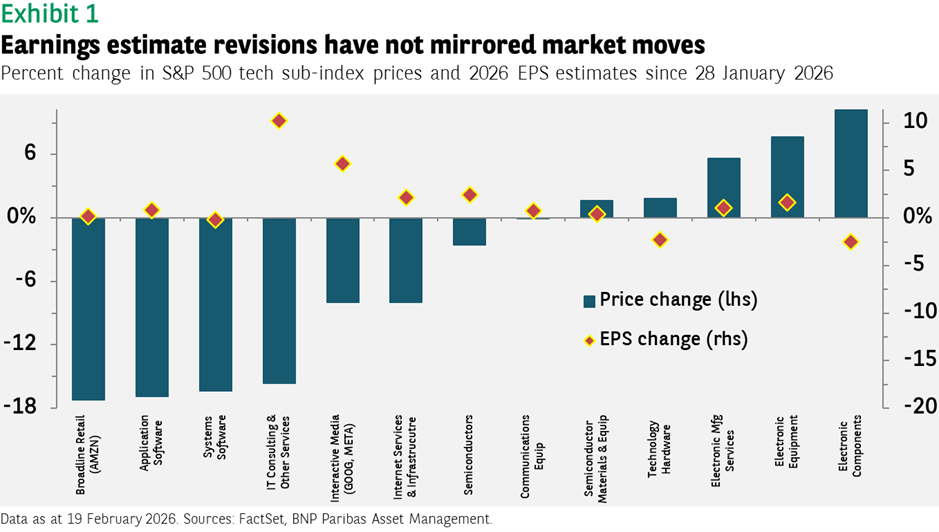

There seems to be little doubt that some companies will not survive this period of rapid technological change (RIP Napster and Blackberry), but one can question whether the market moves have gone too far. While the S&P 500 Application Software and Systems Software indices have fallen 16% since the end of January, revisions to 2026 earnings estimates have actually been modest (see Exhibit 1).

While the market’s concern is perhaps more about corporate profits in the long term rather than over the next 12 months, we suspect any decrease in earnings will happen slowly. Software companies serving businesses have well-established relationships with their customers and provide them with more than just the software’s functionality, integrating it with security requirements, governance and compliance requirements. Software companies will also be able to incorporate new technologies into their offering, potentially limiting customer attrition.

Some of their revenues will nonetheless accrue to competitors. This is not necessarily problematic from an investment point of view, as an investor whose holdings reflect a broad index will likely capture the gains elsewhere. The current situation is a bit more problematic, as two of the biggest disruptors (OpenAI and Anthropic) are private. If the private part of the earnings pie grows while the public part shrinks, investors may lose out.

We believe this is unlikely, however. OpenAI and Anthropic’s 2025 revenues are estimated to be around $23 billion. Total revenue for companies in the S&P 500 Software index was around $550 billion last year according to FactSet, so any loss on the public side should not be meaningful relative to growth across the entire index.

More importantly, the latest developments may well have the same effect as DeepSeek’s AI model last year: an initial market decline as investors worry that business models will be destroyed, followed by a rebound amid the expectation that lower costs will increase demand and expand the total addressable market (TAM).

A key implication for investors is the importance of ‘active diversification’. This is a combination of global diversification - as one does not know where the next disruption will come - alongside active portfolio management in order to identify the potential winners and avoid the stocks of companies that may not survive.

Economic expansion and employment

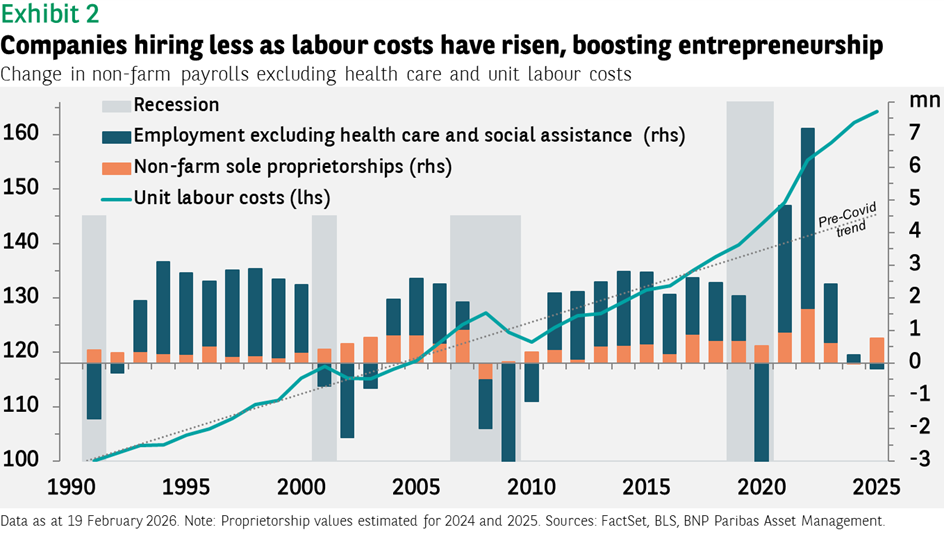

One puzzle these days is the strength of US economic growth alongside weak hiring (outside of the healthcare sector). Over the last two years, private non-farm payroll growth ex-healthcare has averaged just 40,000 compared to 1.8 million in the five years before the pandemic (see Exhibit 2).

Strong hiring in healthcare is not new. Payrolls in the sector have grown steadily over the last 20 years in line with the ageing US population, partly because healthcare is particularly resistant to productivity improvements. Older people generally require more doctors, more nurses and more healthcare assistants. The hiring in this sector has only become salient because of the reduced job creation in the rest of the economy.

The breakdown elsewhere in the link between economic expansion and employment is at least partly a function of labour costs. The surge in wages that followed the pandemic has left labour far more expensive than it would have been based on historical trends. Companies have responded by substituting capital for labour. From a macroeconomic point of view this is positive as productivity has improved, as have corporate profits.

One might wonder, though, where the displaced workers and new entrants to the labour force have gone if they have not found employment in the healthcare sector. At least some of them have set up shop on their own. Our estimate is that sole proprietorships (unincorporated businesses operated by one individual — for example, freelancers or influencers) grew by about 800,000 in 2025. This phenomenon could explain why the unemployment rate has remained low - currently 3.9% for adults - even as the civilian labour force expands.

How AI will impact hiring in the years ahead is one of the great uncertainties facing investors (and the Federal Reserve). What will the opportunities for new graduates be when many entry-level tasks are automated? Teenage unemployment has already been rising more quickly than it has for adults. Productivity gains can go too far if they lead to significantly higher unemployment and a consequent decline in consumer demand.

One encouraging anecdote is IBM’s announcement that it intends to triple entry-level hiring. Bloomberg reports that the company’s junior software developers “now spend less time on routine coding tasks and more time working with customers”. Currently the labour market looks to be close to full employment, but this is a critical indicator to watch.

GDP surprise

Headline US GDP growth for the fourth quarter of 2025 came in at 1.4% (seasonally adjusted annual rate), disappointing versus consensus estimates, but the underlying data was more encouraging. The reason for the comparatively low figure - Q3 GDP expanded by 4.4% - was a decrease in government spending. The drop in public spending, thanks to the partial government shutdown last quarter, reduced economic growth by nearly a full percentage point. By contrast, consumer demand was steady — if slightly weaker — adding 1.6ppt.

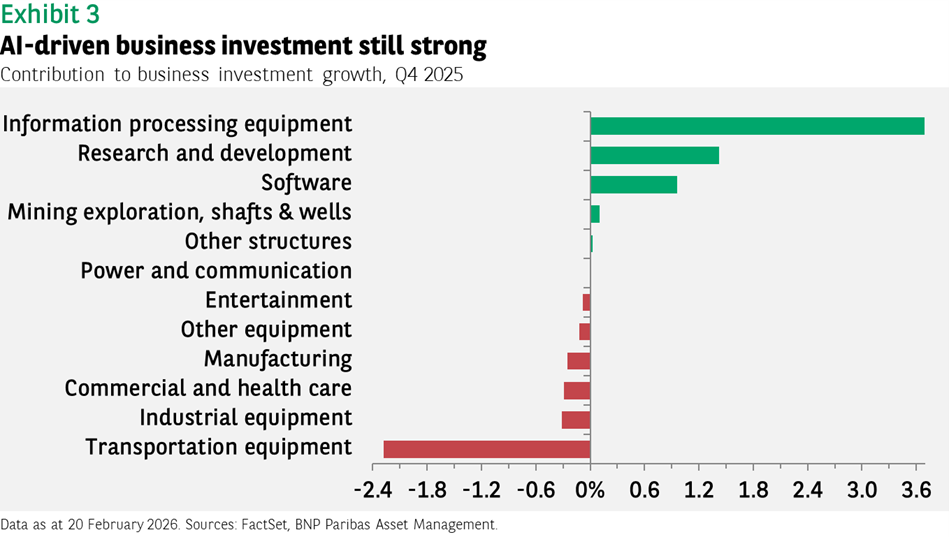

Business investment is arguably the most critical figure, as companies spending money to develop and power AI is a key factor in forecasts for robust US growth this year. The headline figure was discouraging - a mere 0.5ppt contribution thanks to an unusually big decline in the (lumpy) transportation equipment category. But the detail shows that AI-related spending remained strong, though a large part of the IT equipment category was chips imported from Taiwan. Nonetheless, the thesis that AI will continue to be a key support for the US economy remains in place.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of BNP PARIBAS ASSET MANAGEMENT Europe or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.