Five reasons why Europe is back on the investment map

KEY POINTS

1.Attractive valuations

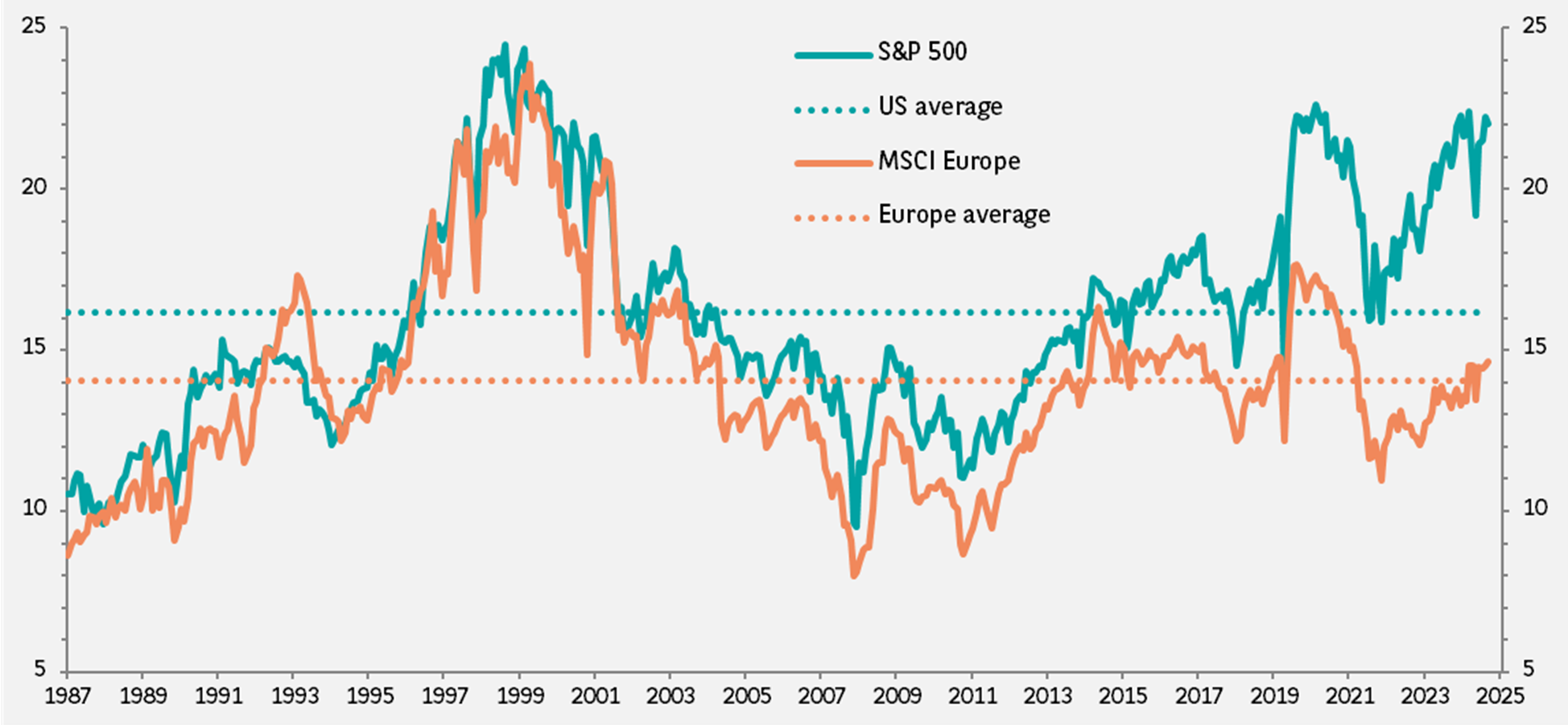

Attractive valuations are a powerful argument in favour of European equities, which currently trade at significant valuation discounts compared to the US.

The next-12-month price-earnings ratio for the MSCI Europe index is currently 14.6 times, slightly above the average since 1987 of 14 times. By contrast, in the US valuations are close to all-time highs, currently 22 times expected earnings.

Europe's average dividend yield is near 3.3% substantially exceeding the US average of about 1.3%.

Exhibit 1: Valuations far lower for European Equities

Next-twelve-month price-earning ratio

Data as at 26 August 2025. Sources: IBES, FactSet, BNP Paribas Asset Management

2.Recovery in earnings looking bright

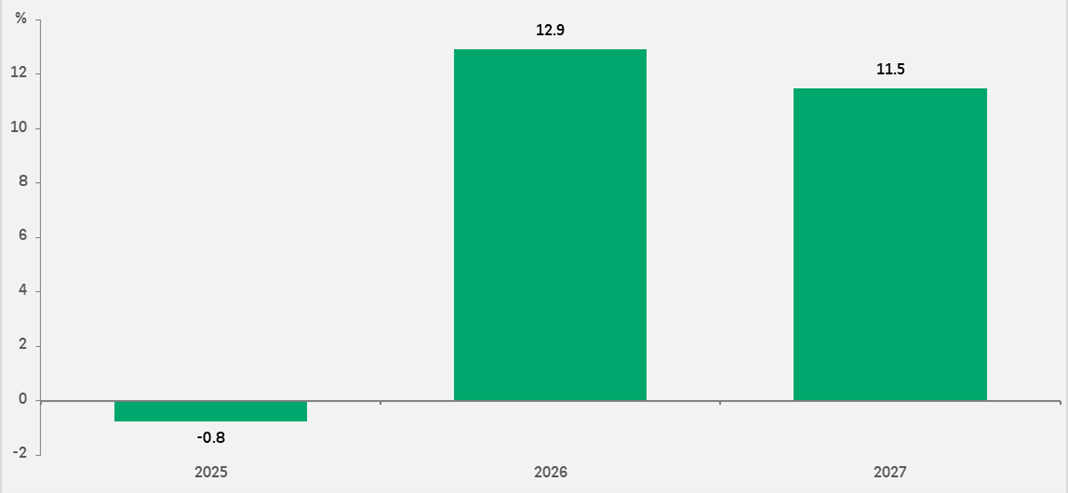

Europe’s equity earnings outlook is brighter than it has been in many years. Consensus estimates for profit gains over the next couple of years see a big improvement on results compared to 2025, as Exhibit 2 shows.

The expected gains are particularly high in industries such as biotechnology, at 34% 2027/2026 earnings-per-share (EPS) growth, semiconductors (24%), and aerospace and defence (17%).

Exhibit 2: Earnings growth is expected to rebound sharply over the next couple of years

Year-on-year EPS growth

Data as at 26 August 2025. Sources: FactSet, BNP Paribas Asset Management

3.Unprecedented increase in Europe’s defence and infrastructure spending

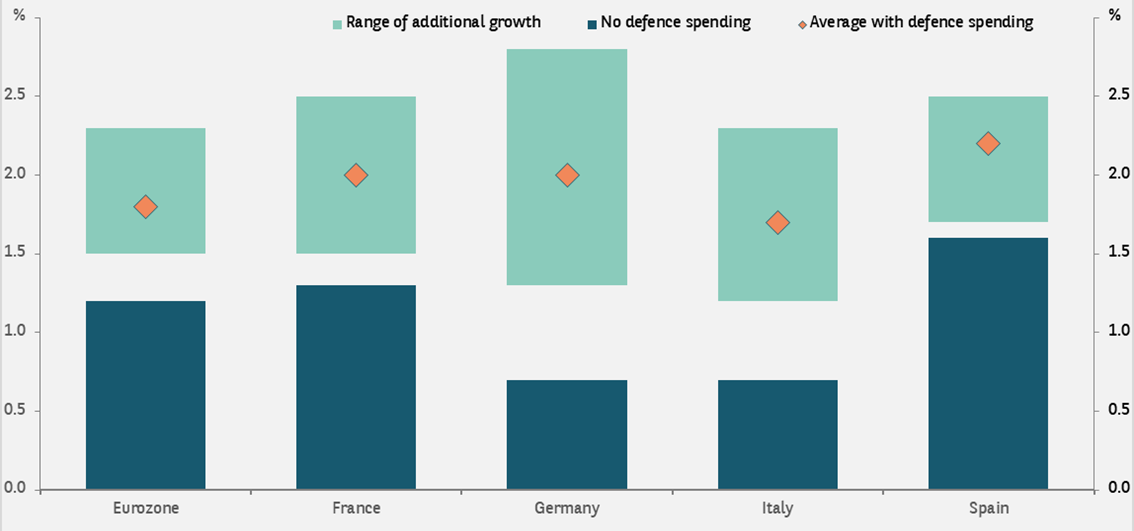

US President Donald Trump’s push for greater defence burden sharing has borne fruit. There is broad acceptance across NATO countries to spend 5% of GDP on defence (broadly defined). We estimate the increase in defence spending could double the rate of real GDP growth across the region.

In addition, Germany has launched a major infrastructure and defence initiative, with investments of €500bn over the next 12 years in sectors including infrastructure, construction, renewable energy, healthcare and defence. This is a huge change for Germany and for Europe, which has historically been reluctant to spend to boost growth. This spending should have a meaningful impact on the continent’s growth rate as there is significant spare capacity in the economy.

Exhibit 3: GDP should increase across Europe

Real GDP growth

Data as at 26 August 2025. Sources: BNP Paribas Asset Management.

Europe’s pursuit for strategic autonomy has emerged as a central priority. For the region to act independently in key areas such as defence, energy, digital infrastructure and critical supply chains, investment plans for key public initiatives of a historic scale are in the pipeline.

The planned investments in Europe’s strategic autonomy amount to over €1.6trn

4.European fixed income offers opportunities

A crucial argument in favour of European fixed income is the confidence in the European Central Bank (ECB) to remain vigilant about inflation risk. Bondholders can rely on the ECB to protect them from inflationary pressures.

European fixed income, and in particular corporate debt continues to perform well with a relatively low level of volatility. In the first half of 2025 it has once again shown resilience in the face of considerable uncertainty.

European economic growth has been resilient in the first half of 2025. There is scope for a further pick-up in corporate investments and M&A activities as the Eurozone economy gains momentum in over the next 12 months. Companies in the corporate debt universe continue to prioritise deleveraging. Inflows into mutual funds and demand for collateral for Collateralized Loan Obligations are bolstering demand.

Our analysis shows fundamental characteristics of companies in the euro high-yield sector as relatively solid. Corporate results for the region continue to demonstrate the resilience of business models. Profit margins are stable, costs are well under control and there is potential for cash generation and balance sheet improvement. While there is limited scope for further significant spread tightening in 2025, we expect carry and security selection to drive performance.

5.Capital meets opportunity for private assets

In addition, private capital is positioned to help reshape the European continent’s global competitiveness by driving innovation, creating European champions, and mobilising the sizeable investments required. We believe Europe is emerging as one of the most compelling destinations for private asset investments.

The case for Europe factors in a gap in market valuation between European companies and their US-listed peers and falling financing costs. But it is primarily based on a growing conviction that economic reforms, combined with a stable environment for long-term investments, pave the way for major opportunities across Europe for all investors.

Europe offers macroeconomic and policy stability - combined with a highly investable structural roadmap. Public plans are creating tangible project pipelines and co-investment frameworks - not just wish-lists. Private capital is explicitly sought after to complement and scale up public capital across asset classes. Deployment is aligned with long-term objectives: impact, resilience, energy security, and re-industrialisation.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.