Euro credit sectors offer opportunities despite market volatility

KEY POINTS

Despite facing multiple episodes of volatility in recent years, the euro credit market has demonstrated notable resilience, consistently delivering solid returns to investors.

Today, Euro corporate bond markets continue to benefit from resilient fundamentals, attractive income levels, and sustained investor inflows. In the first quarter of 2025 alone, European fixed-income funds attracted over €83 billion in net inflows1, reflecting a cautious yet opportunistic investor mindset. With yields remaining elevated, we expect investor demand to grow further as many seek to lock in favourable returns.

However, not all issuers are created equal. We are witnessing increasing divergence across sectors and countries, driven by geopolitical tensions, regulatory shifts, and uneven macroeconomic conditions. For instance, credit standards have tightened in Germany while easing in Italy, reflecting regional imbalances. Moreover, sectors such as luxury goods and autos are more exposed to external demand shocks, while financials and utilities continue to benefit from conservative capital strategies.

In this environment, issuer selection remains critical. Identifying companies with strong fundamentals, prudent financial management, and sectoral resilience is key to capturing long-term value in euro credit markets.

- Source: Morningstar, as of 31 March 2025

Conviction in High Beta Credit

One example of where taking a strategic allocation has been important is within high beta credit. Exposure to Financial Subordinated Debt and Corporate Hybrids has benefited from strong technical support, elevated carry, and improving issuer fundamentals. In 2025, spreads in high beta segments compressed meaningfully, reaching year-to-date tights. High Yield spreads tightened by over 150 basis points since April 2025, while yields remain attractive at approximately 5.1%2. Overall, we believe there is a compelling risk-return profile for Subordinated debt3 and selective allocation to High Yield.

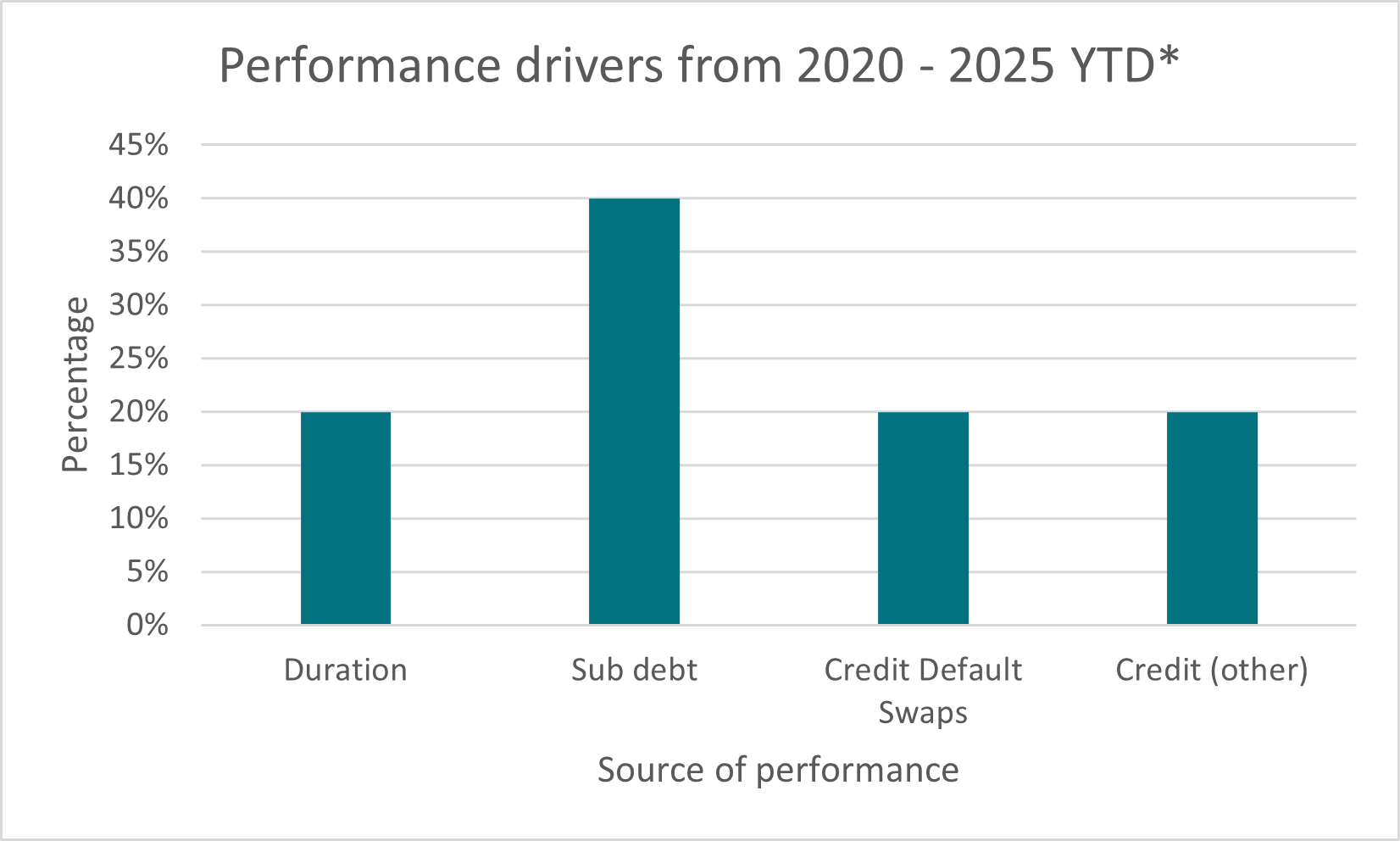

If you look at the last five years, as demonstrated in the chart below, taking a selective positioning in this space has contributed significantly to performance. For such reasons, we maintain our conviction in the segment’s ability to navigate a complex macroeconomic landscape and deliver value.

Source: AXA IM, as of 30 September 2025 Performance drivers calculated from a Total Return strategy between 2020 and 2025 YTD. *YTD as of 30 September 2025. Past performance is not a reliable indicator of future results.

Building for the future

Despite growing uncertainty, driven by geopolitical tensions, trade disruptions, and fiscal policy ambiguity, Euro credit spreads remain close to historical tights, supported by resilient fundamentals and strong technicals.

One sector that we believe continues to stand out is the Banking sector. European banks have posted robust performance in 2025, with equity prices up over 55% year-to-date4, significantly outperforming broader indices. This strength is underpinned by solid capital positions, resilient loan demand, and stabilising net interest margins.

From a fixed income perspective, bank debt offers compelling value and some diversification away from the impact of US tariffs on global growth. Credit fundamentals remain sound, with low default risk, and strong capitalisation ratios well above the regulatory thresholds.

Investor appetite is growing, particularly for subordinated bank debt, as spreads remain attractive relative to other sectors. With banks increasingly focused on digital transformation and cost efficiency, the sector should be well-positioned to navigate structural shifts and deliver stable income to bondholders.

The benefit of flexibility

A sector’s influence on a portfolio’s performance will invariably depend on the macroeconomic conditions as well as market demand and credit availability. While issuer quality should be more important than sector allocation, being able to adapt to various market conditions and move across sectors to benefit from opportunities may be instrumental for adding value, especially during times of volatility.

In today’s landscape, marked by rising political risk, trade tensions, and policy uncertainty, we’ve adopted a more conservative risk stance than earlier in the year. The potential for disruptive tariff policies, geopolitical fragmentation, and uncoordinated monetary easing across major economies has increased market sensitivity.

Nonetheless, we believe European issuers’ credit quality is in good shape, enabling them to withstand a potential economic slowdown. If risk assets experience temporary dislocations, the combination of healthy corporate fundamentals and persistent investor inflows into euro credit should continue to offer attractive opportunities for long-term investors.

- Source: Bloomberg, as of 30 September 2025

- High beta credit are fixed income corporate securities that exhibit greater sensitivity to market movements, often providing higher potential returns but also increase risk.

- Source: https://stoxx.com/index/sx7e/

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.