Green bond market: from niche instruments to core bonds

KEY POINTS

Green bonds have come a long way since their inception. It’s an asset class that continues to innovate and at circa 2.2trn1, they offer investors a broad range of opportunities.

Green bonds were first introduced to the market to offer a financing tool for issuers to transparently address climate and sustainably projects. They were an innovative, new offering designed to deliver positive environmental impacts and the landmark 2015 Paris Agreement on climate change significantly bolstered demand.

In the decade since, the need for environmentally impactful projects has only grown, as has the willingness of companies and governments to finance them. During the green bond market’s nascent phase, smart energy solutions - renewable energy and energy efficiency projects - dominated the landscape. This made way for transport and building sector projects where decarbonisation is urgently needed.

As early investors into the green bond market, we have seen firsthand how the asset class has grown and delivered a compelling range of opportunities. While the main themes remain smart energy solutions, low carbon transport, and green buildings, other themes have also come to the fore such as biodiversity and nature, climate adaptation, pollution prevention, as well as water and waste management.

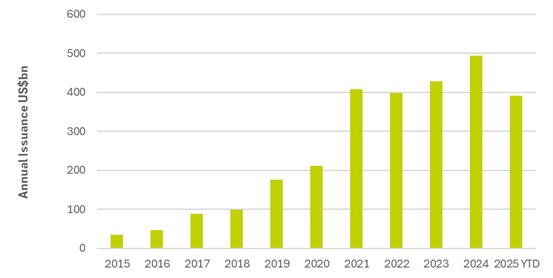

The green bond market has proved resilient, persevering across periods of market turbulence to reach significant scale in terms of annual issuance volumes. Even during the highly turbulent months of 2020 for example, green bonds held their own with supply persevering at levels similar to 2019 before accelerating in the second half of that year to surpass historical volumes. Primary market demand remained relatively unaffected, signalling that the market had already developed a solid and reliable investor base2. After a record year of issuances in 2024, 2025 has still proved resilient YTD and broadly similar to the level of volumes we have experienced in recent years.

Source: AXA IM, Bloomberg as of 04/11/2025.

The current backdrop

The sustainable finance landscape has expanded dramatically over the past 10 years. Investors have witnessed the growth of numerous new vehicles such as transition, social, sustainability and sustainability-linked bonds but green bonds remain the cornerstone of the labelled bond market.

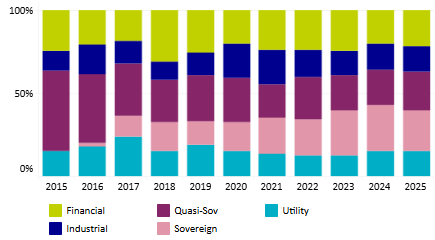

Contrary to common belief, green bonds aren’t pegged to a mere handful of concentrated sectors or types of issuers. In the early 2010s, green bonds were a specialist product largely issued by development banks and a handful of large corporates.

Today, as the chart shows, the universe includes sovereigns, supra-nationals, banks, utilities, and corporates across both developed and developing markets.

Source: AXA IM, Bloomberg as of 04/11/2025

Being held to a higher standard

The green bond market’s evolution from a niche investment into a mainstream, multi-issuer market is nuanced and driven by several factors: policy momentum, investor demand, and a growing ecosystem of standards and verification.

The International Capital Market Association (ICMA) Green Bond Principles, introduced in 2015, provides a framework for green bonds that has been widely adopted. It covers the criteria of eligible projects, governance, allocation of proceeds, and impact reporting. Although not legally binding, these principles have helped create comparability and credibility and the introduction and evolution of such standards and verifications was a much-needed driver for the market.

Beyond these standards, there has also been other regulatory developments that have fortified the market. The European Union’s (EU) push for a unified Green Bond Standard and a broader sustainable finance framework, including taxonomy-based disclosures, has set a high bar for credibility and investor confidence.

To that extent, Denmark has recently become the first sovereign to issue an EU green bond. Although issued in local currency (krone), this sends a positive signal to the market, demonstrating that amid Europe’s regulatory noise, issuers still want to demonstrate EU exceptionalism and adhere to higher standards which help raise market quality and credibility even further.

Across the globe, jurisdictions have developed or adopted taxonomies and standards that differ in emphasis and scope, although international and European frameworks continue to be widely cited and often adapted to country or region-specific contexts. This has produced a mix of standards - from ‘taxonomy-aligned’ to certified bonds in others.

The result is a more complex but ultimately more robust landscape, as market participants push for greater consistency in impact reporting and issuance conventions. It has also brought much more nuance to the conversation of what is considered green, calling for asset managers to have a stronger vision for their green investment philosophy.

- Market Value. Source: Bloomberg as of 04/11/2025.

- {https://www.ecb.europa.eu/press/financial-stability-publications/fsr/focus/2020/html/ecb.fsrbox202011_07~12b8ddd530.en.html;The performance and resilience of green finance instruments: ESG funds and green bonds}

Portfolio diversification

Another key development has been the growth of geographic and sectoral choice which investors have seen. Early issuance was heavily concentrated in developed markets and traditional green sectors. Over the last decade, the Asia-Pacific region - from China and Australia to Singapore and Indonesia - has become a new source of green bond supply. Corporate issuers in energy, banking and real estate, and transportation have used green bonds to support a broad array of climate-friendly investments. This comes in compliment to sovereign and sovereign-related green bonds whose influence on building these markets – both local and international - should not be ignored.

From our perspective, this geographic and sectoral breadth has helped diversify risk and broaden how we can invest in green bonds. Of course, whether unconstrained or investing in short duration, the green bond market continues to provide transparent and credible solutions that aim to contribute to net zero and wider environmental challenges.

Looking Ahead

The green bond market is likely to continue expanding in the medium-term, with growth driven by policy incentives, evolving taxonomies, and the ongoing search for diversified, scalable climate financing.

We are already seeing this evolution in new thematic priorities with the recent introduction of blue bonds - a sub-category of green bonds - which target projects related to fresh water and marine ecosystems.

Still a fledgling sub-category, most issuances have come from the Asia-Pacific region. Nevertheless, we believe, this ultimately highlights the growing appetite for nature-related bonds and the potential opportunities to come from this domain.

We expect these dynamics to continue to assist the positive momentum of the asset class. More growth and diversification should help generate greater investor demand. So far, this demand has contributed to more liquid secondary markets and improved access to funding for climate projects.

Challenges naturally remain, and investors need to be wary of weak impact reporting and greenwashing that may test market integrity. Ensuring funds are deployed to verifiable climate projects that report real-world emissions reductions as well as issuers with credible ambitions are vital as maintaining investor trust requires ongoing effort.

For this reason we believe it is just as necessary today that green bond investors use a robust green bond investment process as it was 10 years ago.

The next decade will likely hinge on stronger standardisation, higher-quality and standardised impact data, and deeper integration with the broader sustainable finance agenda and risk-management frameworks.

And if these conditions hold, green bonds should remain a central tool for mobilising capital toward a lower-carbon and more resilient economy. Looking at where the market stands today, we believe that green bonds may already represent an attractive core bond allocation from a fundamental perspective, while offering additional benefits.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.