Taking advantage of a low-yield environment and uncertainties related to COVID-19

Interest rates are at a historically low level and market volatility is higher than the historical average. There are still many uncertainties, mainly related to fears of a second wave of COVID-19. Despite such a volatile environment, our AXA WF Euro Credit Total Return fund, unconstrained by a benchmark, has proven its ability to take advantage of various opportunities across the entire euro credit universe, and generating a positive total return of 1.31% since the beginning of the year.

After the rapid acceleration of the virus outside China's borders, growth forecasts were revised downwards significantly, but the response of central banks was once again decisive, particularly in the United States. This led to price stabilisation in several fixed income buckets and finally an impressive recovery, including high-beta segments such as high yield. Indeed, central banks are providing massive credit support to the private sector and giving governments the fiscal flexibility needed to make the additional spending required to support incomes, employment and health services. These policies should provide support around economic and credit risks for some time. In the meantime, the underlying uncertainty remains elevated and investors must be vigilant both in their issuer selection and top down exposure.

A unique vehicle in a low-yield environment and uncertainties related to COVID-19

During this volatile period, our unconstrained

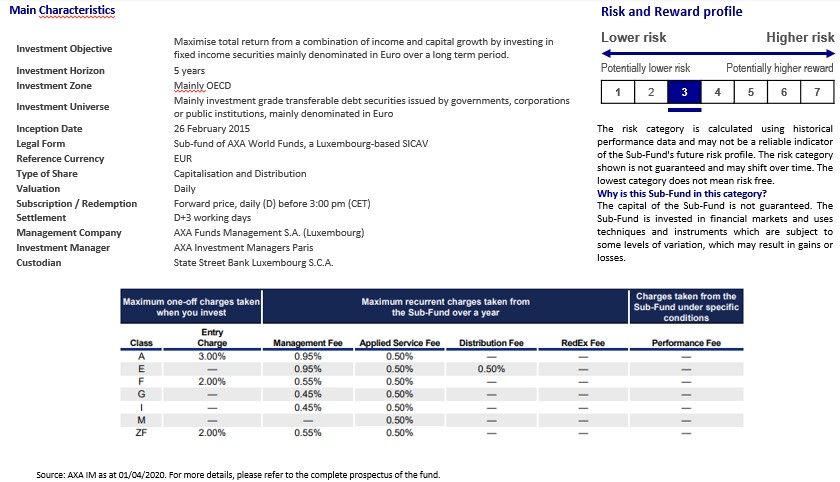

Key characteristics

- Exploiting the full euro credit universe with an extensive leeway on investment grade and high yield allocation (up to 50%)

The investment process described above is provided for illustrative purposes only, and no assurance can be given that it will be applied at any given time. Please note that the investment process is subject to change without prior notice and cannot be considered as a reliable indicator of the ability of AXA IM to manage and mitigate risks, nor can be relied as a guide to future performance. - Flexible management of duration risk (-2 to 6 years)

- High conviction positioning

- Investment grade quality portfolio (BBB)

- Combination of top-down management approach with tactical allocation across identified risk buckets and return drivers

Risk Warnings:

Counterparty Risk: Risk of bankruptcy, insolvency, or payment or delivery failure of any of the Sub-Fund's counterparties, leading to a payment or delivery default.

Liquidity Risk: risk of low liquidity level in certain market conditions that might lead the Sub-Fund to face difficulties valuing, purchasing or selling all/part of its assets and resulting in potential impact on its net asset value.

Credit Risk: Risk that issuers of debt securities held in the Sub-Fund may default on their obligations or have their credit rating downgraded, resulting in a decrease in the Net Asset Value.

Impact of any techniques such as derivatives: Certain management strategies involve specific risks, such as liquidity risk, credit risk, counterparty risk, legal risk, valuation risk, operational risk and risks related to the underlying assets.

The use of such strategies may also involve leverage, which may increase the effect of market movements on the Sub-Fund and may result in significant risk of losses.

Strong positioning versus the competitors

- 5 stars Morningstar ★ ★ ★ ★ ★ in EUR Flexible Bond category

As at 30/06/2020. - Top-performing fund in EUR Flexible Bond category over 1 Year and 5 Years (based on I EUR share class)

- First-decile fund in EUR Flexible Bond category over 3 Years

- Higher YTD performance (-0.38% net of fees) versus its Morningstar peer group (-3.22%) as at end of May

- 17.25% (net) cumulative excess return against peer group since April 2015

- 28.38% fund max gain versus 11.80% for its Morningstar peer group since April 2015 (Max drawdown: -11.11% versus -9.12%)

A portfolio uncorrelated with credit and rates

Investor anticipation about the bond market can evolve quite abruptly. Our flexible approach allows us to have a lower beta than the market when we believe the valuation is not compensating for the risk. This flexible approach is implemented through our bond allocation model and via derivatives, the Fund is exclusively invested in public issuances.

Active Investment Philosophy

We have been quite active in 2020 year-to-date, beginning the period with a limited amount of risk, especially in January and February before the COVID-19 crisis occurred. Once the valuations met out target, we increased our exposure through the ‘Aggressive’ segment (corporate high yield, corporate hybrids and financial subordinated). We also tactically used CDS on the iTraxx Crossover and iTraxx Main to hedge against the volatility at the beginning of the year, and finally in April to increase the beta in portfolio. We have been also participating actively in the primary market to capture risk premiums, notably on the corporate sector purchase programme issuers.

Thematics for H2 2020

Search for yield: With a depressed yield curve, a German bund trading below -0.40% and the amount of negative yielding assets around $13 trillion, the search for yield will remain a thematic, which should be supportive for the credit asset class.

Valuation: After the correction in March and despite the strong recovery from March volatility levels in April and May, we still believe that valuation remains attractive both in euro investment grade and high yield. Moreover, as highlighted by interventions from the European Central Bank and US Federal Reserve, the credit asset class is now a monetary policy tool; as such, the upcoming volatility should be contained.

Virus: The risk of a second wave may put some volatility on the market; however, it will not alter our constructive scenario, and we would use the volatility phases to add more risk.

© (2020) Morningstar. All Rights Reserved.

The information, data, analyses and opinions (“Information”) contained herein (1) include the propriety information of Morningstar; (2) may not be copied or redistributed; (3) do not constitute investment advice; (4) are provided solely for informational purposes; (5) are not warranted to be complete, accurate or timely; and (6) may be drawn from fund data published on various dates.

Morningstar is not responsible for any trading decisions, damages or other losses related to the Information or its use. Please verify all of the Information before using it and don’t make any investment decision except upon the advice of a professional financial adviser. Past performance is no guarantee of future results. The value and income derived from investments may go down as well as up.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.