Where can investors look within Euro Credit

Key points:

- Rates are likely to stabilise as disinflation takes hold but oil could still be a headwind

- Current yields offer attractive entry points for euro credit investors

- Short duration and total return strategies may offer opportunities in 2024

Economies may prove to be less resilient in 2024 than they have been in 2023. In the medium-term, growth and inflation outlook are more uncertain with some volatility expected, as the realm of easy money has ended. In this context, we believe that the current landscape is more conducive for generating alpha as heightened volatility creates dislocations that we can potentially take advantage of.

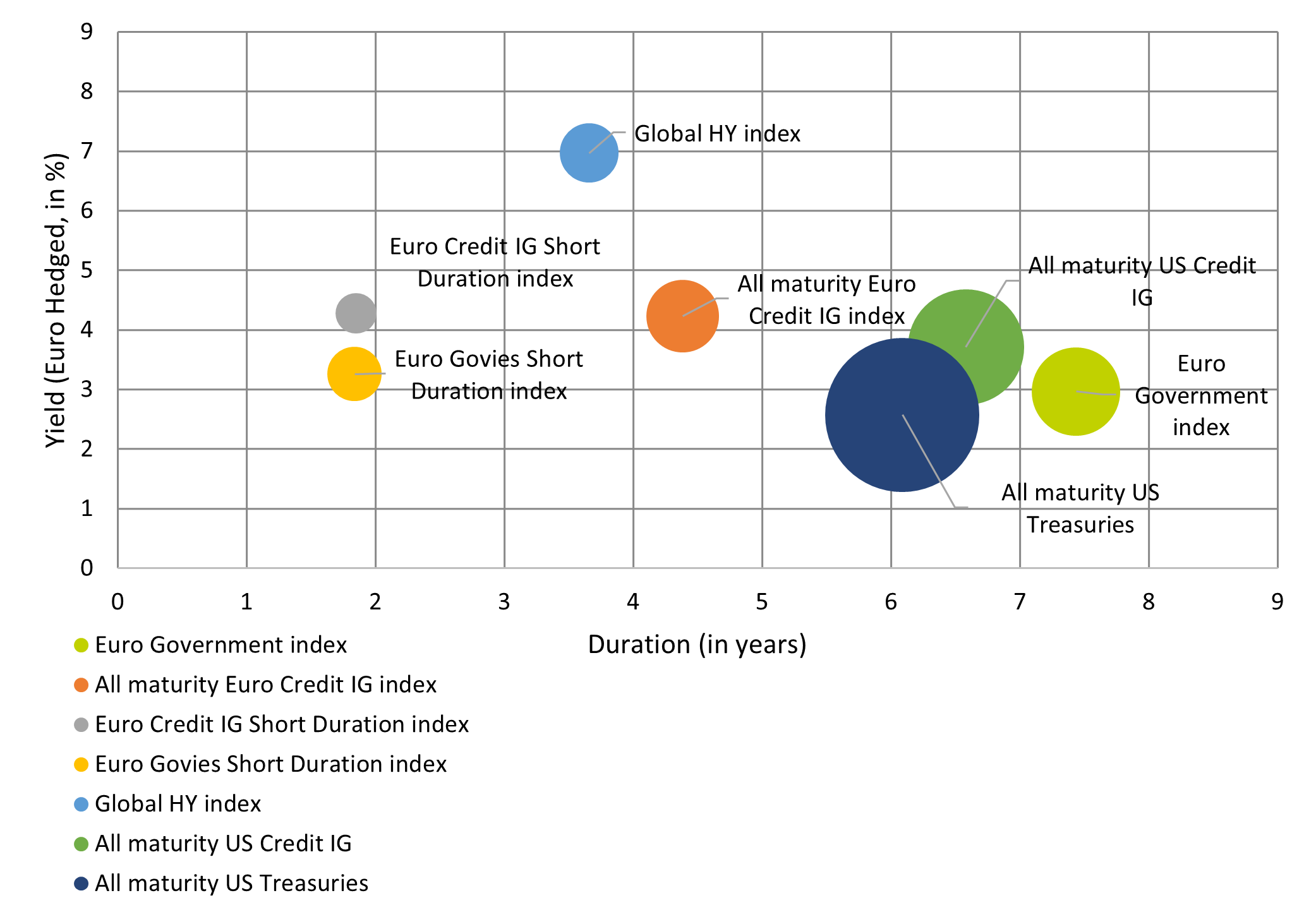

Across euro credit universe, yields are at their highest levels since the Great Financial Crisis driven by recurring rate hikes from the European Central Bank. For example, the Euro Credit IG index currently points at 4.5% yield on the asset class, with a duration level that has decreased over the past 12 months at around 4.5 years.

This is underpinned by company earnings which have been resilient in 2023, as they took advantage of rising input costs to boost pricing power and drive profit margins higher. Besides, corporates have been opportunistic, accumulating significant cash reserves on their balance sheets during Covid-19 when financing conditions where more accommodative. Consequently, there is no immediate need for them to pursue additional funding.

While we have seen some modest spread widening over the past few weeks, we expect it will remain range-bound around 80-100 bps on ASW over the coming quarters. This is because European corporates and financial institutions are well prepared for an economic deceleration. The story is slightly different further down the credit quality spectrum, with European high yield spreads relatively expensive and high level of dispersion of prices observed in the market. Even so, with default rates remaining low at the moment, there are still opportunities with yields around 7.5%

What the macro picture currently tells us

One of the main surprises from 2023 has been the resilience of consumers. The markets expected savings to erode and therefore help bring inflation under control. The savings pool, however, was underestimated and this was one of the reasons that rates were higher than planned. As central banks are now indicating a pause in hikes, rates are likely to stabilise for, at least, some of 2024.

There are already signs that the monetary policy is having an impact: the sharp increase in rates had seen been a marked decline in demand for new credit; although the unemployment levels remain low, job creation is decelerating even in countries like France which have been doing relatively well recently. However, long‐term investors should plan on rates being permanently higher than they were from 2008‐2020.

Disinflation is now broad-based across the eurozone however, one of the key headwinds going into 2024 is oil. Oil prices have increased over the past 12 months and are unlikely to fall, which will mean inflation could remain a sticky problem. For the Eurozone, this will be felt more than in the US which has been a net exporter of fossil fuel since 2019. Added to this is the high level of uncertainty and tensions in the Middle East which could lead to a bull flattening if it sparks an energy crisis.

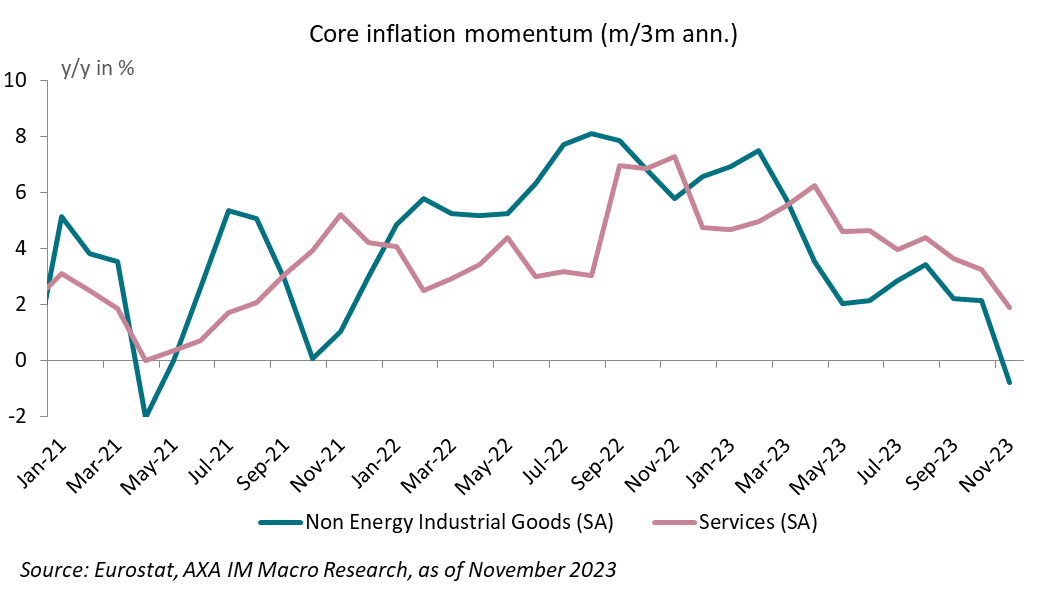

Nevertheless, as the chart below shows, core inflation is down with services manufactured goods prices heading in the right direction.

Short duration and total return

Going into 2024, we prefer short duration and total return strategies which offer attractive yields, a flexible investment approach and aim to mitigate duration risks in market environment prone to uncertainty.

Short Duration IG Credit strategies currently offer high level of yields considering the relatively flat structure of the credit curves. They represent attractive opportunities, especially for conservative investors who are seeking to mitigate interest rate risks and potential drawdowns.

Total return strategies are also worth considering, as they provide flexibility to accommodate challenging market environments. These strategies rely on high conviction positioning focusing on sectors and issuers with the best return potential.

In our view, soft landing is the base case scenario for the coming year, with expectation of easing inflation and a deceleration in credit metrics. Several elements support this soft-landing scenario: financial institution remain well-capitalized, leverage for corporate did not deteriorate significantly and the economy continues to add jobs while overall consumer spending remains robust. This implies that investors can deploy capital at attractive yields with limited downside risks, in our opinion. There is also an entry point for fixed income investors to benefit from a carry effect, that is expected to erode as central banks shift their monetary policies over the course of 2024.

Yields across the fixed income asset class

As the chart above shows, euro short duration credit currently offers a yield of over 4%

Fixed Income

We cover a broad spectrum of actively managed fixed income strategies to help investors build diverse portfolios that can be more resilient to economic and market shifts.

Learn moreDisclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.