Multi-Asset Investments Views: The Final Countdown

KEY POINTS

We entered the summer, a period renowned for thin market trading, with elevated investor sentiment. By mid-July, most equity markets had reached fresh all-time highs, leaving the 21-month bull market ripe for a technical correction. Identifying market volatility triggers is a highly uncertain exercise - hence the emphasis on monitoring the underlying market fragility rather than specific trigger events.

There are plenty of things that might go wrong, for example a significant miss in corporate earnings colliding with ever rising expectations; an escalation in Middle East tensions; or negative US payroll news. Yet, the actual catalyst was not on most investors’ radars: a sharp yen appreciation after a 0.10% rate hike by the Bank of Japan, leading to a sharp unwinding of global carry trades – when investors borrow at a low rate to invest in a currency or asset with a higher rate of return.

Since Japan entered deflation in the 1990s, the Bank of Japan (BoJ) has kept interest rates very low, well below the levels of other developed markets. The yen was historically used as a funding currency to invest in risky assets, domestically but also globally. Over time, the stock of this yen carry trade grew to create its own tantrum moment.

The BoJ’s decision to hike interest rates a little more than expected played a role, increasing the cost of yen funding, especially in relative terms when all other developed central banks are either cutting or about to cut interest rates. The modest negative surprise in US employment data on 2 August - a mildly disappointing update in non-farm payrolls - was also an ingredient, adding some risk-off sentiment to this cocktail, which reminded us of the volatility spike of February 2018 but also of the UK gilt and liability-driven investment crisis of October 2022.

Softening US macroeconomic data has been the focus in recent weeks with all eyes on employment numbers. Disinflation is ongoing and the Federal Reserve (Fed) is now turning its attention to the employment side of its dual mandate. We are not overly worried about the health of the US economy though, as fundamentals are still in good shape. The Atlanta Fed GDPNow growth tracker is currently hovering close to 2% annualised, for the third quarter (Q3) of 2024, consistent with our view that the US economy is only going through a soft patch, not a recession.

Some weakness in the US labour market is welcome for risky assets to ensure that monetary policy easing is on its way. The Labor Department’s 22 August revision to payroll data - 818,000 fewer new jobs were created in the 12 months to March than originally reported - was just enough to give Fed Chair Jerome Powell the opportunity at the Jackson Hole economic policy symposium to confirm the Fed’s commitment to begin to normalise rates. This served to further encourage the market’s dovish assumptions regarding the path and depth of the monetary policy easing to come.

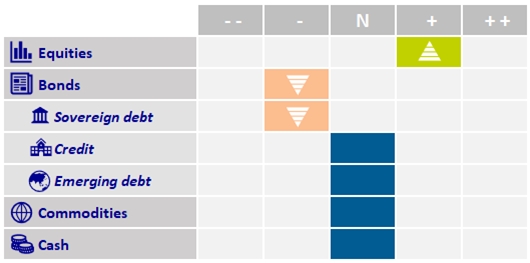

Asset class views

Corporates reported encouraging Q2 results, mostly better than expected, and mega-cap tech companies confirmed their earnings’ underlying stability. This was illustrated by Nvidia delivering strong results that met or beat analysts’ estimates on nearly every metric, albeit falling short of the highest’s expectations.

It appears the yen is stabilising, which should further slow carry trade unwinding although we suspect that most of this has already been executed. We favour the US for its breadth and superior earnings quality and the UK, which captures emerging market growth and likely weaker sterling after a period of surprising strength.

On the fixed income side, the market quickly moved to a risk-off mode. After more than two years of positive correlation between equities and government bonds, this return of ‘bad news is bad news’ is welcome. We expect the Fed to cut interest rates by 25basis points (bp) rather than 50bp on 18 September - neither the labour market weakness nor the soft patch of macro data justifies the larger cut. Similarly, market expectations of 100 basis point (bp) cut by year-end and 200bp cut over the next 12 months seem overcooked.

We believe that a repricing of rate cuts expectations will not necessarily turn sour for risk assets if it comes on the back of growth reassurance and positive earnings guidance.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

Image Source: Getty Images

© 2024 AXA Investment Managers. All rights reserved

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.