Can high yield be a substitute for equities in this low growth environment?

As investors, we are often liable for thinking in specific asset class buckets rather than taking a broader view of the investment universe. Yet, taking a cross-asset class view could assist in smarter investment choices and allocations. This perspective is very visible when comparing high yield bonds to equities: two investments that sit in very different asset class buckets, however, their risk-return characteristics are more similar than most imagine and could be viewed as competing asset classes. So much so, that we would argue that high-yield bonds could be considered as an alternative to equities, but with lower volatility.

For investors this consideration could be relevant when looking ahead to 2023. For example, the Global High Yield market is currently offering investors a yield of around 9%

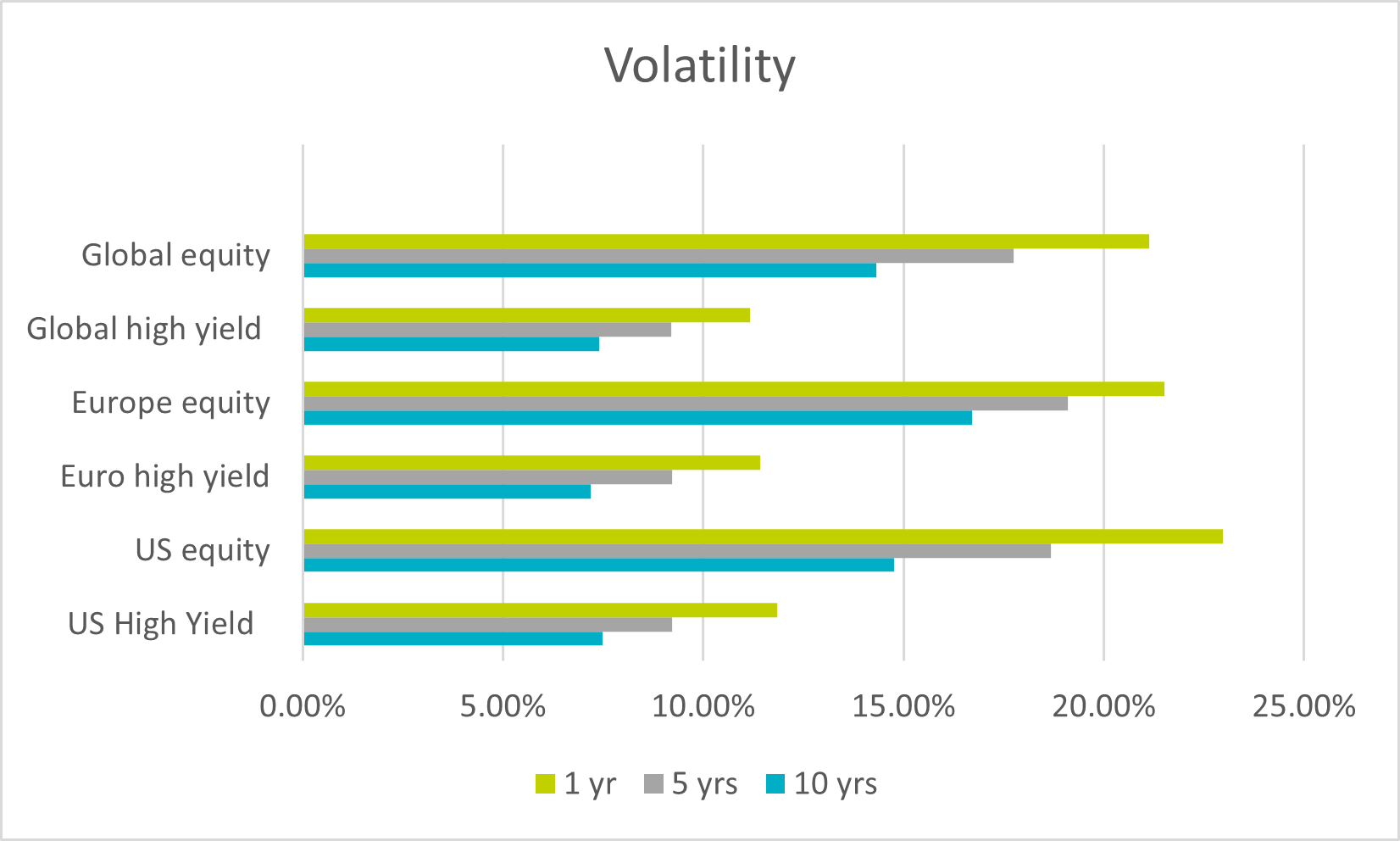

High yield vs Equities: volatility is a differentiator

Overall, there is a high correlation between high yield and equities: global high yield and global equities have had a correlation of 0.83

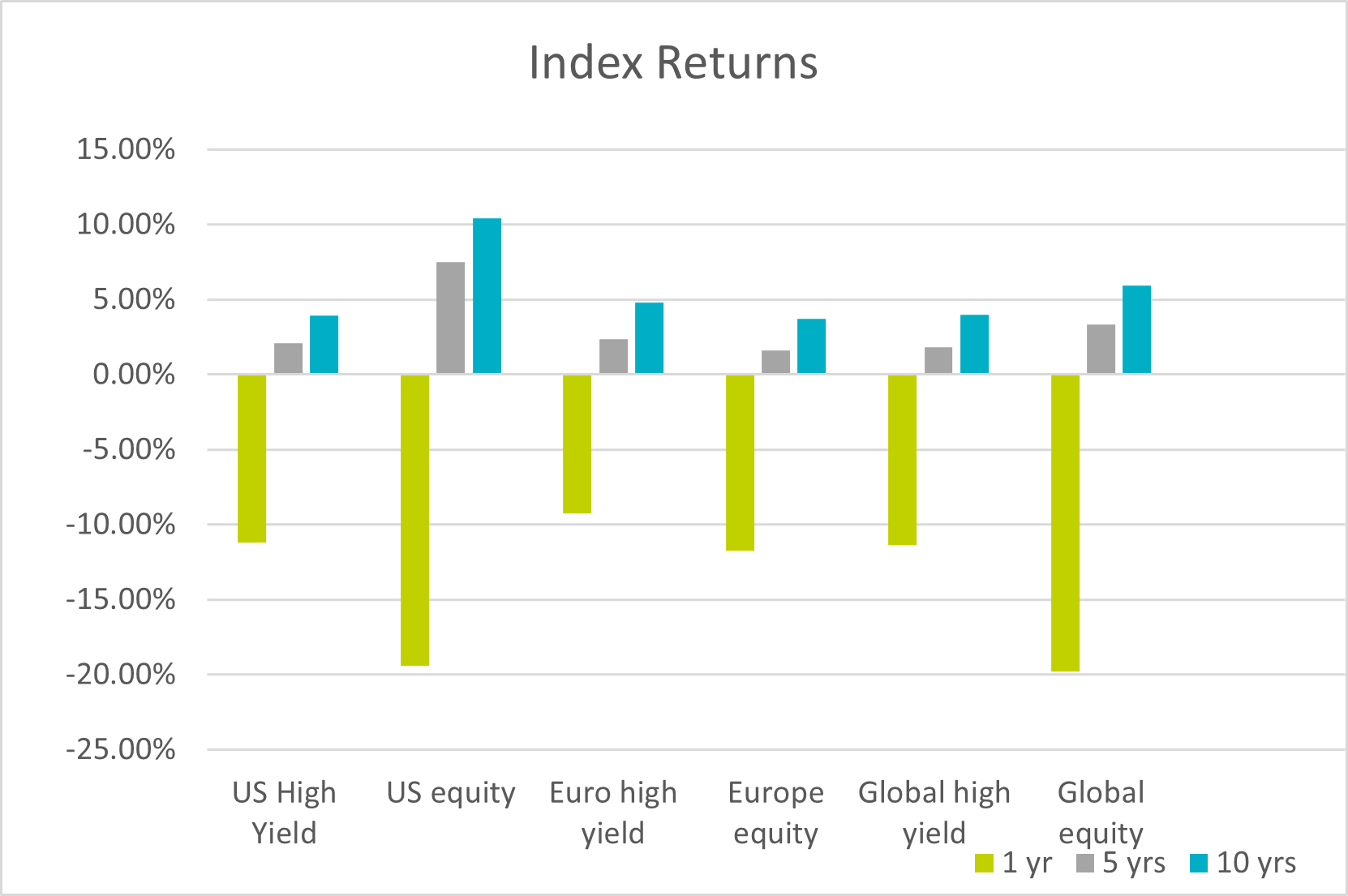

This correlation is reflected, on the whole, in returns. Over a 10 year time period, global high yield has largely kept pace with global equities: 3.98% and 5.95% respectively

Volatility and Index Return ComparisonSource: AXA IM, Bloomberg as at 31 December 2022. Indices are: US high yield: ICE BofA US High Yield Index; US equities: S&P 500 Index Euro High Yield: ICE BofA Euro High Yield Index; Europe Equities: Eurostoxx 50 Index; Global High Yield, ICE BofA Global High Yield Index and Global Equities: MSCI All Country World Index

How they differ in structure:

Of course, volatility is not the only differentiator. In order to generate returns on equities, you need earnings growth or multiple expansion. However, as an investor in high yield, your return is more reliable as it comes from your coupon payment. High yield debt also benefits from interest rate exposure which can help to mitigate losses during periods of volatility.

As well as this, debt sits above equity in a company’s capital structure, meaning that in the event it is listed, a company will halt dividend payments to shareholders before coupon payments to bondholders are interrupted.

It is difficult to discuss debt without referencing default risk when it comes to high yield. While we expect the default and downgrade rates to increase this year in reaction to economic challenges, we believe they will remain relatively low compared to other periods of turbulence. We believe that the key to successful high yield investing is in avoiding those companies likely to be subject to a deterioration in credit quality and therefore to avoid capital loss.

Looking ahead

We expect many of the same risks from 2022 such as inflation and geopolitical challenges that are likely to continue to worry investment returns in 2023. The benefits of a diversified portfolio are not difficult to appreciate in such times, but how investors allocate within that and analyse their allocations is more nuanced. Indeed, generating equity returns from multiple expansion and earnings growth may be more difficult to achieve in a low growth environment, while compounding income from high yield debt could offer more reliable returns. With equity-like returns but lower volatility, it may be worth considering high-yield bonds as an alternative to equities especially in these unpredictable markets.

Glossary

Default Risk: The risk of an issuer not being able to repay their debt obligations.

High Yield Debt: Also known as “junk” bonds, are issued by companies with a lower credit rating than their investment grade counterparts.

Volatility: the degree of variation of a price for a given security or market index. As a rule of thumb, the higher the volatility, the riskier the security.

High Yield Bonds

High yield investing has the potential to offer risk-aware investors an attractive source of income.

Find out moreDisclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.