A nice surprise for US inflation

Key points:

- US inflation was softer than the market expected in October

- The peak of US inflation could be behind us

- Energy and food likely to remain upside risk

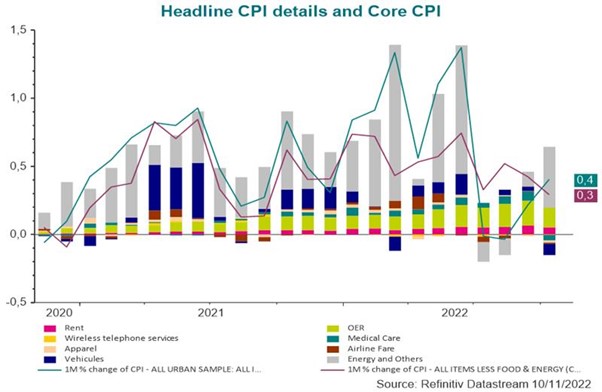

US Consumer Price Index (CPI) while still hot was below market expectations with headline inflation continuing to slow from 8.2% down to 7.7% on an annual basis. This suggests that peak US inflation is likely behind us. The markets reacted positively to this especially as the monthly number for October had been anticipated as being 0.1% higher than it was; it came in at 0.4% including food and oil. Meanwhile, core inflation in October rose 6.3%, on an annual basis, with a monthly increase that was smaller than that experienced in September.

Looking into the numbers there are some trends that provide reasons for optimism:

- Goods prices fell by -0.08% essentially due to lower car prices but it suggests the easing of supply chain pressures. Given that goods prices have been the most affected by Covid-related inflation, this print could mean that it is gradually dissipating

- Below the surface of core inflation are signs of softening with a number of indices falling, led by medical care. While rent inflation has continued to increase with a solid 0.8% monthly jump it is some consolation that the US Federal Reserve (Fed) knows that rent inflation is a lagging indicator. Tackling lagging inflation from shelter will be key, especially as it is likely to remain hot for some months. This is even more prevalent if the latest numbers from medical care mean that that inflation contributor is rolling over.

However, it is not all a story of optimism with food and energy prices remaining hot and an upside risk. Particularly disappointing was energy inflation which, after three months of negative contribution, was positive again in October. Along with food and energy, labour and commodities still look to be upside risks for US inflation going forward.

What does this all suggest?

Inflation was weaker but only an isolated number so far and for the market’s mood to continue to be positive, it will need further inflation cool-down to be sustained. The reason why the market has reacted so positively to the inflation release, despite it remaining elevated on an annual basis, is because shelter was close to being the only significant source of inflation. As shelter has a 30% weight in core inflation this means out of the monthly +0.3% increase in core inflation, 0.24% came from shelter which, as a lagging indicator, suggests inflation may be slowing

Cut the numbers a different way and core inflation less food, energy and energy services was actually -0.1% on the month, its lowest reading since March 2020 Covid crisis. We would expect with this inflation release that the Fed will proceed with reducing the pace of rate increases in the coming months and eventually pause boosting demand for financial assets.

We continue to expect a moderate inflation slow-down with upside risks from food & energy prices. As the chart shows, although US inflation should be past its peak, monthly inflation numbers do remain positive with headline inflation at +0.4% and core at +0.3%. So, while Covid-related inflation is slowly going away and we expect inflation to moderate, we continue to expect positive monthly numbers, hence a slow slow-down.

What is inflation?

Inflation can erode the real returns of investments however tools like inflation-linked bonds could help investors mitigate the effects of inflation on their portfolio.

Find out moreDisclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 7 Newgate Street, London EC1A 7NX.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.