Is now a good time to look at emerging market debt?

Key points:

- Emerging market debt (EMD) is expected to benefit from China’s re-opening coupled with an end to domestic monetary tightening

- Inflation is expected to fall, fiscal balances continue to improve, and commodities remain supportive

- Yields are historically attractive and corporate fundamentals broadly robust

- An active, total return approach may help unveil opportunities given the heterogeneous nature of EMD.

The focus on the recessionary concerns of developed markets means that many investors may not be aware of the burgeoning growth story occurring in emerging markets. With domestic inflation now falling in some regions and growth from China feeding into the rest of the EM complex, investors may want to reconsider how they view EMD and its role in this current cycle.

It hasn’t been an easy run for EMD due to the significant rise in US interest rates. This has been a major headwind for hard currency emerging market debt as it is primarily denominated in USD. However, it now appears as though we are reaching the peak in US rates which should reduce the upward momentum of yields. As interest rates peak, this should also lessen the strength of the US dollar and, thereby, reduce pressure on emerging market currencies.

Since China re-opened its economy at the end of last year, we have seen improved consumer activity with travel and retail sectors particularly experiencing an acceleration in growth. We expect this trend to continue and result in a rotation of growth towards China and away from developed economies. This should also benefit other EM countries that are a beneficiary of trade with China, particularly those within the Asia region. China’s reopening should also be supportive for global commodity prices, particularly metals, providing another boost for those EM countries that are exporters.

This growth potential is strengthened by EM sovereign balance sheets which, overall, remain stronger than G7 countries, even after the Covid19-related increase in government debt and the recent rise in borrowing costs.

Ahead in the monetary cycle

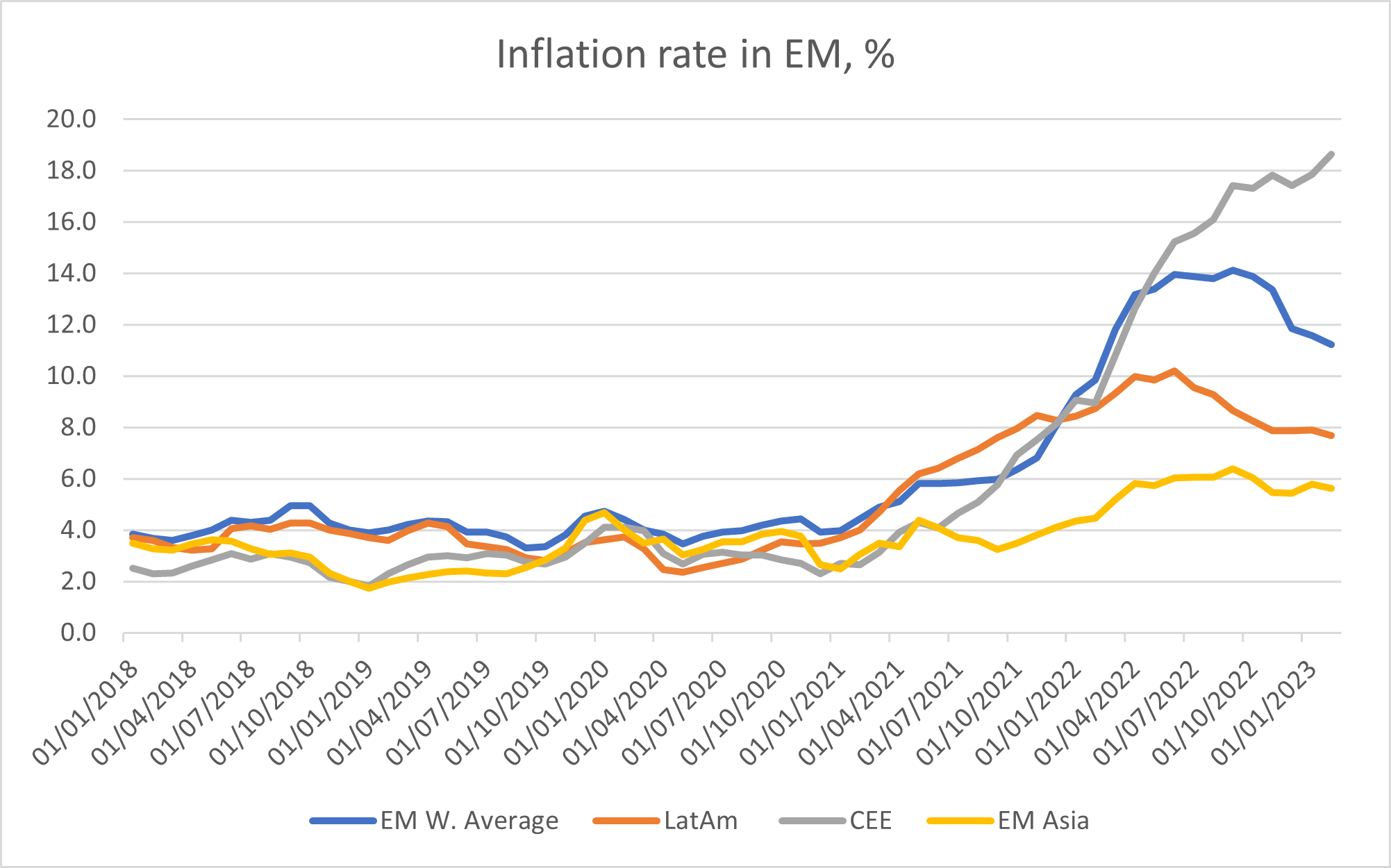

As well as benefitting from strong balance sheets, another interesting aspect about EM countries has been their approach to inflation. Many EM central banks were proactive in raising interest rates as early as 2021, much sooner than their developed market peers. As a result, inflation in many countries appears to have past the peak and many central banks are either at, or near, the end of their hiking cycles.

Source: AXA IM, Bloomberg as at 15/02/23

In Latin America (LatAm), for example, the average year-over-year inflation has come down from 10.2% at the end of June to 7.7%

Of course, there are always outliers when looking at such a broad asset class, and the inflation crisis in Argentina is one such example. The soaring inflation reflects an economic crisis that has been ongoing in Argentina since 2018 rather than a broader trend, and as such, is not something we have seen spreading across the region. Away from the outliers, falling inflation puts EM central banks in a position to potentially cut interest rates later in the year. If this occurs, then it would be another factor supporting growth.

Making the most of emerging markets idiosyncrasies

The situation in Argentina highlights why we believe in an active, total return approach to emerging markets and not being constrained by benchmark exposures. This ability to differentiate across the asset class is important given the heterogenous nature of EM. While some EM economies are indeed fragile, many are investment grade-rated with very solid fundamentals and growth prospects. Within the same region there can be marked differences in countries which a “blanket” approach would not reflect. For example, within Latin America we favour Colombia due to a fragmented congress which, we believe, makes the implementation of any radical policies unlikely. In the same region, Brazil looks less attractive as we believe the political and fiscal risks are greater, with Lula’s administration committed to implementing a large fiscal expansion which will put pressure on public finances. Elsewhere across EM markets, some of the more fragile countries have received support from the IMF which has helped mitigate a more difficult market access since the beginning of 2022.

Within the EM corporate market, company fundamentals remain broadly robust, particularly in the investment grade space. There are instances where credit ratings for issuers are limited by the sovereign’s rating, and so it is important to carry out detailed analysis to uncover opportunities if the rating doesn’t necessarily reflect corporate fundamentals. This is demonstrated in Turkey, where the sovereign faces significant challenges including spiralling inflation and currency depreciation. However, large exporters, who receive revenues in US dollars, may benefit from a depreciation in the local FX rate as their costs are in local currency so their margins improve. As such, we believe the corporate market can represent interesting opportunities for investors.

Default forecasts indicate a positive outlook

Outside the highly distressed names in Russia, Ukraine and Chinese property, default forecasts, a key factor for assessing potential returns, have been revised down to 2.1% for the high yield corporate market.

Diversifying income

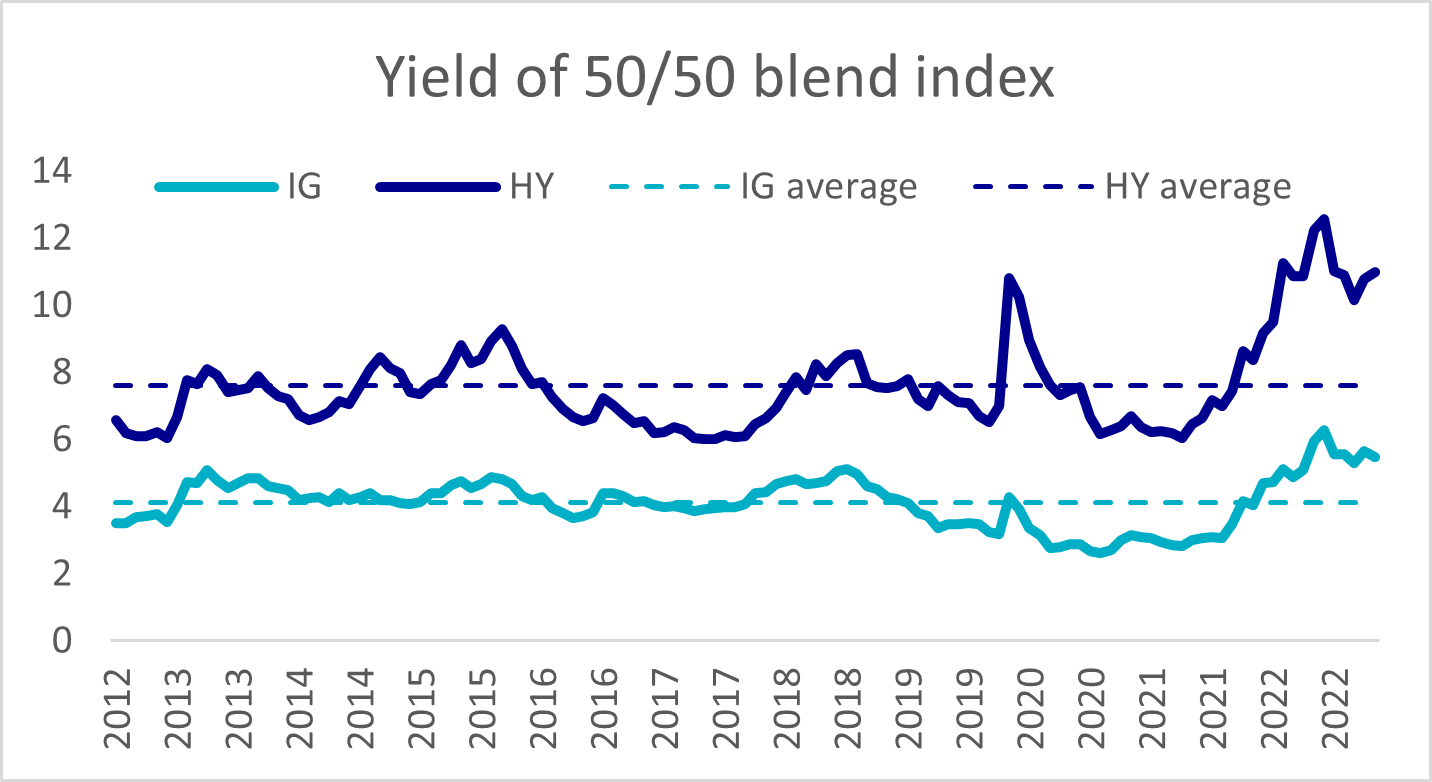

For investors looking for income enhancement, emerging market debt currently offers attractive yields: the JP Morgan hard currency sovereign index currently has a yield of 8.5% while the corporate market yields 7.2%

Source: AXA IM, Bloomberg as at 31/03/23

Taken altogether, we believe EMD has the potential to compensate investors for the additional risk while also providing diversification to a fixed income portfolio.

Fixed Income

We cover a broad spectrum of fixed income strategies to help investors build diverse portfolios that can be more resilient to economic and market shifts.

Find out moreDisclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.