Why now may not be the time to sell inflation-linked bonds

Key points:

- The move away from inflation-linked bonds is expected but potentially misplaced.

- Why investors may want to re-evaluate their inflation-linked bond allocation

- What inflation-linked bonds offer in this market environment

Inflation-linked bonds tend to be at the sharp end of investor behaviour: investors pile in as inflation takes off and then disinvest when nearing the peak regardless of what the inflation level is. This current inflationary cycle has been no different and investors began moving away from inflation-linked bonds towards the end of 2022 as the headline inflation peak was anticipated. This trend continues today.

The challenge for investors, however, is that inflation is still high even by historic standards and, while headline inflation may have fallen from the extremes of this time last year, core inflation remains elevated. Inflation is sticky and we expect it may be a problem for the next decade. Factors that might see inflation remaining sticky such as the green revolution, the continuing supply strains on resources caused by the war in Ukraine and budget deficit concerns mean inflation levels could remain volatile for the foreseeable future.

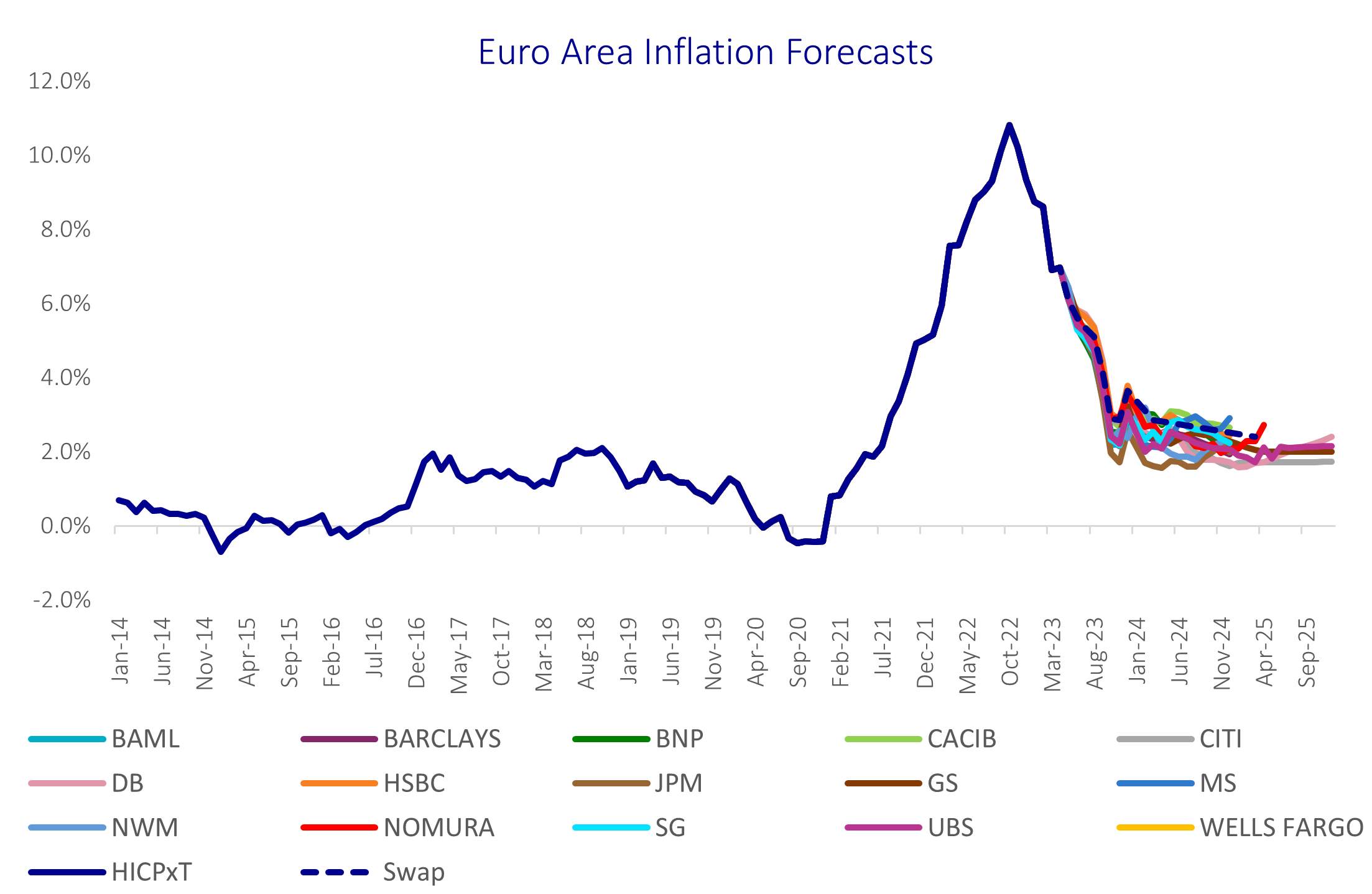

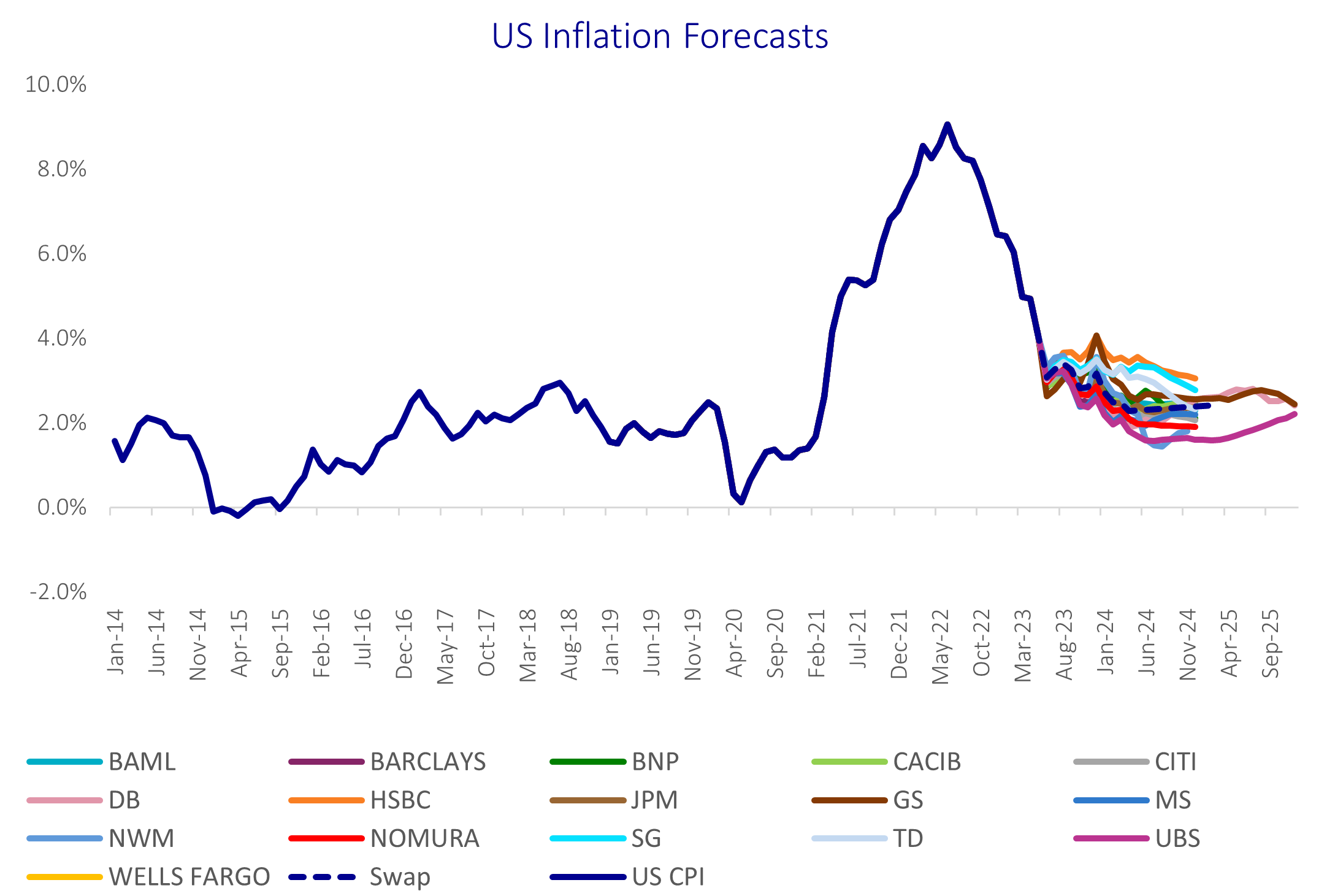

Nevertheless, as the chart below shows, economists are still projecting a return to around the 2% target levels by the end of 2023..

Source: AXA IM Forecasting as of June 2023. The above represents our current market views only and does not constitute investment advice.

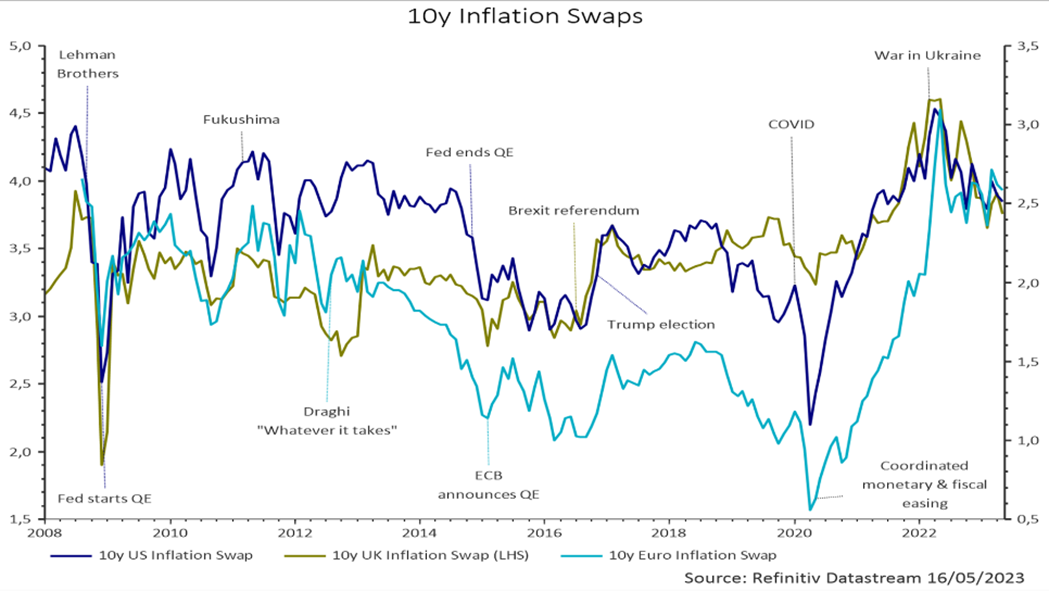

Added to this, the 10Y inflation breakevens suggest that the market is pricing future inflation at similar levels to those seen between 2010 and 2013.

Source: AXA IM, Datastream as at 16/05/2023

Market conditions offering opportunities

We expect that yield curves will remain inverted with overnight interest swap markets (OIS) pointing to US rates at 3.8% in 2-years’ time, Euro rates at 3.1% and sterling overnight rates at 4.4%

When inflation moderates, inflation breakevens tend to go down but this combination of elevated levels of real yields and moderate level of breakevens is where we see opportunities. Inflation-linked bonds’ average real yields are currently at their highest average level since 2009-2010 but they are positive suggesting that investors can lock-in an above inflation income.

We believe that the combination of this with the market complacency towards future inflation risks suggests that inflation-linked bond investors may be able to lock-in positive real yields at their highest level post Lehman while getting exposure to inflation breakevens, (effectively a form of insurance premium against future inflation) at historically attractive levels.

With inflation likely to be volatile for the foreseeable future, inflation-linked bonds may be a useful tool for investors: they provide resilience against sticky inflation and, as all inflation linked bonds cashflows are indexed to inflation and their issuers are often highly rated sovereigns, investing in inflation-linked bonds may be used as part of an investor’s capital preservation strategy.

Investing in Inflation

It's easier to weather inflation when you're better prepared

Find out moreDisclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© 2023 AXA Investment Managers. All rights reserved

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.