UK Election Watch: Nigel Farage enters the race, boosting Reform UK

The Debate

The two main candidates for Prime Minister went head-to-head earlier this week in the first debate of the campaign. The immediate outcome was close, with a YouGov poll putting Rishi Sunak marginally ahead of Keir Starmer, with 51% of the vote, compared to 49%. But the controversy surrounding potential tax increases under a Labour government dwarfed the event. Rishi Sunak repeatedly stated throughout Tuesday’s debate that if Labour were to be elected, households would be hit with a £2000 tax increase, a figure he said had been calculated by the Treasury.

This has subsequently been widely discredited, with the Permanent Secretary to the Treasury stating it should not be presented as an official estimate, given that the department was “not involved in the production or presentation of the Conservative Party’s document ‘Labour’s Tax Rises’ or the calculation of the total figure used”. In addition, the Office for Statistics Regulation has said that as well as being clearer on the source of the figure, Mr Sunak should have made it known that the figure reflected the total over a four-year period, not annually as implied during the debate. The PM has denied misleading people and is standing by the figure; Starmer consistently dismissed the figure as untrue and “garbage”.

The Vote Split

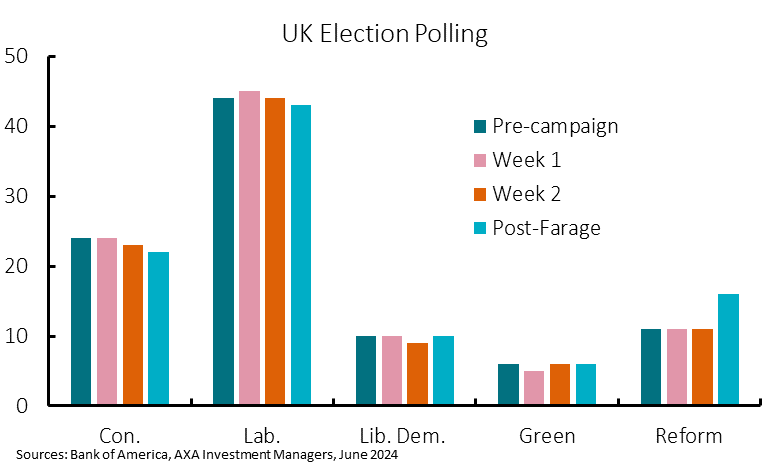

The Conservative party faced a further blow this week, as former Brexit Party leader Nigel Farage threw his hat in the ring, taking over as leader of Reform UK and putting himself forward as a candidate in the Essex constituency of Clacton. He ruled out this exact possibility just three weeks ago. The move has spurred the first major shift in the polls since the election was called, with each of the seven polls since the announcement showing a marked increase in support for Reform. Indeed, Reform UK have gained between four to five points on average and are now polling around 16%, only six points behind the Conservative Party.

The Impact

Growing support for Reform UK, however, does not appear to be impacting the Labour lead, meaning a sizeable Labour majority is still the most likely outcome. The latter has maintained its 20 to 22 point lead this week, with most of the increase in support for Reform UK coming from the Right of the political spectrum. Indeed, this mirrors some recent by-election results where Reform’s vote almost matched the Conservative vote and has appeared to contribute to losses of seats with considerable leads.

We have written about the macro implications of a Labour majority over the past couple of weeks. Insofar as recent polling suggests Labour continues to be on track for a comfortable to large majority with less than four weeks to go to the election, we see little macroeconomic variation from these scenarios. We only see a macroeconomically different outcome if the Labour majority was much smaller, but this currently looks unlikely. We will provide a full analysis of the macroeconomic impact in our upcoming Election Preview.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© AXA Investment Managers 2024. All rights reserved

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.