US reaction: CPI notches 2nd confidence builder

KEY POINTS

CPI inflation eased again in May, the headline annual rate slowing to 3.3% from 3.4% last month, excluding food & energy the rate fell to 3.4%, which is the slowest pace of inflation in exactly three years. Importantly the monthly moves of 0% and 0.2% (0.163%) respectively were marginally softer than market expectations (0.1% and 0.3%).

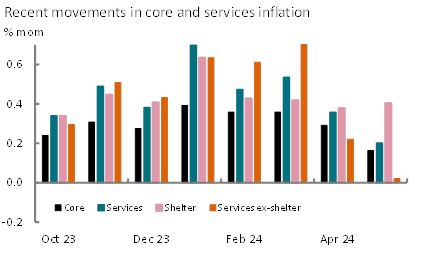

Following the upside surprises in Q1 this year, May’s release provides another month’s evidence that inflation pressures do not seem to be reaccelerating and rather at the current pace provide more evidence that they are moving back towards target. Goods price inflation softened again to an annual 0.1%, from 0.3% last month, with monthly prices falling in each of the last three months and in May helped not only by falling gasoline prices, but lower new car prices, clothing and household furnishings. Yet most focus continues around the more domestically driven services inflation (Exhibit 1). This remained more elevated at 5.2% on an annual basis, but the monthly increase slowed to just 0.2% - its slowest increase in nearly three years. Within this, shelter inflation still showed little sign of deceleration, rising by 0.4% on the month - marginally faster than last month. We believe the sampling of this measure is likely to mean that the expected deflation only materializes after next month, despite broader indicators continuing to point to deceleration. Services ex-shelter drove disinflation in this sector, rising by just 0.02% on the month – its weakest since last May. It is worth noting that the US is one of the few regions to focus on seasonally adjusted inflation figures. The fact that other statistics agencies do not adjust the data is simply a statement of the difficulty surrounding such adjustments. As such, as the Q1 shock seems to fade (and indeed unwind somewhat) over Q2, there is a persistent question as to how much of this reflected ‘seasonal variation’.

Today’s release is an important figure for the Federal Reserve (Fed). Fed commentators have used any number of descriptors for how many softer inflation readings would be necessary to build the “confidence” the Fed says it needs before easing policy. These have included “a number”, “a string” and most explicitly Fed Chair Powell stated “more than one or two”. So the release of today’s figure is likely to be still insufficient to justify the Fed easing tonight. However, we suspect that it will make the tone of tonight’s press conference somewhat easier. We expect the Fed’s dot plot tonight to switch from forecasting three cuts for this year in March to two. To our minds, this will be accompanied by cautious commentary from Powell saying the Fed still needs more confidence, but a signal of two cuts keeps the Fed’s optionality around September open in a way that moving to one would not. That is easier in the light of today’s release.

Market reaction was sharp to the release. The probability of a September cut leapt back to 80% from below 60% before the release, the chances of two cuts this year rose to 90% from 50% before. These moves basically unwound the reaction to Friday’s surprising gain in payroll jobs. Similarly, term yields also reacted, 2-year US Treasury yields falling 14bps to 4.69% and 10-year down 11bp to 4.29% - 2bps above the pre-payrolls level. The dollar also dropped by 0.6%, but this remains around 0.4% higher against a basket of currencies and 0.6% higher than the euro, reflecting increased political uncertainty.

Exhibit 1: Services ex-shelter drive figure lower

Source: BLS, June 2024

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© AXA Investment Managers 2024. All rights reserved

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.