2025 Inflation Outlook: High and could be higher

KEY POINTS

After disappearing from the investors’ risk radar 12 months ago, inflation is now back in focus with expectations of elevated price pressures throughout 2025. The key drivers include:

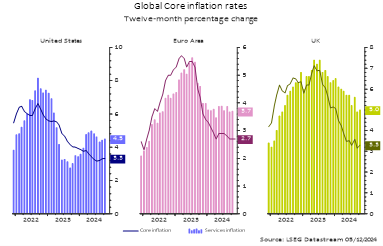

- Services Inflation: with strong demand in service sectors and ongoing labour market constraints, services inflation is expected to stay elevated and just gradually come off from current levels.

Figure 1: Global core and services inflation rate, % yoy

Source: LSEG Datastream 5th December 2024

- Increased fiscal support: governments globally signalled a ramp up in debt issuance for next year to underpin activity and consumption, this is likely to continue to sustain inflation in 2025.

Impact of Trumpnomics

President Donald Trump’s proposed fiscal agenda is unequivocally inflationary, reflecting increased government spending and tax reforms aimed at stimulating economic activity. Donald Trump has discussed the key economic themes for a second term: migration, tariffs, fiscal easing and deregulation.

However, we consider tariffs and migration restriction to be supply shocks and fiscal easing to be a demand boost. This is likely to see US inflation reaccelerate – perhaps sharply depending on scale and pace of tariffs. We forecast an eye catching 2.8% of inflation in 2025, well above market expectation.

In terms of growth, depending on financial market reaction, we expect US activity to remain solid into 2025 – softening from a robust 2.8% expected for 2024, but likely to remain above trend at 2.3% for 2025. However, assuming broad implementation of Trump’s policies across 2026, we expect to see material headwinds to growth in 2026 to 1.5%.

In other regions, the outlook is more nuanced

In the UK, for example, headline inflation is expected to average 2.5% in 2025, with additional price pressures stemming from tax adjustments outlined in the latest Budget. However, the growth picture is set to remain sluggish as household spending remains subdued.

Finally, inflation in the Euro bloc is forecast to undershoot the European Central Bank’s 2% target for much of 2025 and 2026, reflecting subdued wage growth and structural challenges. This outlook is already priced into markets, limiting surprises for investors.

Amid these dynamics, inflation breakevens remain depressed, particularly in the US and the UK, offering attractive tactical opportunities for inflation-conscious investors. However, our most favoured trade lies elsewhere in long real rates.

Investment opportunities: keep it real

As widely anticipated, G10 central banks pivoted to rate cuts in 2024, marking a notable shift from the aggressive monetary tightening of recent years. This easing cycle, aimed at countering growth headwinds and taming recession risks, came in response to declining short-term inflationary pressures. However, the broader market reaction highlighted a divergence in rate dynamics, particularly for long-term yields.

2024 was indeed a tale of two tenors: While central banks slashed short-term policy rates, long-term yields ended the year significantly higher, a development that caught many by surprise, because of the stubbornly high inflation. We expect the volatility in rates to remain until market participants have more clarity on the deployment of Donald Trump’s agenda, but this is likely to happen in the first months of the year.

However, with growth momentum expected to fade as fiscal policies lose steam, long-duration positions in real rates present a compelling opportunity. Real rates are in positive territory across all markets, and we believe this level remains on the restrictive side. As growth slows and inflation stabilises, long real rate positions are poised to deliver robust returns.

The interplay of policy decisions, inflation expectations, and debt dynamics is shaping a complex investment landscape for 2025. While long-term rates defy traditional patterns, selective opportunities in breakevens and real rates offer value. Investors should remain nimble, navigating the evolving economic environment with an eye on long-term growth and inflation trends, the variable that we expect to remain “higher for longer”.

Subscribe to updates

Have our latest insights delivered straight to your inbox.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.