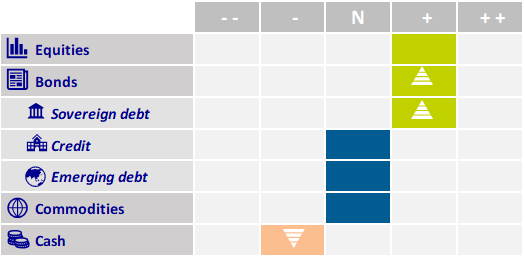

Multi-Asset Investments Views: Bond market optimism runs into reality again

KEY POINTS

Historically, bond investors have either been associated with a certain pessimism or well-informed optimism while equity investors have been portrayed as eternal optimists. Recent events have challenged these notions with bond markets expressing an unusual degree of optimism.

In the graph below showing three-month secured overnight financing rate (SOFR)1 futures, we highlight how the US bond market has persistently misunderstood the Federal Reserve’s (Fed) intentions in terms of monetary policy easing. The most recent experience, since the Fed’s September bumper 50 basis point (bp) cut, has proven to be just another iteration of misplaced optimism in the current cycle, and the subsequent unwinding of long positioning, especially the US, has been painful.

- Benchmark interest rate for US dollar-denominated loans

During the summer, the Fed clearly signaled that its attention had moved from inflationary to employment concerns, therefore reviving the so-called ‘Fed Put’ as mentioned last month. Perhaps the 50bp cut was more an effort to relieve the tighter financial conditions experienced by smaller corporates and poorer households who fund at floating rates and where some distress has been evident in recent months with credit card delinquencies and small business loan defaults on the rise. These do not pose an imminent risk to the broader economy but pre-empting any weakness is certainly prudent as small businesses are a significant source of employment in the economy and household consumption is the largest contributor to GDP.

Meanwhile, for the US economy, where our equity risk is mainly concentrated, things are going just fine. Since the summer, the Atlanta Fed nowcast indicator of GDP growth that we follow has risen from 2% at the end of August to near 3.5% currently. Core inflation remains sticky (core CPI was up 3.3% year on year in September) as wages and rents have slowed their incremental descent thus delaying hitting the Fed’s target. The labour market is proving to be resilient, should the last non-farm payroll numbers (+254,000) prove to be accurate post their customary revisions.

Given the context as described, it is not surprising that US yields have risen, albeit rather sharply which reflects more the unwinding of losing positions than the extent of the acceleration in the macro or the more prudent post cut rhetoric from members of the Fed. This is now being seen through core Eurozone bond markets where the macro situation is increasingly calling for a more proactive stance at the European Central Bank (ECB). The rise in US yields has dragged euro markets higher to have an improved entry point above 2.2% for the 10-year German Bund.

We remain in no doubt that central banks will be reducing rates further but just not quite as swiftly or as deeply as anticipated in the US. On the other hand, we are increasingly confident that the divergence of the ECB’s path from the Fed’s is still in play and over the month we have seen a widening of the yield differential between the two zones having been positioned on the relative value trade at the five-year point of the respective bond curves, US versus Germany.

Our attention is now focused on the third quarter earnings season which has kicked off with excellent results, especially from the financial sector. According to our analysts, the bar for earnings has been set relatively low this time around so we see good potential for some upside from here. In Europe, where the depth of earnings revisions over the past weeks has been significant, heavyweights such as semiconductor firm ASML and luxury goods group LVMH disappointed and weighed on European indices.

The US presidential election is almost upon us, and right now it’s too close to call. The recent improvement in Donald Trump’s polling has likely contributed to US bond markets coming under pressure as his policy mix would be the more inflationary of the two outcomes. Our base case for either a Trump or Kamala Harris win remains positive for equity risk in the short-to-medium term.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© 2024 AXA Investment Managers. All rights reserved

Image source: Getty Images

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.