Managing drawdown risks in credit portfolios

KEY POINTS

A credit portfolio has a pretty straightforward goal – an investor wants exposure to the global corporate bond market while maximising yield and avoiding defaults or downgrades. They might also want to optimise the portfolio’s profile from an environmental, social and governance (ESG) perspective.

To do this, a robust process of research, portfolio construction and allocation is essential. However, there are two key tail risks to consider that can threaten performance over time.

First, interest rate hikes. When central banks ramp up benchmark rates this can reduce the appeal of older bonds – their coupon payments will be lower than those of new bonds hitting the market. That’s fine if you intend to hold to maturity but would crystallise a loss if the bonds are sold.

We saw a useful, if extreme, example of this in March when Silicon Valley Bank (SVB) got into difficulties. SVB had invested excess deposits into long-duration bonds and saw their value tumble as US interest rates moved up sharply. Deposit outflows then forced SVB to sell bond holdings at a loss.

Second, credit spreads - the contrast in yield between bonds of a comparable maturity but with differing credit quality - may widen over time. Again, this suggests that the previously issued corporate debt may look less attractive than newer issuance.

Investors can address these risks using a portfolio overlay, also known as a drawdown risk control strategy. The goal here is to limit the potential losses over a given horizon by strictly managing rates and credit spread exposure and using derivatives - a type of contract to buy or sell a stock at a set price in the future - to help neutralise or at least minimise portfolio sensitivities.

For interest rate risk, this process can be relatively simple. Bonds are grouped by currency, and then for each currency the risk is projected across different maturities and hedged using futures or interest rate swaps – a means of reducing exposure to fluctuations in rates.

Liquidity issues

That challenge reflects the fact it is difficult to buy or sell protection on an individual bond. And so our view is the first step should be to find a bond index which represents the portfolio’s exposure. The underlying idea is the potential credit spread shock of our bond portfolio is as close as possible to that of the index.

As an example of the kind of shock we’re referring to, during the COVID-19 crisis, the credit spread of the European Corporate Aggregate Bond iBoxx index increased by 200 basis points.

One way to hedge the credit exposure is to trade total return swaps on the chosen bond index, whereby the investor receives the performance of the bond index over a given period and pays a fixed annual premium. However, one takeaway from the pandemic is the potential lack of liquidity of such derivatives in stressed conditions. Some investors were left with a significant exposure to a credit spread widening due to the limited size of the total return swaps market.

An alternative might be a credit default swap (CDS) on a global credit index. Traders were able to trade significant volumes of such derivatives even during the pandemic.

Single-name CDSs function as insurance against a default. The ‘protection buyer’ transfers the credit risk to the ‘protection seller’ in exchange for a premium. Should a company default, the buyer is compensated, for example by receiving the difference between the notional amount of the corporate bond and its recovery value from the protection seller.

A blended approach

This concept has been extended to a pool of entities, such as the iTraxx index in Europe and Asia and the CDX index in North America. The index CDS price corresponds to the average CDS price, or spread, of the most liquid firms.

The iTraxx

An index CDS trades in a similar way to a single-name CDS, but in the case of a company’s default, it would be removed from the pool. An investor would receive the protection on the defaulted name and continue to hold the protection against the remaining names. The pool composition is updated regularly to reflect changes in liquidity and credit quality.

However, the composition of the index covered by the CDS can be quite different from the names in an investor’s portfolio. One approach to address this issue is to use statistical techniques that seek to make good those discrepancies, as far as possible.

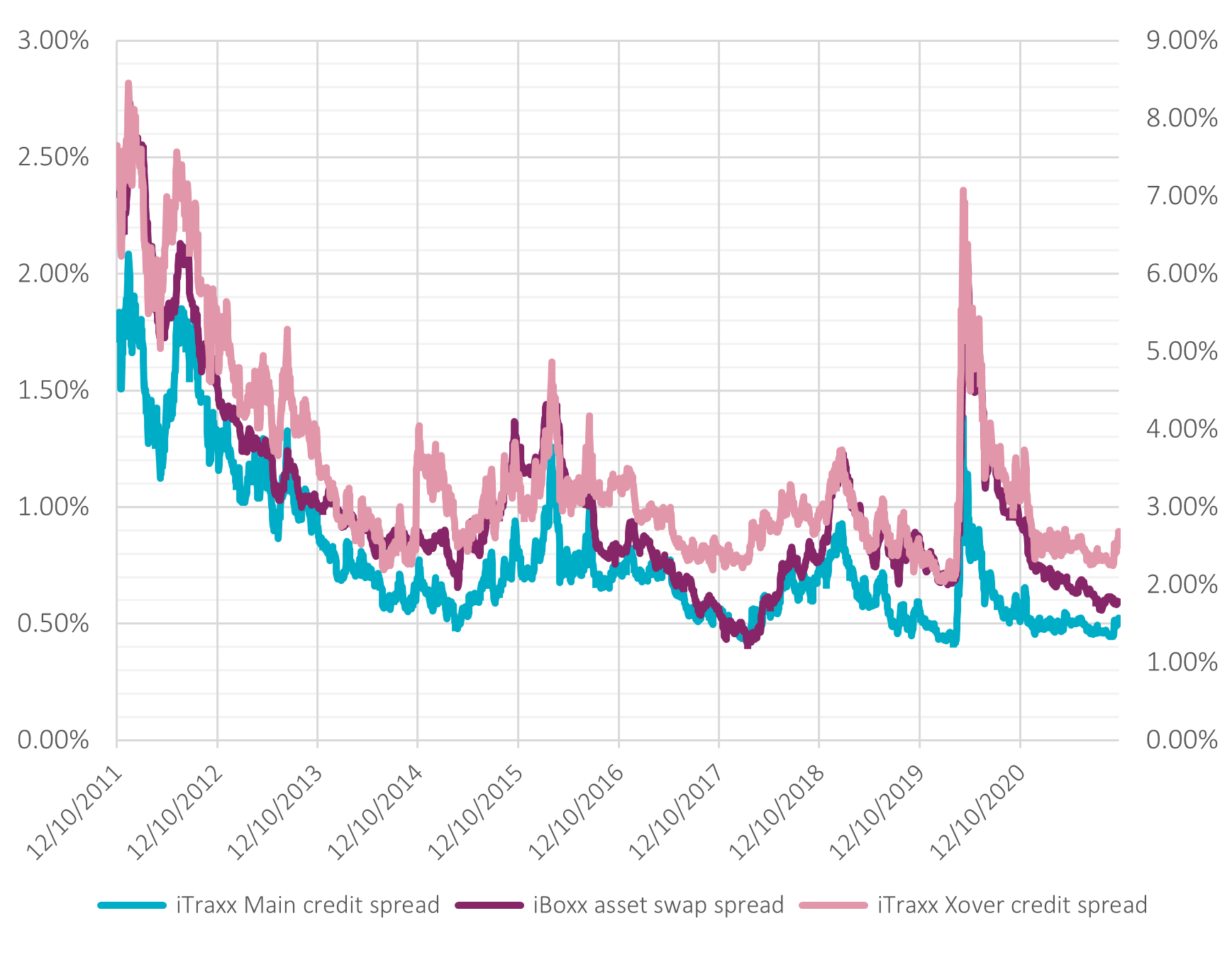

In the illustrative example below, the iBoxx Euro Corporate Aggregate Index plays the role of our credit strategy. Its asset swap spread – the difference between the bond yield and the swap rate with similar maturity – is used as a proxy for credit risk. We then set it against the credit spread – or rather the cost of insuring the names within – for both the iTraxx Main and the iTraxx Crossover.

The key finding is that there appears to be, in this example, a positive correlation between CDS spreads and the bond index asset swap spread. In normal market conditions, the bond index asset swap spread dynamic is close to that of the iTraxx Main dynamics, while in stressed market conditions (during COVID-19 for instance), it is closer to that of the iTraxx Crossover.

This implies we should be able to combine CDSs on investment-grade and high-yield indices, effectively calibrating the weightings of each in a bid to neutralise as far as possible the credit spread risk for a specific portfolio.

How credit risk changes according to market conditions

Source: For illustrative purposes only. Bloomberg, AXA IM. Retrieved April 2023

Putting it into practice: Hedging rate and spread risks

So how can we show this in action? As an illustrative case study, we can let the iBoxx Euro Corporate Aggregate once again play the role of our model portfolio, and we can use the hedging techniques described to try and understand the potential effects.

As an interest rate risk hedge, we use a rolling interest rate swap with five-year maturity where we pay a fixed rate and receive the floating rate. Hence, when rates increase, the interest rate swap value increases to compensate the potential loss from the bond portfolio

- A rolling five-year CDS on the iTraxx Main investment grade index where we buy the protection and pay the annual premium

- A rolling five-year CDS on the iTraxx Xover high yield index where we buy the protection and pay the annual premium

- The weights of iTraxx Main and iTraxx Crossover in this mix should be updated daily, and their calibration should account for both normal and stressed conditions. It is also important to include a ‘memory effect’. This means the weight calculation should learn from recent crises but should ‘forget’ it gradually over time as we move back to more normal conditions. This process is designed to ensure that the approach is viable in both normal and stressed market conditions.

As a result, the iTraxx Crossover was underweighted in this example from 2011 until early 2019, while it increased gradually in early 2020. The weighting then stabilises after the COVID-19 crisis period, which is itself included in future calculations, so the hedge is still reactive in potential future crises.

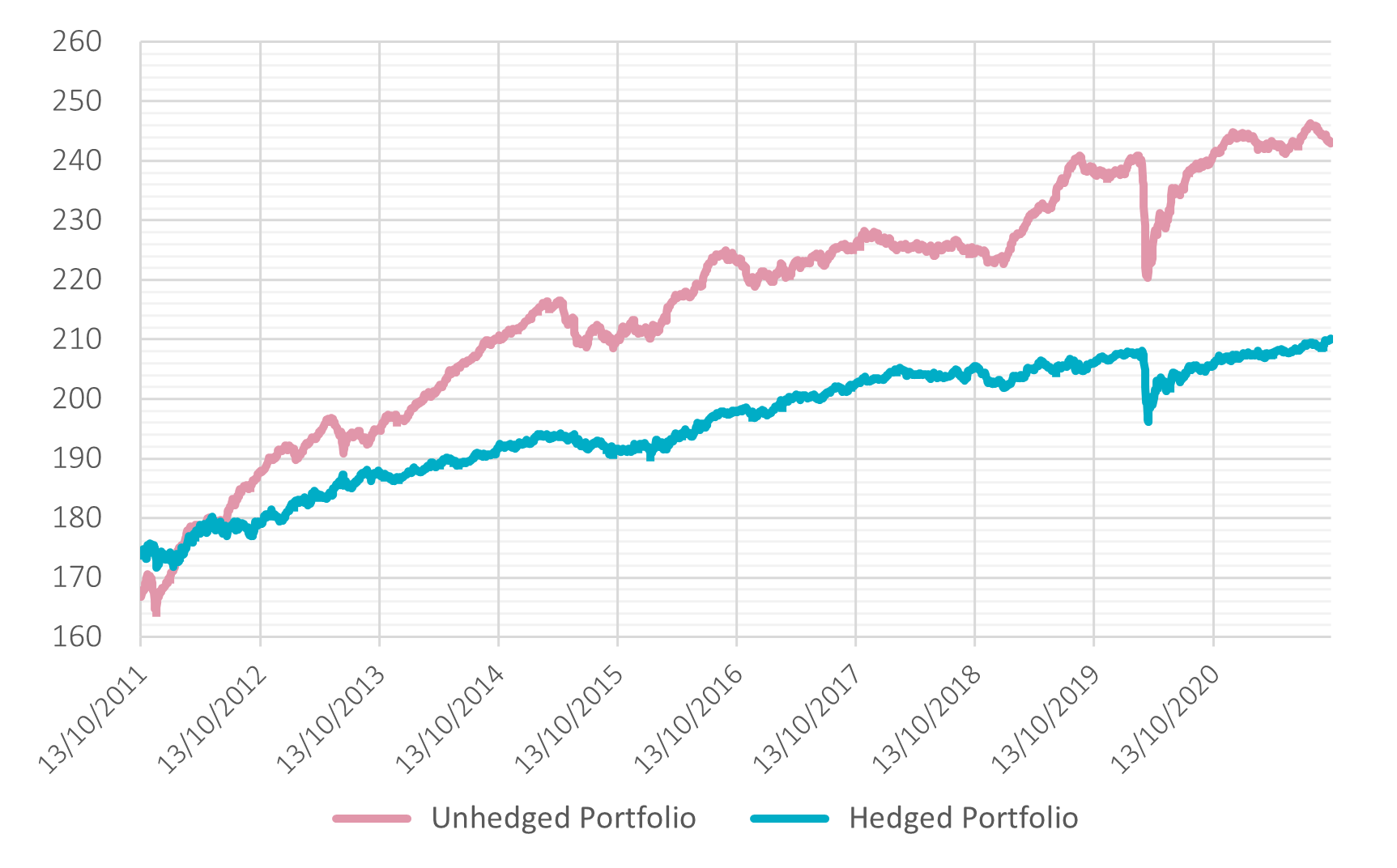

Our theoretical back-test of the hedging strategy over the last decade (including the pandemic) is shown below. The red line shows the absolute level of the iBoxx index (called ‘unhedged portfolio’ in the chart). The green line shows the hedged alternative.

During the COVID-19 crisis we can see from the earlier chart that the iBoxx asset swap spread (our proxy for credit risk) widened by +2% . As the iBoxx has a five-year duration, the corresponding loss would be -10% as we can see in in the chart below.

The back-test implies this suggested approach can work to reduce drawdown risk. Simply put, if interest rates or the credit spread increase, the value of the derivatives should act to compensate. An investor might use a trigger point to set the conditions under which the strategy is deployed, meaning costs (the CDS premia) are only incurred if the trigger point is reached.

Of course, if rates or the credit spread decrease, the bond value increases but the derivatives value decreases, thus the performance of the hedged portfolio could be negatively impacted. If a client is concerned about such an eventuality there are other options for addressing these risks.

Hedging back-test of the 'portfolio' (iBoxx Euro Corporate Aggregate index)

Source: AXA IM internal data, Bloomberg, retrieved April 2023

Finding a balance

The goal here, ultimately, is to minimise drawdowns and foster more stable return profiles. In turn that should mean clients are potentially less likely to sell at distressed prices and avoid crystallising losses in their credit portfolio.

Interest rate risk is generally relatively simple to address in credit portfolios but dealing with the risk that credit spreads widen, and damage valuations, is more difficult.

Total return swaps might look like a useful tool to do this as they allow to swap the bond index performance against an annual premium. But the pandemic revealed potential liquidity issues. Instead, we think investors could potentially consider a blended/hybrid strategy that uses investment grade and high yield index CDSs to build a hedge that closely resembles the risk profile of the portfolio in question.

Depending on the portfolio, global CDS indices should be carefully chosen to be as close as possible to the portfolio’s composition. A good balance between investment-grade index and high-yield index could mitigate the potential portfolio loss in both normal and stressed market conditions.

Disclaimer

This marketing communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Before making an investment, investors should read the relevant Prospectus and the Key Investor Information Document / scheme documents, which provide full product details including investment charges and risks. The information contained herein is not a substitute for those documents or for professional external advice.

Past performance is not a guide to current or future performance, and any performance or return data displayed does not take into account commissions and costs incurred when issuing or redeeming units. References to league tables and awards are not an indicator of future performance or places in league tables or awards and should not be construed as an endorsement of any AXA IM company or their products or services. Please refer to the websites of the sponsors/issuers for information regarding the criteria on which the awards/ratings are based. The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested. Exchange-rate fluctuations may also affect the value of their investment. Due to this and the initial charge that is usually made, an investment is not usually suitable as a short term holding.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.