Multi-Asset Investments Views: Here Comes the Sun

KEY POINTS

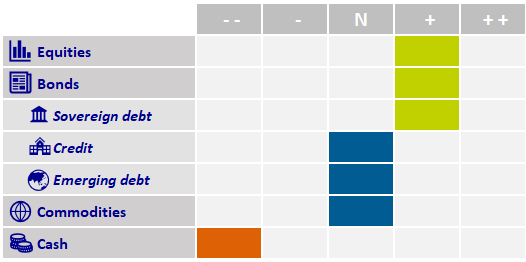

Our views

Dark clouds hanging over financial markets dissipated, and May was a strong month for multi-asset portfolios. Stocks indices rose to new highs and credit spreads tightened markedly as interest rates fell across the board. Cross-asset volatilities marked a U-turn and collapsed to the lowest levels seen this year. This sharp return to optimism has first to do with a stronger than expected earnings season. First quarter (Q1) earnings surprised to the upside, showing margin resilience across sectors in the US while Europe had the strongest earnings per share (EPS) revision ratio trajectory among major global regions. The ‘Magnificent 7’ results came under a lot of scrutiny and chiefly reassured investors that the artificial intelligence (AI) boom is very much alive and well. The strength of earnings upgrades revisions outside of the technology sector led us to broaden our equity exposure to the European market, typically to more value sectors such as banks and to the more medium capitalization space which has lagged large caps.

The second decisive element comforting financial markets in May was the assertion from the Fed’s Powell that monetary policy is sufficiently restrictive, ruling out the possibility that the next policy move will be an interest rate hike. While the Fed needs “greater confidence” that inflation is converging back towards 2%, calling for patience, the dovish tone was enough to prevent interest rates rising any further. An unexpectedly weak print for April’s US Nonfarm Payrolls indicates that the labour maker is starting to ease, which we see as a prerequisite for the current sticky services inflation to finally resume a downward path. We welcome the recent wave of negative economic surprises in the US as a positive development for risky assets and believe that a certain amount of bad news is indeed good news in the US by allowing interest rates volatility to recede and support further multiple expansion.

The situation in Europe is different. Stronger economic activity, albeit from low level, is a good omen so long as it does not derail the inflation outlook. European Central Bank (ECB) officials have been telegraphing very clearly the first interest rate cut at the June meeting. Still, we expect the ECB to remain cautious in the forward guidance regarding the extent of policy adjustment available and on what horizon. Negotiated wage rates in the Euro Area (+4.7% year-on-year in the first quarter of 2024, see chart below) are still growing at twice the speed of pre-pandemic years albeit driven exclusively by Germany. The risk of an increasingly self-sustaining positive services price loop cannot be ignored, while labour productivity remains stubbornly low. We do not feel current yields are sufficiently attractive to add to our long Eurozone sovereign debt position for now.

Our portfolios remain overweight global equities. We booked some profits in US Tech to diversify into European stocks, especially banks. We still like the secular growth story behind the technology sector, but we also see opportunities in areas offering more cyclicality. Europe trades offer lower valuations compared to the US market and we like the banking sector which offers both solid earnings and generous shareholder returns in the form of high dividend yield and large stock buyback programmes. We also hold on to duration through Eurozone sovereign debt, whilst we patiently wait to expand into US duration, favouring the front-end of the curve for now (two-year). We remain neutral on commodities. Copper and industrial metals have shown signs of exuberance lately, with a surge in prices fueled by a recovery in manufacturing activity in China and announcements of concrete measures to tackle the ongoing property crisis there. Gold shot to new historic highs following its brief and shallow consolidation and oil prices settled back towards the middle of the expected trading range ($75-$90 for Brent). We are waiting for more attractive levels before we re-engage with the commodity complex.

Eurozone Percentage Change of Negotiated Wage Rates still way above pre-covid years

Source: ECB, Bloomberg

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© 2024 AXA Investment Managers. All rights reserved

Image source: Getty Images