Rain or shine: what to consider for fixed income this summer

Key points:

- Uncertain macro outlook with central banks remaining fixated on inflation and recessionary risks still around.

- Credit continues to offer opportunities, but it may not be the time to sell out of inflation-linked bonds.

- Short duration continues to look attractive however, for some investors, it may also be a good time to extend the duration

Perhaps it is that the summer sun is shining but the situation in the US seems a little rosier than was projected earlier this year: the US Federal Reserve (Fed) demonstrated its intention to “stay put” for now by pausing interest rate hikes and, currently, economic data is not overwhelmingly pointing to recession. However, despite the Fed pause, there are suggestions that future hikes are not out of the question and the debate over whether we will see a recession or a soft landing will continue to be a focal point.

Overall, central banks remain fixated on inflation and there are still recessionary risks, as demonstrated by the Bank of England, European Central Bank, Reserve Bank of Australia and Bank of Canada all having raised rates in June.

Fixed income investors continue to see historically high yields across the bonds market. Even if the Fed’s pause means yields fall and the range that has been in place in 10-year Treasury yields (3.25% to 4% since last November) is broken to the downside, the total return for bonds should remain attractive.

With such clouds threatening to block the sunshine, where might investors look for opportunities within their fixed income portfolios?

Credit remains the 2023 golden child

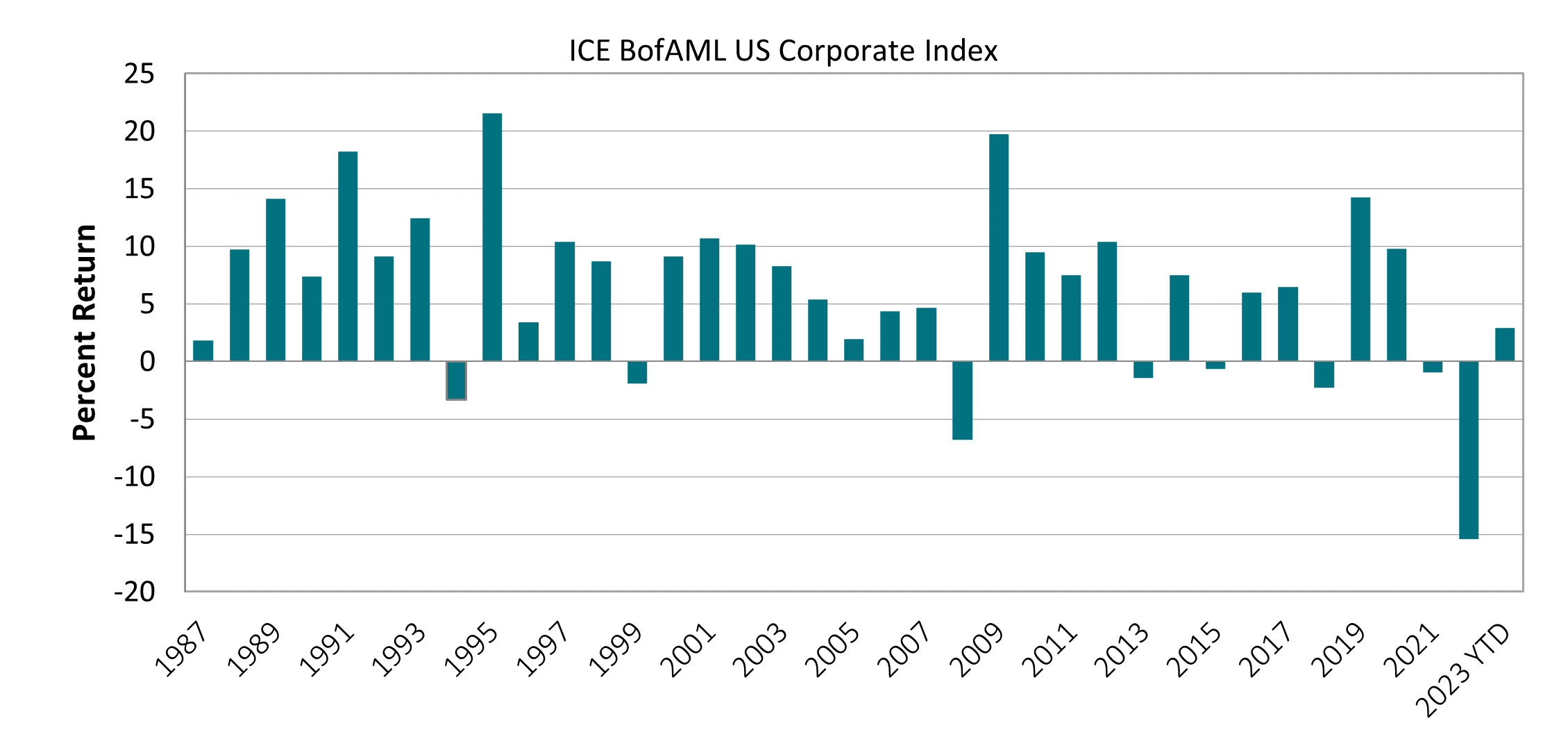

The US investment grade market has experienced strong yields which has helped revert the negative returns of 2022 with some positive numbers this year as income has taken over.

Annual Returns: ICE BofAML US Corporate Index YTD

Source: AXA IM, ICE BofAML as of 31st May 2023

It is also evident that company fundamentals remain solid: strong nominal earnings growth has allowed leverage to come down and borrowers have been able to raise money in the bond market in recent months, allowing them to build up cash buffers in case growth does weaken markedly.

Across the “pond”, with yields remaining high, how European corporates will cope in a higher funding cost environment is coming under greater scrutiny. Despite this concern, fundamentals also remain positive for European corporates: quarterly earnings for Q422 were positive and the earnings for Q123 have surprised the market on the upside. Against this backdrop, we are seeing opportunities in subordinated debt from certain investment grade issuers.

Opportunities in high yield but need to know what to look for

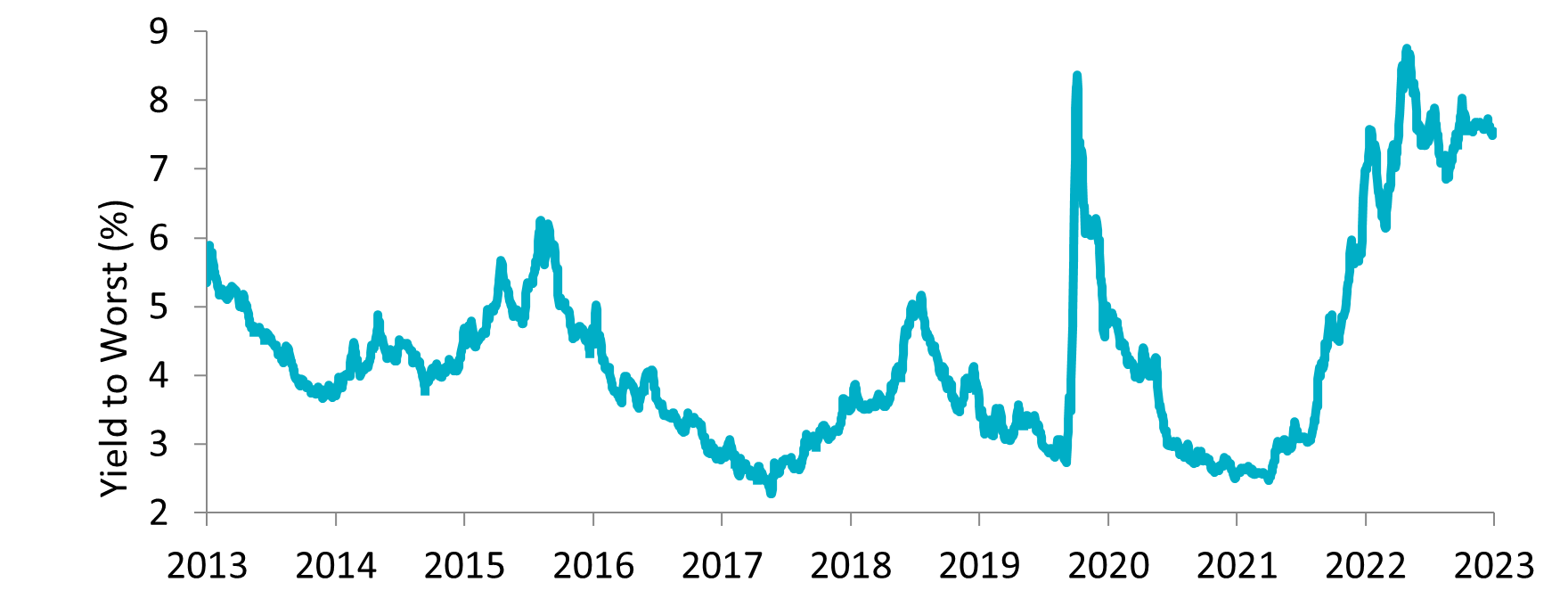

European high yield valuations are currently attractive, with yields near their highest levels in over 10 years; levels which have historically been associated with positive subsequent returns.

European High Yield Valuations

Source: AXA IM, Bloomberg as of 19th June 2023

European high yield is still offering investors a yield pickup of around 350bps1over the investment grade market, which we believe helps to compensate for the additional credit risk, especially when considering that the asset class is nowadays predominantly BB-rated.

From a sector perspective, recessionary concerns mean that sectors that have been most dispersed were those most affected by default sensitivity such as Media, Retail and Leisure. In this environment, we continue to favour defensive credits in sectors such as Capital Goods, Telecommunications and Healthcare.

In the US, the default rate has continued to be a focus for investors, given the expectation that it will increase as the economy weakens. We expect the increase to be at manageable levels and in the region of 3-4%, partly because only 30% of companies have loans and the majority of companies can afford higher interest rates. We, therefore, do not envisage a major deterioration in broad corporate fundamentals. As seen in May, however, with two high yield bond defaults and three distressed exchanges, actively analysing individual names, we believe, will be important for assessing opportunities across high yield markets.

Now may not be the time to disregard inflation-linked bonds

While surveys suggest that inflation and inflation expectations may have peaked, services prices and wages remain strong, giving weight to our view that inflation, and particularly core inflation, may remain sticky for the foreseeable future. As markets have priced-out rate cuts for 2023, we find it interesting that breakeven inflation rates are almost unchanged and trading close to central banks’ targets.

Source: AXA IM, Refinitiv Datastream as of 06 June 2023

We believe that real yields, which are close to cycle-high levels, are attractive as inflation-linked bonds offer both duration and inflation exposure.

Emerging Market Debt offers growth and opportunities for higher risk investors

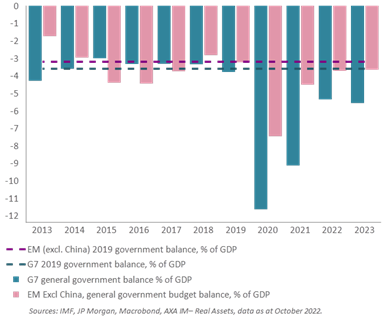

For investors with a higher risk appetite, emerging market debt (EMD) currently offers an alternative landscape to that being experienced in developed markets. EM sovereign balance sheets remain stronger than G7 and the overall budget deficit in EM will be almost back to pre-Covid-19 levels in 2023; a faster progress in fiscal consolidation than in G7.

EM budget deficit closer to pre-Covid 19 level than G7

Source: AXA IM – Real Assets, IMF, JP Morgan, Macrobond; EM excl China as of October 2022, G7 as of May 2023

There are also trends that are offering opportunities for investors such as ‘near- or ‘friend-shoring’, favouring selected emerging markets at the periphery of the US or euro area rather than de-globalisation and re-shoring to developed markets.

Flexible duration management

With the yield curve remaining inverted, short duration continues to look attractive given the value at the front end of the curve. For cautious investors, it also provides mitigation against future interest rate increases and widening credit spreads. However, as it is likely that most of the job of monetary policy tightening is done, it may also be a good time to extend the duration as we get closer to the first cut in rates.

The pace of rate hikes is slowing and a hard recession across the main markets is looking less likely, giving room for hope. However, the macro outlook remains uncertain with recessionary concerns, the expectation of further interest rate hikes and with inflation likely to remain sticky for the foreseeable future. Overall, this low growth environment has historically been positive for fixed income returns, particularly for risk assets such as high yield where there are still high levels of carry on offer. Even for cautious investors, this situation should offer opportunities across strategies such as short duration and investment grade credit.

- Source: AXA IM, Bloomberg as of 31 May 2023

Fixed Income

We cover a broad spectrum of fixed income strategies to help investors build diverse portfolios that can be more resilient to economic and market shifts.

Find out moreDisclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.