Investing in a sustainable future: Renewable energy

Green bonds are financial instruments designed to raise funds for projects that deliver positive environmental impacts.

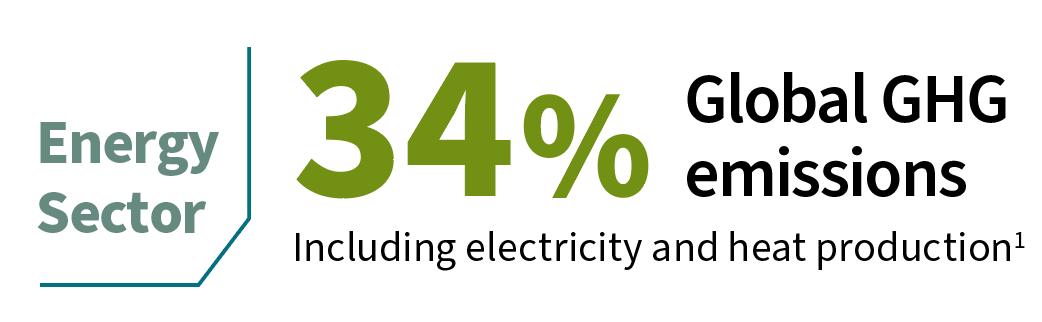

Key facts and trends in renewable energy

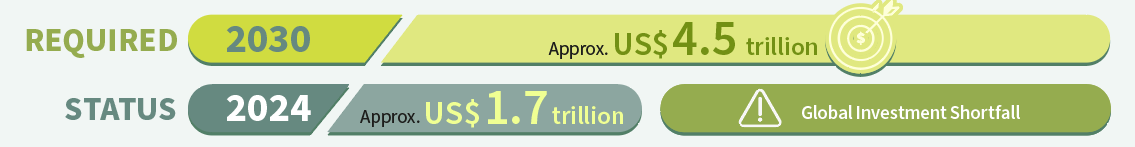

The road to net zero by 2050

To reach Net Zero by 2050, approximately US$4.5 trillion is required annually by 20303, mostly in renewable power, grids, storage, and efficiency. In 2024, global investments in clean energy totaled approximately US$ 1.7 trillion4, suggesting a shortfall of US$2-2.8 trillion annually.

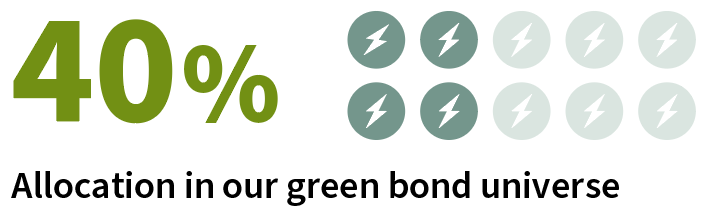

Where do green bonds fit in?

Smart Energy Solutions

Eligible Projects Financed

- Renewable energy (solar, wind power generation, hydropower with sustainability safeguards)

- Grid infrastructure upgrades and interconnections

- Battery and storage projects

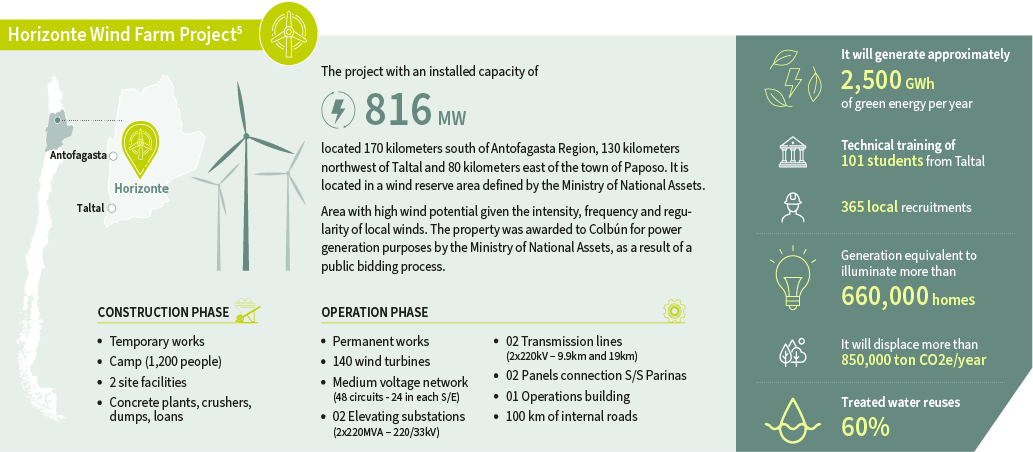

Case study

Colbún S.A. - A Green Revolution in Chile

Colbún S.A. is a major Chilean electric utility company that produces, transmits, and distributes electricity primarily across the central and southern regions of Chile. The company is committed to achieving carbon neutrality by 2050 and plans to phase out from coal by 2040, with the closure of its last coal power plant.

Its Green Financing Framework, published in 2021, supports projects that enhance energy efficiency and promote renewable energy. The company has also implemented adequate measures to manage and mitigate potential environmental and social risks associated with the projects financed under this framework.

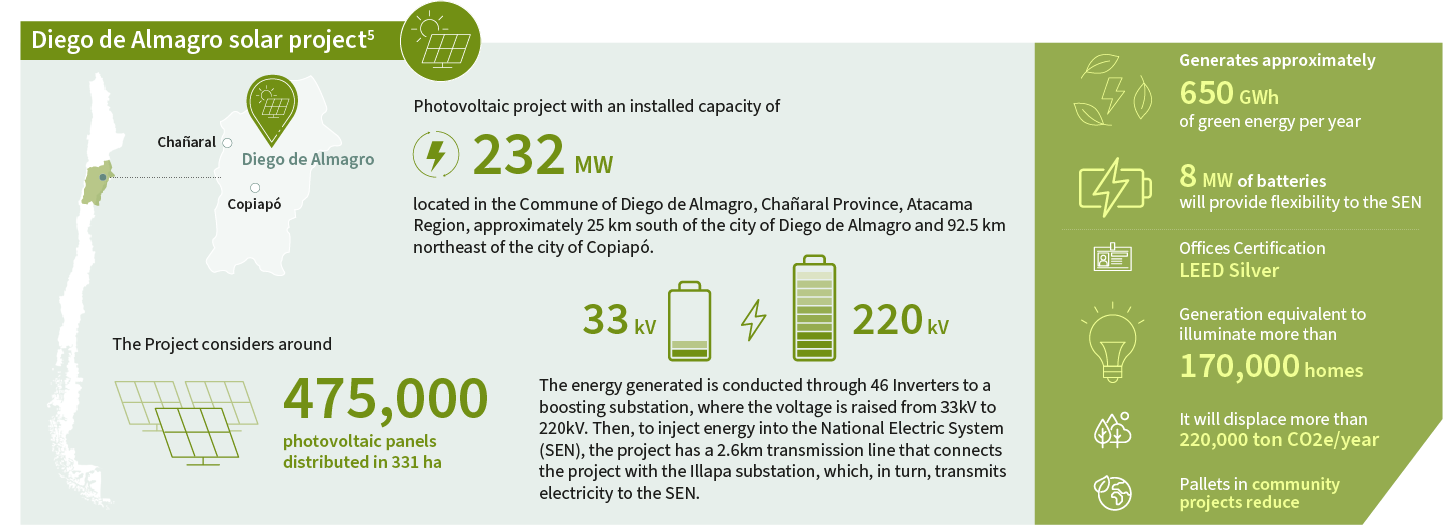

By issuing its first green bond, Colbún is financing two major projects focused on wind and solar energy. The Horizonte Wind Farm project harnesses strong winds to generate large-scale energy, while the Diego de Almagro solar project produces solar energy combined with battery storage for enhanced grid flexibility. Together, these initiatives aim to reduce carbon emissions by over 1 million tonnes annually, create hundreds of jobs, and engage local communities through training and supplier inclusion, all while supporting Chile’s ambitious climate goals.

Green bonds are one of the most appropriate debt instrument to accompany issuers committed to transition to a low carbon economy. It supports the decarbonization of the energy sector by channeling capital towards projects that reduce GHG emissions and provide investors with a higher level of transparency and measurability. Contact us to explore more.

Sources:

[1]Source: Global Greenhouse Gas Overview by United States Environmental Protection Agency. Data from IPCC (2022)

[2]Source: IEA https://www.iea.org/data-and-statistics/data-tools/greenhouse-gas-emissions-from-energy-data-explorer

[3]Source: World Economic Forum IEA: Clean energy investment must reach $4.5 trillion per year by 2030 to limit global warming to 1.5°C | World Economic Forum

[4]Source: IEA’s World Energy Investment 2023

[5]Source: Colbun's Green Bond Impact Report June 2023

Disclaimer

Companies shown are for illustrative purposes only as of 31 August 2025 and may no longer be in the portfolio later. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute an other to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Not for Retail distribution: This document is intended exclusively for Professional, Institutional or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This marketing communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision. It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document. Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

In Australia, this document has been issued by AXA Investment Managers Australia Ltd (ABN 47 107 346 841 AFSL 273320) and is intended only for professional investors, sophisticated investors and wholesale clients as defined in the Corporations Act 2001 (Cth).

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.