AXA IM Equity QI celebrates 40 years of quant equity innovation

2025 marks a significant milestone for AXA IM's Equity Quantitative team (EQI), which celebrates its 40th anniversary this summer. Few asset managers, especially in the quantitative space, can lay claim to such a long period of continuous success and industry recognition. 1

We believe the key to this enduring success lies in our commitment to continuously evolve our investment strategies, while remaining anchored in an investment philosophy that is as relevant today as it was at its genesis in 1985.

- AXA IM wins three IAN Awards for Excellence, 2025: Best Quantitative Solutions Manager, Best Emerging Markets Equity Manager, Best Use of AI: {https://insuranceasianews.com/awards/institutional-asset-management-awards-2025/;Institutional Asset Management Awards 2025 - InsuranceAsia News}, AXA IM’s Sustainable Equity QI Strategy wins Responsible Investments (ESG) category at Financial Newswire/ SQM Research’s Fund Manager of the Year Awards 2024: {https://financialnewswire.com.au/funds-management/axa-ims-secret-sauce-delivers-10-years-of-esg-success/;AXA IM’s ‘secret sauce’ delivers 10 years of ESG success - Financial Newswire}, AXA IM named Factor Investing Manager of the Year, 2020: {https://ukpensionsawards.com/live/en/page/2020-winners;Professional Pensions UK Pensions Awards 2025 - 2020 Winners}

Barr Rosenberg’s pioneering legacy

AXA IM's Quantitative Equity franchise is built upon the pioneering work of Barr Rosenberg, who is widely regarded as one of the godfathers of quantitative finance, particularly in the field of ‘factor investing’. Rosenberg’s path to investment innovation was not direct; a notable mathematician, Rosenberg’s earlier endeavours saw him harness increasingly powerful computing technology to unlock the potential of large datasets.

Rosenberg's work during the mid-1970s proposed that, to better understand stock price risk, investors needed to move beyond beta (the anchor of the capital asset pricing model (CAPM)), and recognise that various factors—such as style, industry, and size—significantly influenced stock price movement. The factors he identified became known as “Barr's Bionic Beta.” This concept not only advanced quantitative economic theory—building on the work of figures such as Fama, Black, Scholes, and Sharpe—but also, through what became the Barra risk model, provided an innovative framework which significantly changed how both traditional and quantitative investors incorporated risk into their investment decisions.

By 1985, having already made significant and disruptive impact within the financial technology industry, Barr founded Rosenberg Institutional Equity Management, now known as AXA IM EQI, to capitalise on the benefits of systematic factor investing. The alpha engine at launch was based on a proprietary valuation model designed to exploit return premia associated with value. The model assessed company fundamentals (i.e., income statement and balance sheet data) to determine a stock's fair value and compared it with the current share price to identify attractive investment opportunities. Since the investment process was fully quantitative, it could cover very large investment universes and refresh the alpha insights it generated daily.

In addition to constructing proprietary alpha insights, the team built sophisticated risk and optimisation systems, ensuring that every buy and sell decision simultaneously considered both risk and return opportunities. While systematically building portfolios that optimise risk-reward outcomes may be common practice today, it is not an overstatement to say that, 40 years ago, this approach was truly pioneering.

An enduring investment philosophy

Since 1985, our proprietary models have been grounded in a robust investment philosophy – namely, that company fundamentals ultimately drive share prices. While the EQI team has continually refined the methods and models used to assess these fundamentals, the core principles outlined below remain as relevant today as they were at the outset:

- Earnings fundamentals ultimately drive risk and return outcomes

- Mispricing of fundamentals occurs because short-term inefficiencies exist

- By performing detailed quantitative modelling of company fundamentals, we can uncover investment return opportunities for our clients

- Return opportunities should always be considered alongside risk.

A history of continuous, research-led improvement

While our philosophy has acted as an enduring investment cornerstone, EQI has fostered a culture of research-led innovation that has resulted in continuous improvement in our investment process. Sometimes, research ideas are motivated by simple ideas to improve outcomes; at other times, they have been spurred on by the availability of new financial data, or new analytical tool capabilities.

Historical EQI research enhancements can be broadly classified into three overarching categories:

- Progressive and incremental enhancements to existing models to improve stock selection

- Innovations through the development of new models that provide entirely new insights for stock selection

- Improvements in portfolio construction, focusing on how stock selection models are combined to deliver optimal outcomes for our clients.

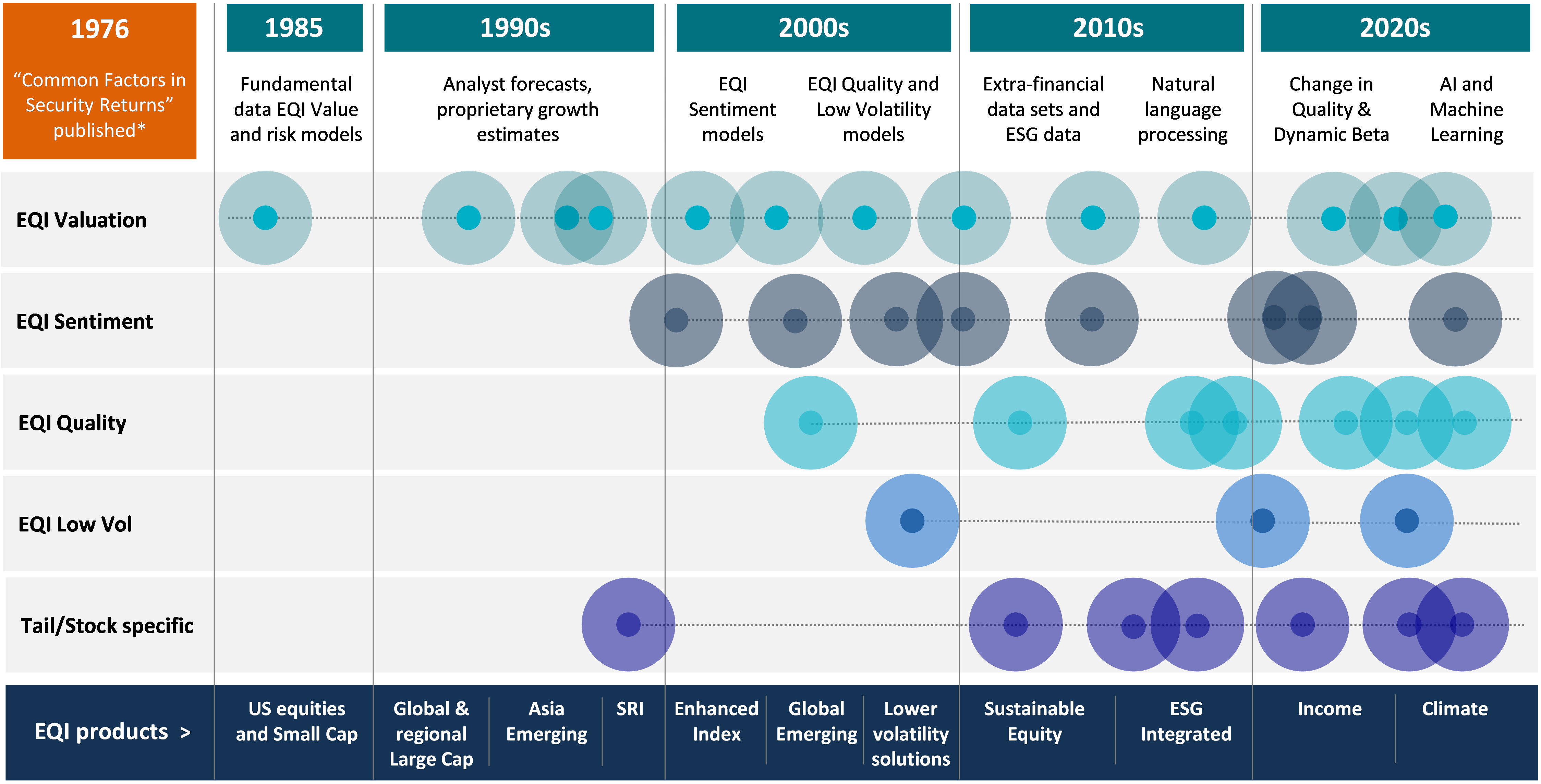

In the exhibit below, we plot the history of research enhancements at EQI, starting from 1985 with Barr’s original valuation model. This also shows when EQI expanded its range of insights to include information about companies’ quality, sentiment and volatility, as well as stock-specific insights. Major enhancements to our key investment models are represented by the coloured circles:

Exhibit 1: History of EQI investment models and investment strategies

Source: AXA IM EQI. *Research paper published in 1976 by Barr Rosenberg and Vinay Marathe, University of California, Berkeley. Barr Rosenberg Associates (Barra Inc., now MSCI Barra) was founded in 1974; Rosenberg Institutional Equity Management, now EQI, was established in 1985. Exhibit is illustrative not intended to be comprehensive and research initiatives may be ongoing.

We have also marked at the bottom of the exhibit when new EQI investment strategies were launched, all of which were made possible by research that drove an expansion of EQI's proprietary model insights. While there are far too many enhancements to cover each one in detail below, we note some major milestones as examples.

Enhancing our valuation insights (1990s)

EQI’s original valuation model estimated the relationship between a company's reported fundamentals and its share price using a cross-sectional regression. The model can be thought of as conducting a granular breakdown analysis of a company into its component parts (industry, balance sheet, income statement), using the market to determine the fair value of each component part, and summing the component parts to determine a fair value for an individual company. This works because information is extracted from the entire global equity market, comprising approximately 20,000 stocks, and calculated simultaneously.

A significant enhancement to this model was made in the early 1990s with the development of a proprietary earnings forecast model, leveraging increasingly widely available analyst estimates. The result was the creation of a more complete view of a company by generating a one-year forward outlook on earnings, which helped the model avoid value traps.

While EQI’s valuation insights have been continuously enhanced, including the addition of new models to better account for the importance of long-term growth prospects, the original model has truly stood the test of time and remains a key component of EQI's valuation insights today.

Exhibit 2: EQI's valuation model determines a company's fair value by assessing market prices for its component parts—industry, balance sheet, and income statement—then summing these components to establish overall relative value

| Component Part | Regression Coefficient | Big Tech Company (per share) | Contribution |

| Net Sales : Software | 25.9 | 25.7 | $667.6 |

| Cash operating costs : Software | 28.8 | -16.8 | -$486.1 |

| Gross Profit | 5.7 | 2.84 | $16.2 |

| Income Tax | -4.2 | -1.28 | $5.6 |

| Research & Development | 0.65 | 7.40 | $4.8 |

| Long-term Debt | -0.42 | 5.69 | -$2.4 |

| Common Equity | 0.33 | 3.75 | $1.2 |

| Earnings Change | 0.61 | -1.25 | -$0.8 |

| Retained Earnings | 0.20 | -1.26 | -$0.2 |

| Fair Value | $206.1 | ||

| Closing Price | $194.4 | ||

| Relative Value | +6% | ||

Source: AXA IM EQI. For illustrative purposes only.

Going beyond value and the development of Sustainable Equity QI (2000s)

While the inclusion of one-year-ahead forecast earnings within the EQI Valuation model, noted above, was a first step toward leveraging forecast earnings, in the early 2000s EQI built its first model designed to explicitly capture the momentum factor. This model combined price momentum signals with a proprietary model of sell-side analyst earnings revisions.

In 2004, EQI insights were further extended with the development of models for earnings quality and low volatility. The development of EQI's Quality model was a good example of its research philosophy in action, as it was built by performing a detailed analysis of the fundamentals associated with a company’s earnings dynamics, such as long-term profitability, the trend and stability of earnings growth, dividend growth, investment discipline, leverage, and accounting practices. As with other EQI models, Quality has been incrementally enhanced over time, and in 2017, an important new complementary model designed to capture changes in quality was added to the family.

The development of EQI Quality has proven to be a game changer, allowing the team to build more diversified multi-factor core strategies and giving rise to Sustainable Equity QI. Launched in 2013, Sustainable Equity QI combines EQI Quality and Low Volatility signals with the objective of delivering long-term excess returns with lower total risk. The strategy has proven to be a commercial success, growing from scratch to over $7 billion over the last 12 years.

Sustainability and ESG integration (2010s)

EQI started managing socially responsible investment (SRI) strategies, usually based on clients’ ethical beliefs, in the late 1990s. Because EQI covers 20,000 stocks, the investment process is well suited to incorporating SRI or environmental, social and governance (ESG) exclusions, as eligible alternative stocks with attractive fundamentals can be identified during portfolio construction.

The 2010s marked a pivotal expansion of ESG investing. More granular and detailed ESG information drove several research initiatives to assess how sustainability could improve EQI's fundamental models and investment outcomes for clients. A good example of this was the addition of boardroom diversity into EQI's Change in Quality model in 2017. By 2015, ESG information was integrated into all EQI strategies and funds, making EQI one of the first quantitative firms to be 100% ESG-integrated. The EQI Sustainability range expanded in 2020 with the launch of EQI Global and Eurozone climate strategies, which include explicit carbon pathways focusing on companies with revenue from climate change mitigation activities.

Exhibit 4: More diverse companies appear to be more resilient in the face of competitive pressures. EQI Quality model added boardroom diversity into in its Quality model in 2017

Top ROEX Quartile Partitioned by Diversity

January 2005 – July 2017

Source: AXA IM EQI

AI and Machine Learning (2020s)

Driven by advancements in computing power (such as graphics processing units (GPUs) and cloud computing) and the availability of data, EQI's investment process is increasingly leveraging artificial intelligence (AI). EQI’s approach remains firmly aligned with its long-term investment philosophy, as its use of AI serves as a tool to model fundamentals and refine stock selection.

Examples of research enhancements enabled by AI include a model to identify the probability that a stock will experience a sharp increase in volatility over the next month, which uses machine learning (2017), and Natural Language Processing (NLP) models to extract insights from earnings call transcripts (2000-2023). NLP models now supplement existing EQI factors; for instance, we use NLP models to detect whether company management is using "precise language" or "positive language," and these insights are incorporated into our EQI Quality and Sentiment signals.

40 years of sustained, cutting-edge technological innovation

In this look back at the EQI story, we have focused on the history of EQI's research philosophy, the evolution of the investment process, and the development of new insights and investment strategies. This work has been accomplished by a large number of EQI researchers and portfolio managers over the years. However, it is essential to recognise that the quant team is also a technology team, and the contributions of the technology team have been nothing short of heroic.

The changes in coding languages and technology infrastructure that support our quant platform have been tremendous over the last four decades. Staying ahead of the technology curve has been a critical part of EQI's success, and this achievement has only been possible because of the dedicated partnership between the EQI investment team and the technology team.

EQI capabilities are continuously evolving to take advantage of the accelerating pace of technological advances – to this end, the EQI platform has been significantly upgraded several times and continues to evolve. Recent examples can be seen in EQI’s continued commitment to platform enhancements; on-premise EQI platform has been migrated to the cloud, supporting AXA IM’s broader data centre and infrastructure modernisation. The tireless efforts of our technology team play a crucial role in driving innovation and ensuring that EQI remains at the forefront of the industry.

What next for EQI?

EQI’s creation is deeply entwined with the origins of quantitative investing; its longevity and success is a testament to our enduring investment philosophy, research-led innovation and evolution. As we look to the future, we believe that the expanding breadth of data available to investors, along with cutting-edge tools—including AI—will revolutionise the investment landscape. This evolution will position quantitative methods at the forefront of investment strategies, enabling EQI to harness new opportunities like never before.

Forty years on, we stand on the cusp of a new chapter in the EQI story and are excited by the innovations and opportunities for our clients that lie ahead.

Disclaimer

Risk warning:

No assurance can be given that our investment strategies will be successful. Investors can lose some or all of their capital invested. Our strategies are subject to specific risks including, but not limited to: equity; emerging markets; global investments; investments in small and micro capitalisation universe; investments in specific sectors or asset classes, volatility risk, liquidity risk, credit risk, counterparty risk, derivatives risk, legal risk, valuation risk, operational risk and risks related to the underlying assets. Some strategies may also involve leverage, which may increase the effect of market movements on the portfolio and may result in significant risk of losses.

Disclaimer:

This marketing communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.