Global Factor Views: Positive on Growth and Quality but warning signs for Momentum

KEY POINTS

The US economy has remained strong, underpinned by a robust labour market and productivity growth - the latter partly thanks to increased post-pandemic investment and the continued development of artificial intelligence.

Since the start of the year, inflation has been firmer than expected which has introduced some uncertainly in the outlook for interest rates. However pricing of forward interest rates is still indicating a cut by the Federal Reserve this year.

In the Eurozone there are some signs of a recovery in the service side of the economy, but overall growth generally looks weaker than the US and the European Central Bank is still expected to cut interest rates in 2024.

Equity factor outlook

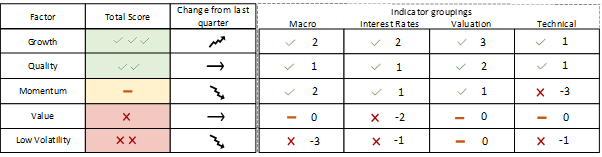

Given the current macro and interest rate backdrop we have updated our Global Factor Dashboard, shown below.

Exhibit 1: AXA IM Factor Dashboard (April 2024)

Source: AXA IM, April 2024

The scores shown in the interest rates indicator pillar of the dashboard reflect how factors have historically responded to a falling interest rate environment. At present the level and rate of change of the Institute of Supply Management (ISM) New Orders Index

As things stand after measuring macro, interest rates, valuation and technical elements (e.g. crowding and short-term volatility levels) the highest ranked factors on our dashboard are Growth and Quality while Low Volatility and Value are the lowest ranked.

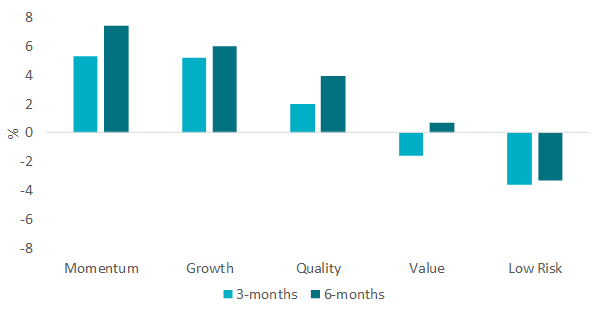

The factor suffering the biggest decline in ranking is Momentum, which as a factor captures stocks that have had a positive price change, relative to the market over the past 12 months. Momentum was the highest ranked factor when we last published our scorecard in November and this ranking was maintained going into the early part of 2024, supported by favourable macro and micro conditions. Since then, Momentum has strongly outperformed, illustrated by the chart below. This has resulted in Momentum becoming more crowded and thus scoring lower on our Technical signal, meaning its ranking has fallen.

Exhibit 2: Global factor performance over the last three and six months

Source: AXA IM, April 2024

We set out in detail our outlook for equity market factors below.

Growth: Positive

Our macro measure is in the early acceleration phase of the cycle which has historically been supportive of the Growth factor. The prospect of falling interest rates is also supportive of Growth and the prevailing view that rates will soon start to ease explains the improved ranking for the factor. The Technical indicator remains supportive, notably due to a decline in volatility over recent months. The forward valuation for growth, while not cheap, is supportive of the factor at current levels.

Quality: Positive

We remain positive on Quality (equities with premium levels of profitability). Quality stocks tend to be rewarded when macro sentiment is in the early acceleration phase of the cycle. Overall, the valuation of Quality is trading at a premium to average levels; however, unlike other factors, Quality’s performance has not historically been sensitive to periods of high valuation. We would recommend an active approach to Quality investing with a focus on forecast quality which is more adaptive to changing economic conditions.

Momentum: Neutral

Momentum was the highest ranked factor when we last published our scorecard in November. This ranking was maintained going into the early part of 2024, supported by favourable macroeconomic and micro measures. While the macro and interest rate environment still argue in the factor’s favour, its very strong recent outperformance (see Exhibit 2) has resulted in it becoming a ‘crowded trade’ i.e., it has become hugely popular.

A crowding measure that has started to register a negative warning signal is the one-month relative dispersion of returns. This measure gauges the variation of a factor’s returns, and when returns are varied it suggests they are diversified – they are coming from different sources. But when they move together, as is the case currently, this indicates a crowded factor which historically has been negative for future momentum returns. For investors who wish to retain exposure to Momentum we would recommend focusing on earnings momentum which is less crowded and offers a more explicit link to future fundamentals than price momentum.

Value: Negative

Macro and interest rate conditions favour Growth compared to Value. Value has historically underperformed Growth when our ISM index macro indicator is in the early acceleration phase of the cycle. It has historically also suffered when interest rates fall, which the market expects to be the case soon. The Valuation and Technical indicators for Value currently receive a neutral score on our dashboard.

Low Volatility: Negative

Low Volatility is the lowest ranked factor on our scorecard because it tends to underperform when macro sentiment is in the early-stage acceleration phase of the cycle and suffers when interest rates fall. Given the recent underperformance of the Low Volatility factor, valuations now look attractive, and as a result its score has improved on this measure over the last three months. We would note that any downside surprise to the macroeconomic outlook would likely favour the factor’s inherent defensive attributes.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© 2024 AXA Investment Managers. All rights reserved

Image rights: Getty Images

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.