Not just a tariff pivot: Why Europe’s investment landscape may offer long-term value

KEY POINTS

Against an uncertain geopolitical and macroeconomic environment, European equities are emerging as a bright spot for investors, as the region’s market soars and new competitiveness initiatives look set to boost economic growth.

Lower interest rates – with further cuts expected - alongside attractive valuations and hopes of an end to the Ukraine war have helped the Euro Stoxx 600 index achieve a 12% year-to-date total return. In contrast, the MSCI World Net Return (NR) index has fallen 3% while the US’s S&P 500 and technology-heavy Nasdaq are down 6% and 10% respectively

It represents a marked turning of the tide; it wasn’t long ago that Europe was trailing in the wake of a US technology surge. In 2024, European stocks significantly underperformed global markets; the Euro Stoxx 600 delivered an underwhelming 2% against the MSCI World NR index’s 19%, and the S&P 500’s impressive 25%

Much of the US market’s fall is of course due to uncertainty over the potential impact of President Donald Trump’s trade tariffs, and other policies. Europe is essentially at the centre of a global realignment, responding to US threats to withdraw some of its overseas spending on global security. This shift has prompted a significant increase in European government spending, particularly on defence.

But despite the US-driven uncertainty, we believe Europe’s more benign market backdrop is more than just a pivot response and is underpinned by long-term trends – it is a narrative of fiscal spending and growth initiatives.

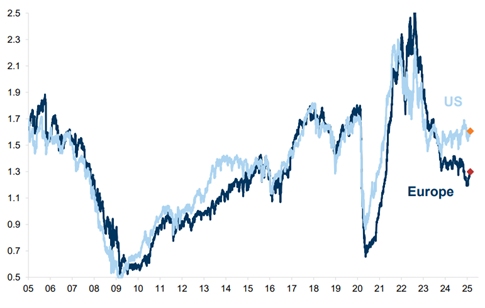

More attractive valuations

European equity valuations were slightly below their long-term average at the start of 2025, while US equity valuations were at a historic high. But right now, on certain measures, European stocks appear to be offering much better value than their US counterparts (see figure 1).

Figure 1: Europe is undervalued versus the US

Source: Datastream, Goldman Sachs Investment Research. Based on 12-month forward price-to-earnings ratio divided by second 12 months forward earnings per share growth. 7 March 2025

Admittedly, Eurozone GDP growth has been relatively weak – the bloc’s economy expanded just 0.2% in the final three months of 2024, and is expected to see subdued growth throughout 2025 – both AXA IM and the market consensus predict 0.9% expansion for the year as a whole

However, the European Central Bank (ECB) cut interest rates by 25 basis points to 2.5% in March, its sixth cut in the current cycle, with further cuts expected. Lower rates should help spur better economic growth, which in turn should potentially boost stock markets.

Global growth exposure

Exposure to European equities effectively means exposure to global growth given the abundance of multi-national names in the region. These include the so-called ‘Granola’ stocks – often seen as Europe’s equivalent of the US’s so-called ‘Magnificent Seven’ tech stocks.

The ‘Granolas’ consist of pharmaceutical firms GSK and Roche; semiconductor supplier ASML; food and drink group Nestlé; Novartis and Novo Nordisk – both also pharmaceuticals; cosmetics company L’Oréal; luxury goods firm LVMH; pharmaceutical firms AstraZeneca and Sanofi and software company SAP.

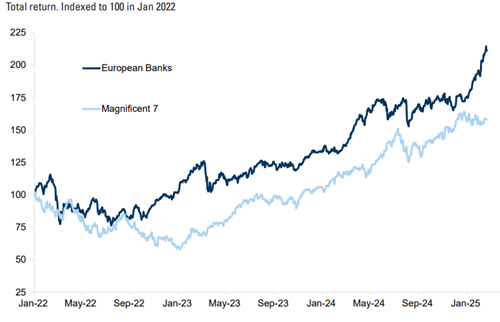

These are all heavyweight companies with sizeable international exposure, that are expected to deliver solid earnings growth in sectors with high barriers to entry. But they are not the only European stocks worth investors’ attention. Europe’s banking sector has outperformed the Magnificent Seven over the past year, as lower interest rates helped support the sector (see figure 2). Meanwhile European Union (EU) plans to increase defence spending to support Ukraine and address longer term security concerns have also bolstered European aerospace and defence stocks.

Figure 2: European banking sector has outperformed the Magnificent Seven

Source: Datastream, Goldman Sachs Investment Research, 28 February 2025

Rising competitiveness

The European Commission recently launched a new Competitiveness Compass, an initiative to improve economic growth in the Eurozone focusing on innovation, decarbonisation and security. That sits alongside existing European initiatives including the European Chips Act, designed to increase the region’s position in the globally important semiconductor sector, and the NextGenerationEU stimulus package, which invests in digital transformation, healthcare and the green transition, among other areas.

In addition, Germany’s newly elected leader Friedrich Merz has pledged to change the country’s fiscal rules to ease government spending constraints, particularly for defence and infrastructure investments; the increased spending in Europe’s biggest economy could prove to be a boon for the bloc’s GDP.

Elsewhere EU companies are driving global research and development growth, surpassing the US and China, with automotive and health sector companies leading the way, according to the European Commission

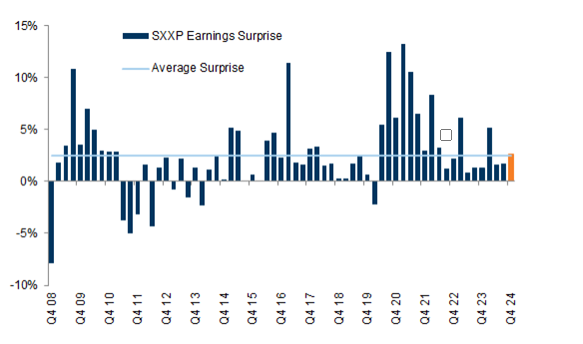

Fourth quarter earnings announcements from European companies also provided positive earnings surprises – see figure 3.

Figure 3: Earnings surprises from Stoxx Europe 600 (SXXP) companies

Source: Goldman Sachs Investment Research, 7 March 2025

Increasing inflows into Europe

Investors are already returning to Europe - in February 2024, European equity funds recorded their biggest weekly inflow in three years, according to data provider EPFR

More broadly, on the back of improving market conditions and investor confidence, European investment funds saw a record €665bn of net inflows in 2024, a sharp increase from the €237bn seen in 2024, according to the European Fund and Asset Management Association

However, uncertainties remain; at the top of the list is the ongoing Ukraine conflict and the US’s threat of a trade war. At the time of writing, Trump has threatened tariffs on the EU, and already imposed 25% global tariffs on steel and aluminium, prompting Europe to announce counter tariffs. Ongoing uncertainty and geopolitical risk are likely to give rise to further market volatility – but despite this, we are confident that European stock markets are in a relatively robust position.

Ultimately, given the more beat environment - attractive valuations; the scope for further interest rate cuts; better growth prospects, and a universe providing exposure to global growth trends, we believe Europe’s investment potential is becoming increasingly compelling.

Subscribe to updates

Have our latest insights delivered straight to your inbox

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© 2025 AXA Investment Managers. All rights reserved

Image source: Getty Images

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.