What is the Evolving Economy?

Companies are growing ever more global and multi-sector in their approach, but many investors’ approach to equities remains the same. We’ve identified five themes that we believe will shape the way companies operate in future, which will also have a radical impact on equity investors: automation, the connected consumer, ageing and lifestyle, cleantech, and transitioning societies. We call these themes the Evolving Economy.

What is thematic investing?

Thematic investing – often called trend investing or mega-trend investing – is a broad term used to describe investment approaches which focus on certain economic, corporate, social or technological themes. In today’s highly disruptive world, these themes are typically focussed around the main two drivers of long-term corporate behaviour – demographic shifts and technological changes.

The five evolving economy themes we have identified are the results of long-term demographic trends and technological developments. We believe they can offer equity investors access to the best opportunities for long-term structural growth, regardless of how companies are defined geographically or from a sector perspective.

Does thematic investing work?

We believe that geographic or investment sector definitions – which were once a convenient way for investors to classify companies and decide asset allocations – must evolve to meet the reality that the world is increasingly complicated and connected than ever before.

A thematic investment approach aims to help investors:

- Tap into drivers of long-term change and growth

- Better identify companies’ longer-term prospects

- Articulate particular investment convictions

Is thematic investing a long-term approach?

We believe that thematic investing should fundamentally seek long-term outcomes for investors and is therefore a rational rather than fashionable approach. In fact, we see thematic as the new normal of equity investing.

While many individual themes or trends can capture investors’ attention, it’s important to take a nuanced and diversified approach. This can help investors mitigate volatility and cyclicality which may arise from a theme having a small or concentrated investible universe of suitable companies.

Active thematic investing

Disruption in the corporate world is dynamic in nature, and it is therefore critical to identify the individual long-term winners, as there are losers even in areas of high structural growth.

Understanding the difference between short-term hype and longer-term commercial reality is therefore crucial for investors looking for sustainable performance.

A thematic approach can also help investors understand how companies which are evolving their business model might fare in future – for example, a company which still generates most of its revenues today from a traditional business or product, may be making great strides into a new industry or customer base that may make it a compelling long-term investment.

Why us for thematic investing?

To differentiate market hype from the investable reality when identifying long-term trends, we look for evidence (like research/statistics from relevant and credible sources) that the theme has the potential to deliver 10% or more growth year-on-year over the next decade.

As companies become more global and more multi-sector, understanding a businesses’ market, strategy and customers is crucial to identifying the long-term winners and losers within a theme.

- Time tested active approach since 1960

- Focus on companies with the proven ability to deliver commercially sustainable results from innovations

- 100s of meetings each year with company management helps us identify winners and losers

Our active selection approach is rooted in our Equity’s’ fundamental philosophy of selecting high-quality companies we think have the highest potential, rather than just investing in a basket of stocks that operate in a certain sector.

To give investors access to long-term drivers of returns, we have evolved our collaborative research organization to prioritise thematic exposure over geographic and sector information which is less relevant for evaluating today’s multi-sector businesses.

- Collaborative research pods help us combine deep expertise with a best-ideas approach

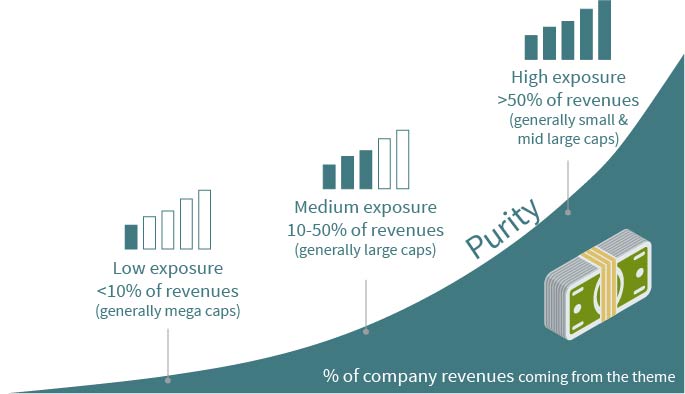

Our proprietary thematic exposure database also allows us to quantify companies’ levels of exposure to specific themes across the evolving economy, across a universe of approximately 11,000 listed companies.

Source: For illustrative purposes only.

Our portfolios tend to have a high level of purity related to the themes. Typically more than 70% of stocks in our portfolio have high or medium exposure to a specific growth theme1. This ensures high thematic purity with suitable diversification, while also allowing us to invest in companies with high potential at an earlier stage of tapping into long-term trend or changing their business.

Note: All figures quoted are correct as at 30 September 2020.

- Subject to change without notice

Thematic investing set to transform asset management

A view of the global growth in thematic equity investing.

Download the reportRisks

No assurance can be given that our equity strategies will be successful. Investors can lose some or all of their capital invested. Our strategies are subject to risks including counterparty risk, credit risk, geopolitical risk, liquidity risk, and the impact of any techniques such as derivatives.

Disclaimer

This promotional communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.