Is now the time to switch from cash into short duration bonds?

- 21 January 2025 (5 min read)

KEY POINTS

There was much debate in 2024 around what strategies investors should look to as a cash alternative given the backdrop of falling interest rates.

However, this narrative has since moved on, as today fewer interest rate cuts are priced in - especially in the US and UK.

Presently, and after 100 basis points (bp) of cuts, we expect the Federal Reserve to lower interest rates just once more in March, before pausing until the second half of 2026. Elsewhere, we anticipate the Bank of England will make four cuts this year while the European Central Bank will likely be more active and deliver back-to-back 25bp cuts until its deposit rate reaches 2.0% in June.

Policy pivot

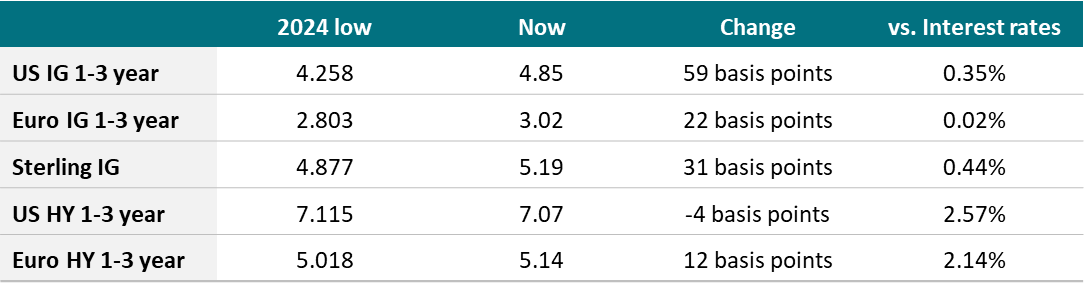

For those seeking a cash alternative, in our view short duration currently looks attractive, especially as bond yields have risen as sentiment has changed. Taking the ICE/Bank of America one-to-three-year investment-grade (IG) and high-yield (HY) indices as proxies for short-duration credit strategies, yields are mostly above their 2024 lows - see table below:

Source: ICE/Bank of America (Bloomberg) as at 20 January 2025*

Yields on short-duration bonds have become more attractive. They have risen as much as around 60bp above their 2024 lows; they are above interest rates, and they are well above prevailing and expected inflation rates.

By short duration’s nature, interest rate sensitivity is low, so capital losses on any further upward movement in rates is potentially limited. We don’t expect interest rates to move higher; and the outlook for inflation is key to this. In both the US and UK, December’s inflation data was better than expected, leading oversold bond markets to rally. Fundamentally we see bond yield levels in general as attractive for investors looking for positive total returns over the next year.

Total returns for the one to three-year indices in 2024:

- US IG = 5.4%

- EU IG = 4.6%

- UK IG = 5.1%

- US HY = 9.1%

- EU HY = 7.3%

Source: ICE/Bank of America (Bloomberg)1

- UGFzdCBwZXJmb3JtYW5jZSBpcyBub3QgYSBndWlkZSB0byBmdXR1cmUgcmV0dXJucw==

Future returns

Yields are around the level we saw at the beginning of 2024 in US and UK investment grade, while they are lower in high yield and euro investment grade. However, current yields and short duration strategies’ lower sensitivity to interest rate movements should help to potentially deliver meaningful total returns in 2025.

Given the macroeconomic and monetary policy uncertainties, short duration bond strategies are well suited to this environment. We believe they have the potential to deliver returns which are likely to beat, or at least match, cash returns - as they did in 2024. The advantage of bonds over cash is that there is also the optionality for higher returns should interest rates turn out to be reduced more than is currently priced in.

Bonds in 2025

Bond market moves are driven by growth, inflation, policy, and geopolitical events. The first week or so of 2025 saw a continued rise in government (and other) bond yields to multi-year highs. Total returns are far from covered in glory year to date. But it is good that bond yields are high as it raises the probability of decent returns across the asset class. Despite all the commentary around bond markets, liquidity is good, demand is strong and losing money through default is still a very rare event.

We believe with yields this high, it is a potentially good time to invest in fixed income – and short-duration strategies look like a potentially solid cash alternative.

Subscribe to updates

Have our latest insights delivered straight to your inbox.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© 2025 AXA Investment Managers. All rights reserved

Image source: Getty Images