Global pension trends: What to expect in 2026

KEY POINTS

Global backdrop

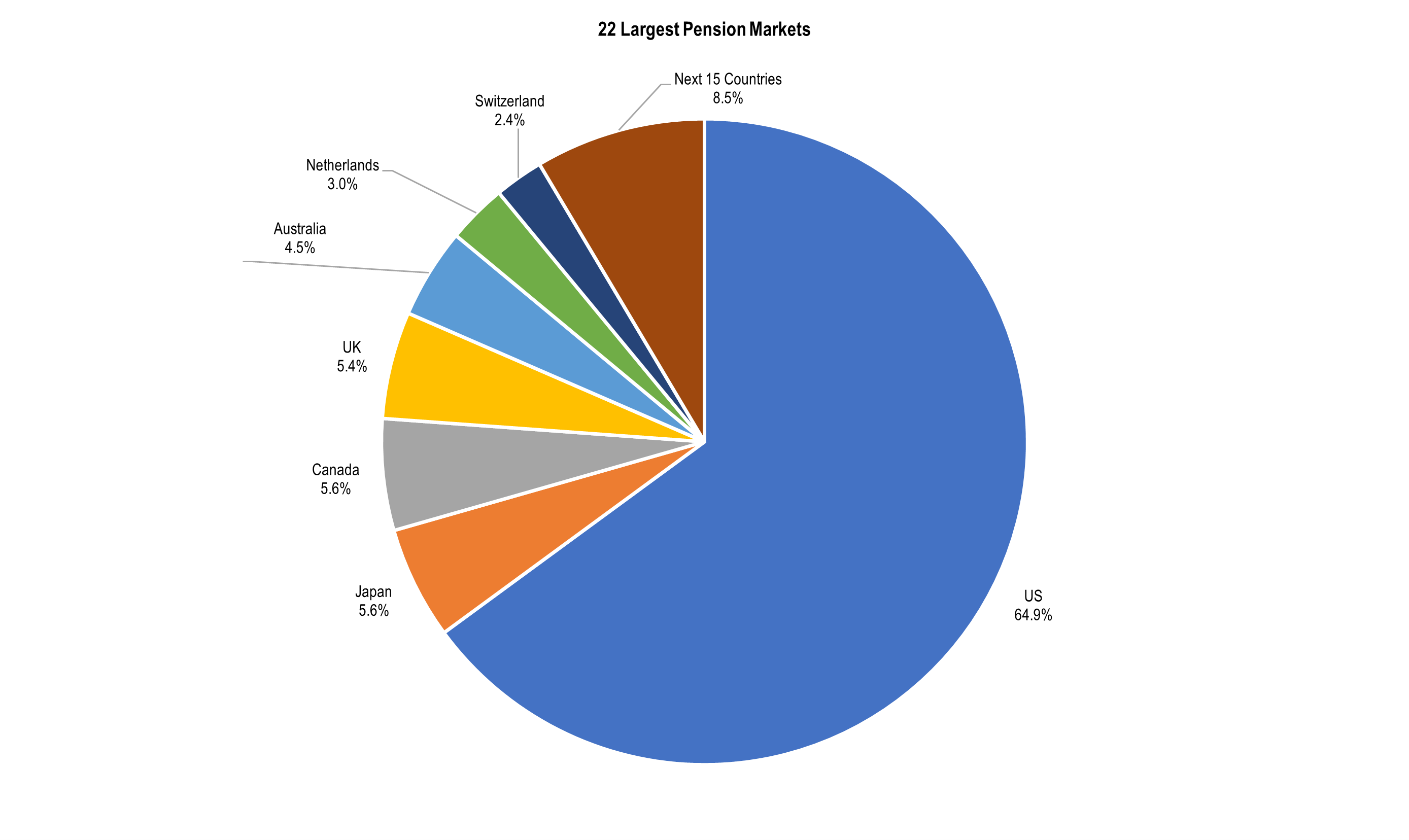

The world’s pension assets are concentrated in 22 major markets and total some US$58.5trn, as at the end of 2024, with the US accounting for 65%. In all, the top seven markets – the US, UK, Japan, Netherlands, Switzerland, Australia, and Canada - account for US$53.5trn.1

Assets grew in 2025, supported by positive performance and contributions, though they remain below 2021 highs. The long running shift from defined benefit (DB) to defined contribution schemes (DC) continues – and DC assets have grown faster (6.7% per annum vs. 2.1%) and now form an increasing share of totals.

Source: Thinking Ahead Institute, Global Pension Asset Survey, 2025

Pension fund equity and bond weightings have gradually declined since 2003 while private markets, real assets, and alternatives rose to circa 20%. Average allocation at end-2024 came in at 45% equities, 33% bonds, 20% others, and 2% cash.2 Home bias continues to fall. Private credit, infrastructure, and private equity remain the fastest-growing asset classes, supported by outsourcing and partnerships due to capacity constraints. ESG integration has become mainstream as frameworks such as the Corporate Sustainability Reporting Directive (CSRD) and Securities and Exchange Commission (SEC) rules make sustainability risk assessment mandatory.

- Source: Thinking Ahead Institute, Global Pension Asset Survey, 2025

- {https://www.thinkingaheadinstitute.org/content/uploads/2025/02/GPAS-2025.pdf;GPAS report}

Country highlights

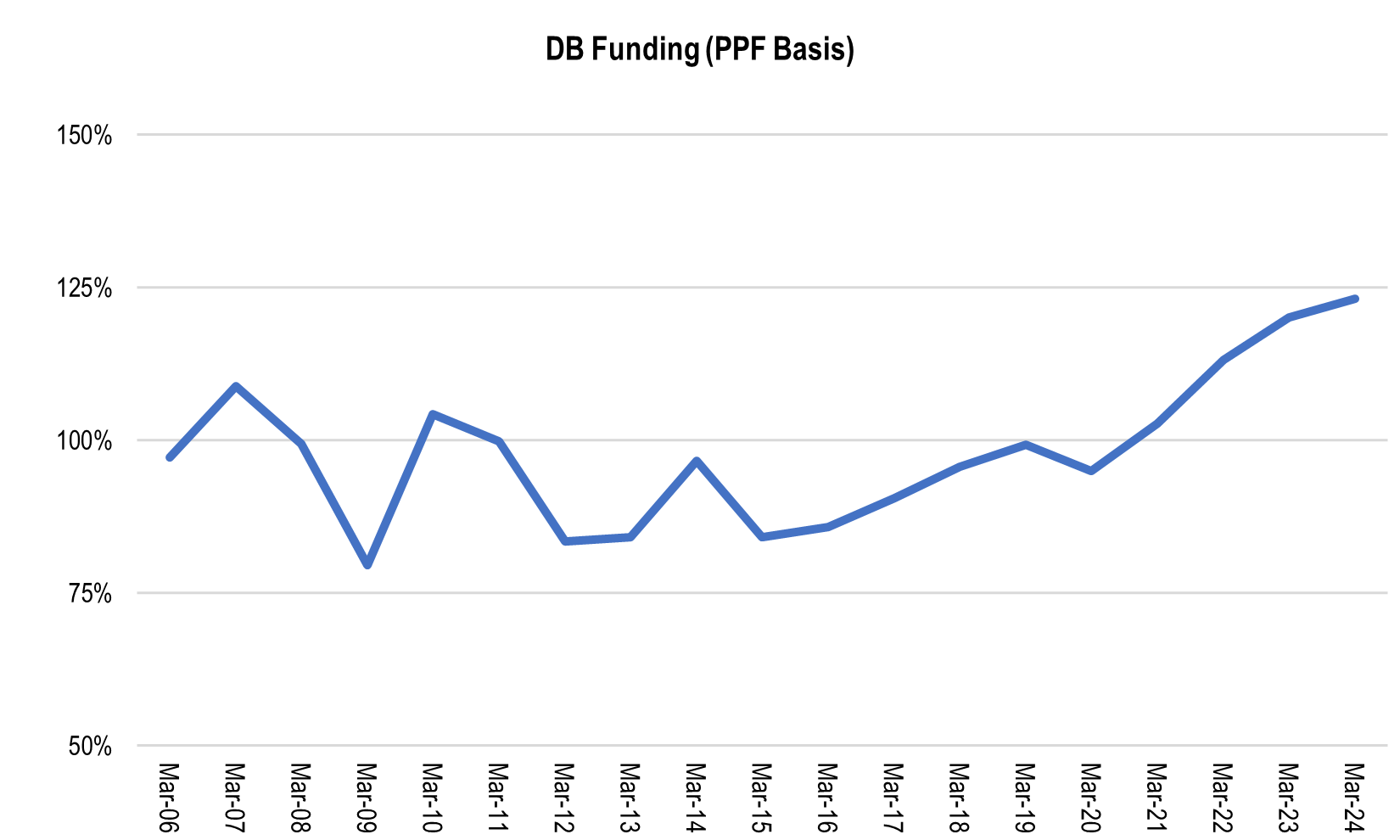

In the UK, the average DB funding ratio reached around 125% in 2024.3 DB portfolios remain bond-heavy (at circa 70%), with growing private asset sleeves. De-risking via buy-ins/buy-outs will continue, with cashflow driven investment (CDI) strategies expanding. DC assets (£1.9trn) are set to surpass DB by the late 2020s.4The nascent “superfunds” should increase the consolidation of the sector by offering insurance-like guarantees at lower costs.

Policy initiatives target 10% in private markets by 2030, 50% invested in the UK (under the Mansion House Compact, embodied in the dedicated Long-Term Asset Fund vehicle), and are promoting consolidation into large master trusts for the UK DC market.

Source: PPF, Purple Book, 2024

In the US, DC dominates private sector pension arrangements while federal, state and other public pension funds remain mostly DB. Allocations to private credit and infrastructure continue to rise, supported by lifecycle designs retaining equity exposure. This trend should be maintained in 2026.

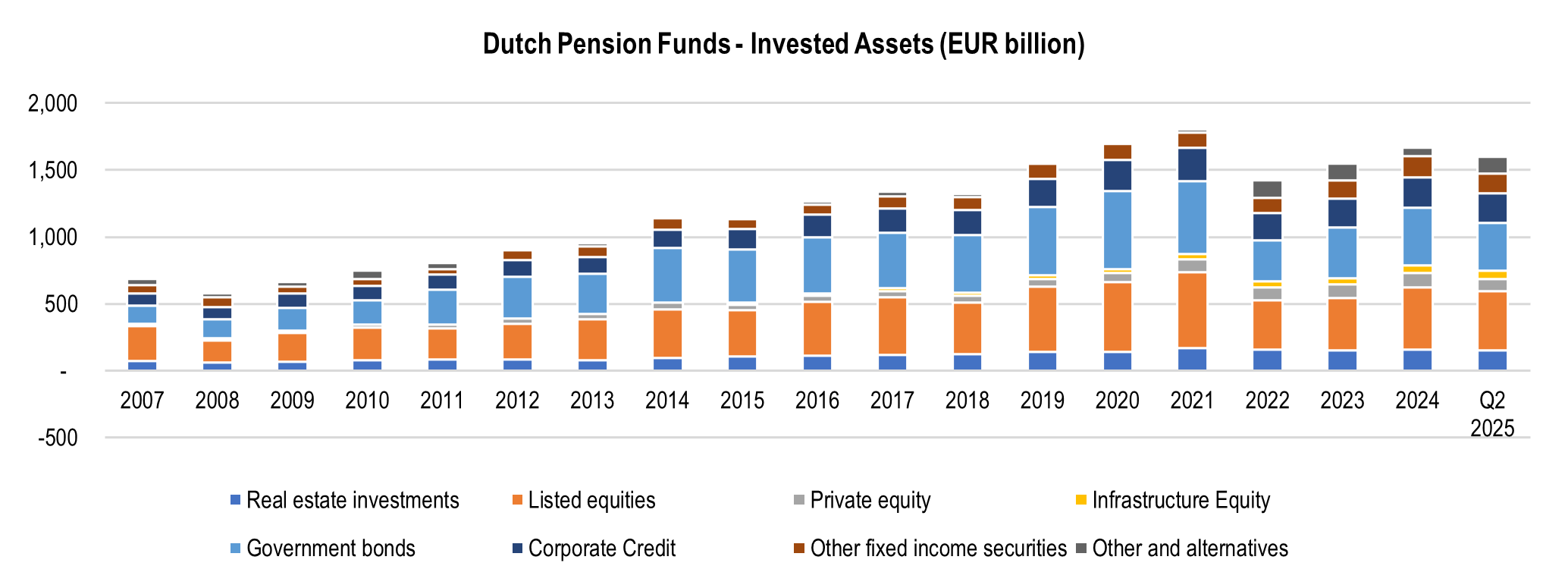

The €1.6trn Dutch pension system is transitioning from DB to DC under the Future Pensions Act. Over half of the participants will migrate by mid-2026, a pivotal year for reallocations and hedge adjustments. Reduced duration and higher risk budgets will most likely shift portfolios toward equities, credit, and private assets within CDI structures.

Between 2023 and 2025, pension funds increased their interest rate hedge ratios above 75% in preparation for the transition, and others decreased their equity position to strategic minima. Post-transfer, funds are expected to unwind part of those hedges, reducing structural demand for ultra-long Dutch and Euro government bonds, and swaps and possibly other duration sources. The new target duration will be significantly lower compared to the current system.

- {https://www.pwc.co.uk/press-room/press-releases/research-commentary/2024/uk-db-pension-schemes-reach-new-record-funding-level-ahead-of-po.html;UK DB pension schemes reach new record funding level ahead of potential pensions overhaul}

- A small minority of UK DB funds are actually re-risking since their solvency has improved (thanks to higher discount rates).

Source: DNB, Invested Pension Assets, 2025

The well-funded Scandinavian retirement systems with high sustainability standards are also increasing exposure to infrastructure and private credit, emphasising energy efficiency and diversification.

The conservative German structures are gradually embracing capital-market and illiquid investments. Larger corporates enhance liability-driven investment (LDI), while small and medium-sized enterprises explore funding and higher-yielding strategies. Incremental moves into private credit and infrastructure debt are expected.

For the rest of Continental Europe, asset growth persists albeit unevenly. Regulators push broader coverage and cross-border pension integration, and allocations are migrating toward private markets (especially to infrastructure and private credit in European Long-Term Investment Funds, similar to the UK’s long-term asset funds), quality bonds, and diversified equity.

Australian Superannuation funds remain equity-heavy with significant internal private investments. Data, valuation, and operational infrastructure underpin scalability. Domestic investment initiatives mirror the UK approach. Similarly, the large Canadian plans blend internal and external management, investing heavily in systems and data for private markets designed to harvest organisational alpha (people, processes, governance). Partnerships with insurers in infrastructure and private credit are expanding.

Asset-class outlook

- Public markets

DC outcomes typically improve with equity allocations, and we expect continued usage of global equity, factor and low-volatility sleeves. Home-bias keeps falling and increased governance favours global diversification. At the same time, the higher risk of listed equities, currently at all-time highs, call for risk management strategies.

Fixed income remains the core risk-management anchor for DB pension funds (in the UK and the Netherlands especially). In DC, we expect a greater use of investment grade (IG) credit, inflation-linked bonds, and short duration as ballast in glidepaths. We see a migration towards structured finance, with an emphasis on highly rated instruments such as Collateralized Loan Obligations (CLO) and asset-back securities (ABS) as well as fixed income pension solutions from insurers. Further interest rate cuts are uncertain given European and American monetary policy and fluctuating inflation expectations. Therefore for 2026, we anticipate limited upside potential for bond prices. In case of a reversal of trend in the equity markets, there would be little relief to be expected from listed bond allocations.

In the current market configuration, protection of equity allocations is therefore advisable. With low implied volatility, equity protection can be achieved cost-efficiently with listed equity index options and futures.

- Private markets

The clear direction is more private investments, often via third-party specialists, with a sharp increase in operating spending earmarked for risk / data systems and artificial intelligence investment models in 2026 and beyond. The biggest talent gaps should remain in private markets and co-investments for pension funds with a limited workforce. The solution appears to be partnerships between institutional investors and retirement institutions, which are becoming more common.

We expect high investor interest in resilience, inflation linkage, and energy transition exposure of infrastructure debt and equity. We note a growing demand for infrastructure debt as a defensive income sleeve. Sustainability priorities include energy efficiency, carbon, climate resilience and community benefits. The top net inflow expectation among large asset owners is for private credit as it is used for yield, downside protection, and diversification. We expect large growth in scale via external specialists, co-investments and secondaries. We also anticipate that exposure to private markets, and in particular private credit, will be through diversified private market funds rather than sub-optimal and expensive funds of funds.

Moderate net increases in private equity allocations are expected. There is nevertheless a lot of sensitivity when it comes to exit / liquidity conditions. The broader use of secondaries and continuation vehicles, with valuation transparency should hopefully start to improve sentiment.

There is mixed near-term sentiment for real estate. There may be increased interest in logistics, residential, and retrofit / energy-efficiency themes as markets stabilise and interest in sustainable investments renews.

Sustainability and ESG

The notion of sustainable / ESG investments is evolving very rapidly and we can expect it to encompass new and innovative concepts in the years to come. It is now embedded in most investment strategies of non-US plans, even though the terminology usage has cooled in some markets. In infrastructure and private equity, energy efficiency and climate resilience are persistent drivers of allocation. Despite political headwinds in the US and cost-of-living fatigue in Europe, global surveys show circa 60% of pension investors plan to increase ESG allocations, especially through passive and index-based strategies reflecting new regulatory benchmarks. The share of ESG-linked assets in Europe is therefore forecast to rise from €6.2trn to €9.4trn by 2027, with greater use of passive ESG ETFs.

The next wave of DC design will focus on impact and sustainability outcomes rather than box-ticking. Members show increasing preference for climate-aligned and transition strategies, but transparency and data integrity remain ongoing concerns.

Closing DB and exiting DC

The use of life insurance policies is now common for DB in the UK and US. Many UK DB funds have focused their buy-in / buyout transactions on the least risk and often largest cohort (the pensioners) but must now deal with the rest of the pension fund members. We expect similar developments in DC (as demonstrated in the US) where participants can purchase insurance guarantees (i.e. variable annuities) on an ongoing basis and at institutional rates. In this framework, insurers bid on guaranteed withdrawal rates as the participants’ income base grows annually. At retirement, participants can “activate” their benefit and draw income from the policy / annuity.

Conclusions and asset allocation implications

|

Sources

OECD Pension Markets in Focus 2024 and Pensions Outlook 2024

OECD on DC design (equity in defaults), 2024

IPE’s DB to DC shift, equity in DC and payout design, Jun 2025

Thinking Ahead InstituteGPAS, 2025

PPF’s Purple Book, 2024

Mercer’s Large Asset Owner Barometer, 2025

IFM Investors’ Private Markets 700, 2025

HSBC, Dutch reform market impact, Oct 2025

HSBC, UK pensions surplus, de-risking persistence, and gilt buyer dynamics, Jan 2025

NatWest, A Big Week for Pensions, Jun 2025

HBS, RTX’s lifetime income strategy: shaping the future of retirement, May 2025

- Congress, U.S. Retirement Assets: Data in Brief, 2023

- SEC, SEC Adopts Rules to Enhance and Standardize Climate-Related Disclosures for Investors, December 2024

House of Commons Library, Pensions: Defined Benefit Superfunds, July 2025

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.