MSCI World Climate Paris Aligned Index (PAB): A world of opportunity with a decarbonisation twist

ETF investors seeking to build a regionally-diversified portfolio in a single, convenient transaction have long turned to tracking global equity indices but historically, this approach offered limited scope for ESG integration. Recent industry innovations mean ETF investors are now able to use index investing to reflect carbon-related goals in their portfolios more effectively. Decarbonisation indices – such as Paris-Aligned Benchmarks (‘PABs’) - are designed for investors looking to decarbonise their portfolios while achieving a return on their investment.

Global is better

Global equities have the potential to be a source of long-term growth for investors. Those with lower risk apetities may find the diversification offered by global markets to complement the historically lower volatility profile of larger companies. Innovation and opportunities amongst developed markets await beyond the confines of countries and continents.

A global approach can help capture the growth potential associated with the sectors and industries that are often associated with specific, dominant markets around the globe, such as technology or manufacture, healthcare or engineering, in one place. Increasing diversity of exposure in this way can also help to dilute the effects of geopolitical volatility across a wider portfolio. Indeed, the effects of currency movements may also be less concentrated. This diversity is increased further when taking into account the global sources of revenues typically achieved by large- and mega-cap companies, which transcend the borders of regional stock markets.

Investing in global indices means investing in global industry – yet, the proportional inclusion of carbon-intense companies and sectors, such as traditional energy providers, chemicals or construction may not be suitable for responsible investors, or those with decarbonisation and climate change goals attached to their portfolios. Read on to discover how the ESG-aware may still participate in the long-term growth opportunity offered by global equity markets, while continuing to achieve sustainability goals.

Shining a light on MSCI World Climate Paris Aligned Index (PAB)

MSCI’s range of Paris-aligned indices are designed to offer investors a way to harness the growth potential of equity markets, with the added benefit of aligning investment goals with the objectives of the Paris Agreement, the global treaty designed to strengthen the global response to climate change. Contributing to the fight against rising global temperatures could offer greater portfolio resilience against climate-related risk, as well as the potential to benefit from exciting opportunities associated with the transition to a net-zero economy.1

Based on the MSCI World Index, which includes large and mid-capitalisation securities across developed markets, the PAB is designed to reduce the exposure to transition and physical climate risks, and to pursue opportunities arising from the transition to a lower-carbon economy while aligning with the Paris Agreement requirements. The Index incorporates the Task Force on Climate-related Financial Disclosures (“TCFD”) recommendations (which are complementary to the EU Paris aligned

benchmark requirements) and intends to exceed the minimum standards of the EU Paris aligned benchmark requirements.2

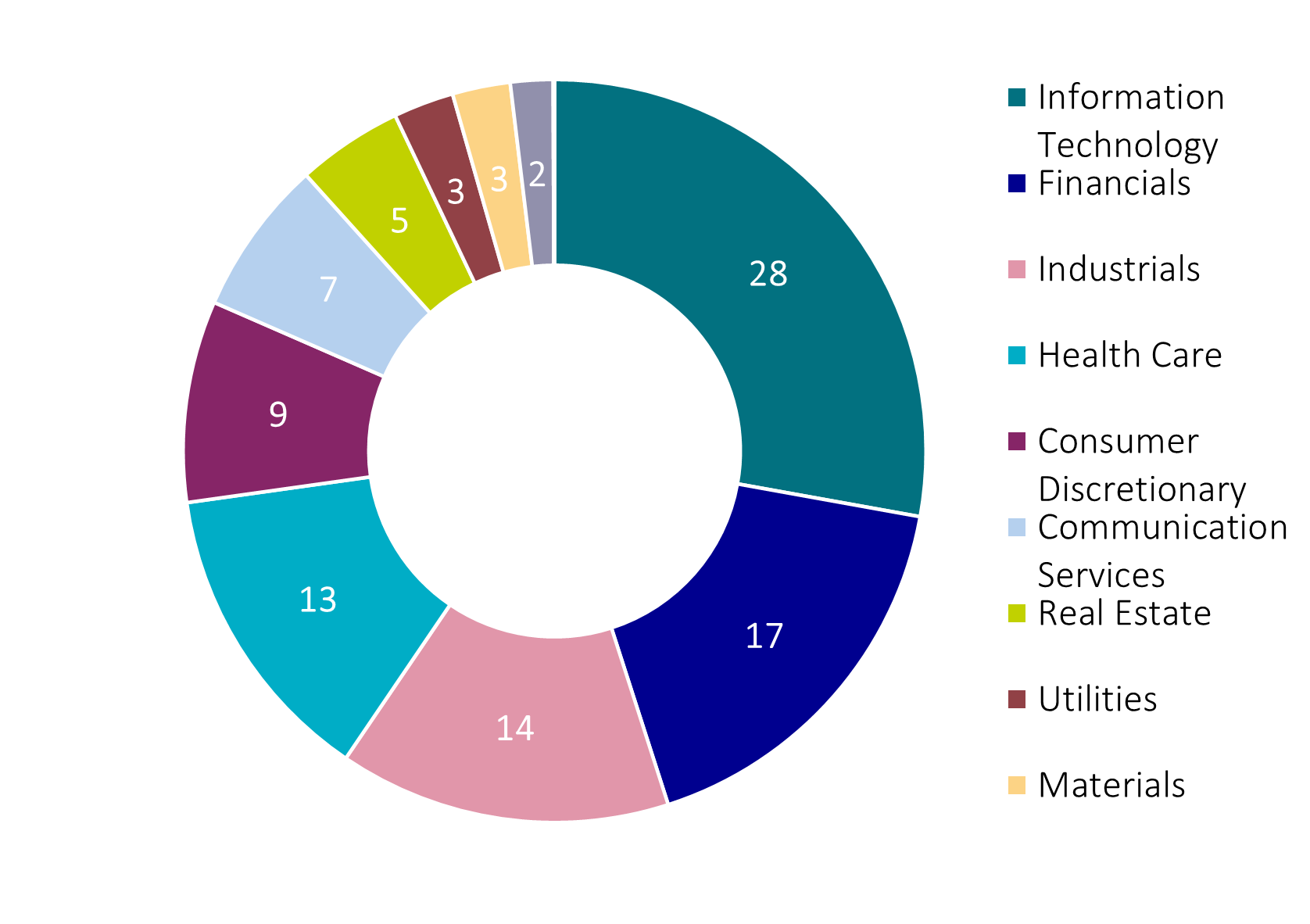

ETF investors who wish to gain access to a more diverse range of opportunities that are offered by country-specific indices can do so by tracking the MSCI World Index® universe (adjusted for Paris-alignment), as well as maintaining the relatively broad range of sector exposure within developed global markets:

Figure 1: MSCI World Climate Paris Aligned Index® sectors breakdown (in %)

Source: AXA IM, MSCI as of 31/05/2024

While the appeal of a globally-diviersfied portfolio is clear, a decarbonsiation benchmark has become a well-regarded option for investors looking to incorporate a climate-focused approach into their ETF building blocks. With similar characteristics to the parent index, there should be little trade-off for using a Paris-aligned Benchmark.

- {https://www.msci.com/our-solutions/esg-investing/esg-indexes/climate-paris-aligned-indexes;Climate Paris Aligned Indexes - MSCI}

- The Index qualifies as an EU Paris-aligned Benchmark under Chapter 3a of Title III of Regulation (EU) 2016/1011 to progressively align with the objectives of the Paris Agreement. For more information on the Index and Parent Indices, please refer to the Fund prospectus.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.