Can high yield be a substitute for equities in this low growth environment?

- 19 January 2023 (3 min read)

As investors, we are often liable for thinking in specific asset class buckets rather than taking a broader view of the investment universe. Yet, taking a cross-asset class view could assist in smarter investment choices and allocations. This perspective is very visible when comparing high yield bonds to equities: two investments that sit in very different asset class buckets, however, their risk-return characteristics are more similar than most imagine and could be viewed as competing asset classes. So much so, that we would argue that high-yield bonds could be considered as an alternative to equities, but with lower volatility.

For investors this consideration could be relevant when looking ahead to 2023. For example, the Global High Yield market is currently offering investors a yield of around 9%1 which represents levels that, historically, have been associated with subsequent positive returns. Alongside this, high yield markets are of better credit quality in general than in the past which means that although defaults are likely to rise in this challenging environment, they are expected to stay contained. On the other hand, it is likely that factors such as a deteriorating earnings outlook and continuing high interest rates will remain headwinds for equities for some time. Against this backdrop, for investors looking for equity-like returns, high yield may provide them with such a solution.

High yield vs Equities: volatility is a differentiator

Overall, there is a high correlation between high yield and equities: global high yield and global equities have had a correlation of 0.832 over the last 10 years. Even at a regional level, the correlation between these two asset classes is high: US is 0.79 and Europe 0.753 . This demonstrates how investors may start to think of high yield as an alternative to equities because the two should perform in relatively similar manners.

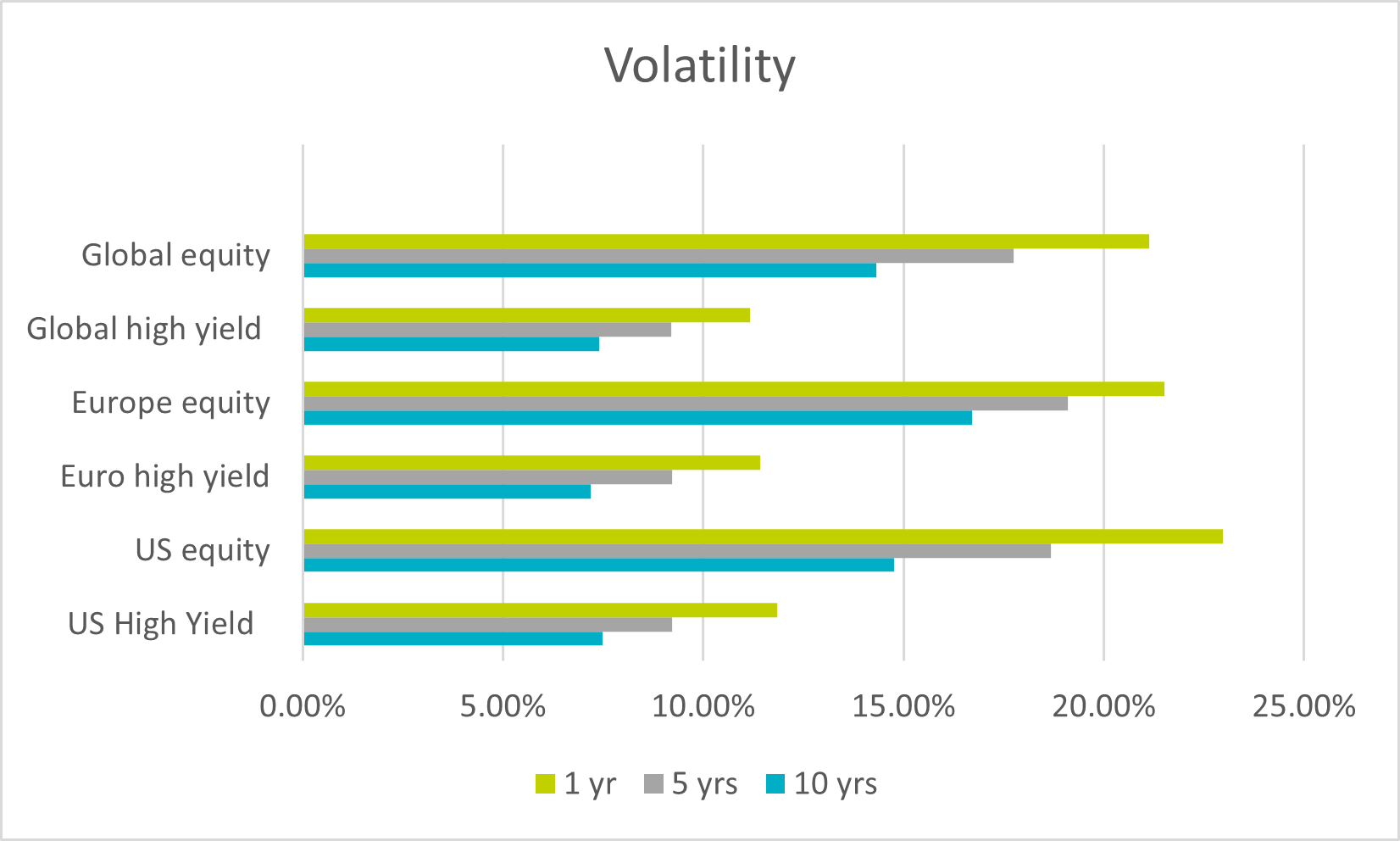

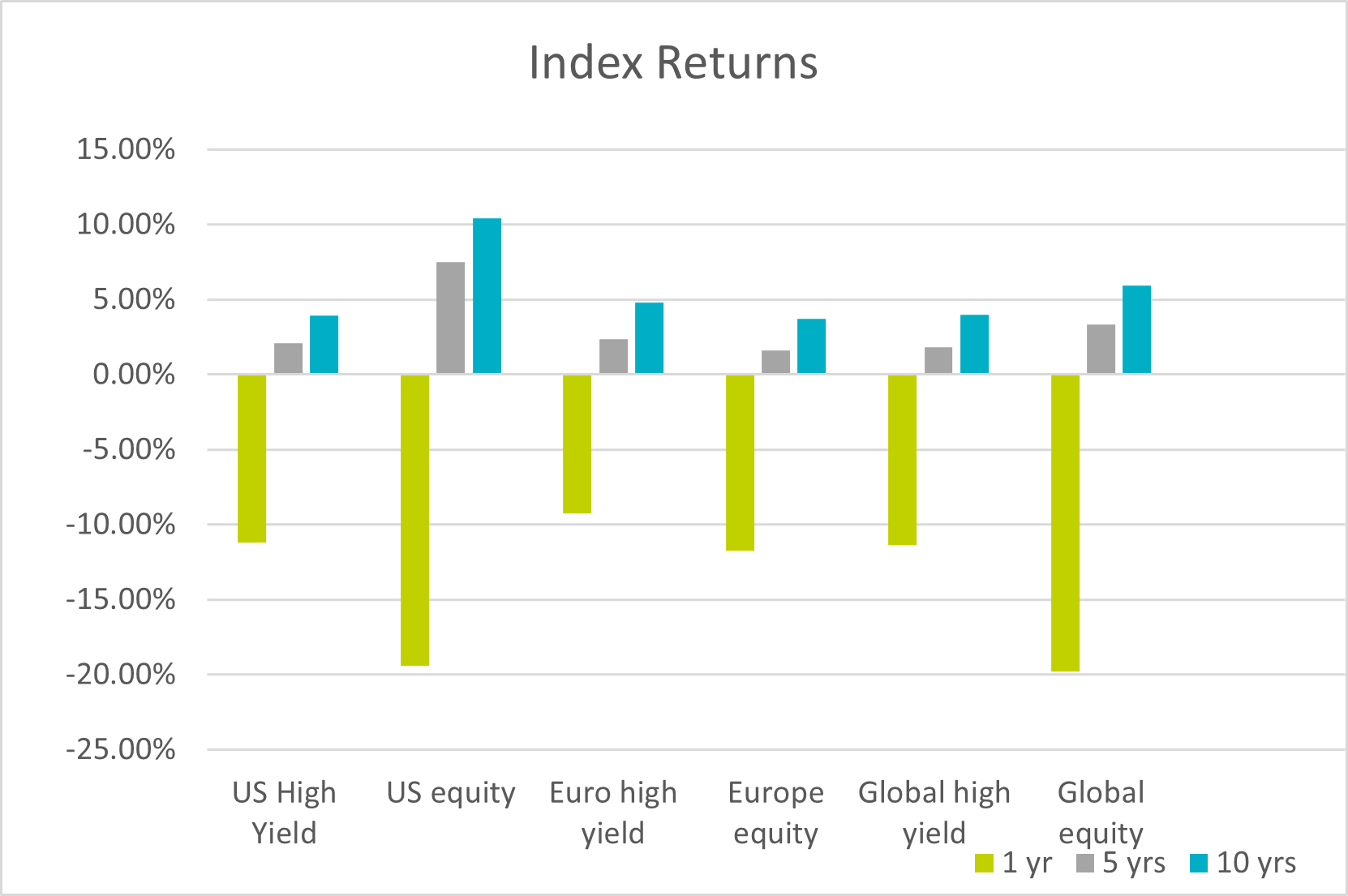

This correlation is reflected, on the whole, in returns. Over a 10 year time period, global high yield has largely kept pace with global equities: 3.98% and 5.95% respectively4 While, the returns for global equities have outperformed global high yield in stronger years, in 2022 with markets falling, global high yield provided investors with a relatively better return than equities: -11.39% for global high yield versus -19.8% for global equities over the year5 . To that measure, high yield bonds behaved as you would expect a bond to behave against equities - providing some protection during periods of negative markets while also not gaining as much when markets are strong. But it is the difference in volatility levels that is a key differentiator between high yield and equities and one that could be relevant coming into 2023 as many of the risks from the last 12 months persist. As the charts below demonstrate, high yield across the three main investment universes offers a lower volatility than equities with, often, similar returns.

Volatility and Index Return Comparison6

How they differ in structure:

Of course, volatility is not the only differentiator. In order to generate returns on equities, you need earnings growth or multiple expansion. However, as an investor in high yield, your return is more reliable as it comes from your coupon payment. High yield debt also benefits from interest rate exposure which can help to mitigate losses during periods of volatility.

As well as this, debt sits above equity in a company’s capital structure, meaning that in the event it is listed, a company will halt dividend payments to shareholders before coupon payments to bondholders are interrupted.

It is difficult to discuss debt without referencing default risk when it comes to high yield. While we expect the default and downgrade rates to increase this year in reaction to economic challenges, we believe they will remain relatively low compared to other periods of turbulence. We believe that the key to successful high yield investing is in avoiding those companies likely to be subject to a deterioration in credit quality and therefore to avoid capital loss.

Looking ahead

We expect many of the same risks from 2022 such as inflation and geopolitical challenges that are likely to continue to worry investment returns in 2023. The benefits of a diversified portfolio are not difficult to appreciate in such times, but how investors allocate within that and analyse their allocations is more nuanced. Indeed, generating equity returns from multiple expansion and earnings growth may be more difficult to achieve in a low growth environment, while compounding income from high yield debt could offer more reliable returns. With equity-like returns but lower volatility, it may be worth considering high-yield bonds as an alternative to equities especially in these unpredictable markets.

- U291cmNlOiBBWEEgSU0sIEJsb29tYmVyZyBhcyBhdCAxMSBKYW51YXJ5IDIwMjM=

- U291cmNlOiBBWEEgSU0sIEJsb29tYmVyZyBhcyBhdCAzMSBEZWNlbWJlciAyMDIyLiBCYXNlZCBvbiBJQ0UgQm9mQSBHbG9iYWwgSGlnaCBZaWVsZCBJbmRleCBhbmQgTVNDSSBBbGwgQ291bnRyeSBXb3JsZCBJbmRleA==

- U291cmNlOiBBWEEgSU0sIEJsb29tYmVyZyBhcyBhdCAzMSBEZWNlbWJlciAyMDIyLiBCYXNlZCBvbiBJQ0UgQm9mQSBVUyBIaWdoIFlpZWxkIEluZGV4LCBJQ0UgQm9mQSBFdXJvIEhpZ2ggWWllbGQgSW5kZXgsIFMmYW1wO1AgNTAwIEluZGV4IGFuZCBFdXJvc3RveHggNTAgSW5kZXg=

- U291cmNlOiBBWEEgSU0sIEJsb29tYmVyZyBhcyBhdCAzMSBEZWNlbWJlciAyMDIyLiBCYXNlZCBvbiBJQ0UgQm9mQSBHbG9iYWwgSGlnaCBZaWVsZCBJbmRleCBhbmQgTVNDSSBBbGwgQ291bnRyeSBXb3JsZCBJbmRleA==

- U291cmNlOiBBWEEgSU0sIEJsb29tYmVyZyBhcyBhdCAzMSBEZWNlbWJlciAyMDIyLiBCYXNlZCBvbiBJQ0UgQm9mQSBHbG9iYWwgSGlnaCBZaWVsZCBJbmRleCBhbmQgTVNDSSBBbGwgQ291bnRyeSBXb3JsZCBJbmRleA==

- U291cmNlOiBBWEEgSU0sIEJsb29tYmVyZyBhcyBhdCAzMSBEZWNlbWJlciAyMDIyLiBJbmRpY2VzIGFyZTogVVMgaGlnaCB5aWVsZDogSUNFIEJvZkEgVVMgSGlnaCBZaWVsZCBJbmRleDsgVVMgZXF1aXRpZXM6IFMmYW1wO1AgNTAwIEluZGV4IEV1cm8gSGlnaCBZaWVsZDogSUNFIEJvZkEgRXVybyBIaWdoIFlpZWxkIEluZGV4OyBFdXJvcGUgRXF1aXRpZXM6IEV1cm9zdG94eCA1MCBJbmRleDsgR2xvYmFsIEhpZ2ggWWllbGQsIElDRSBCb2ZBIEdsb2JhbCBIaWdoIFlpZWxkIEluZGV4IGFuZCBHbG9iYWwgRXF1aXRpZXM6IE1TQ0kgQWxsIENvdW50cnkgV29ybGQgSW5kZXg=

Glossary

Default Risk: The risk of an issuer not being able to repay their debt obligations.

High Yield Debt: Also known as “junk” bonds, are issued by companies with a lower credit rating than their investment grade counterparts.

Volatility: the degree of variation of a price for a given security or market index. As a rule of thumb, the higher the volatility, the riskier the security.

High Yield Bonds

High yield investing has the potential to offer risk-aware investors an attractive source of income.

Find out moreDisclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.