US High Yield Outlook 2025

- 20 January 2025 (7 min read)

The US high yield market delivered an attractive total return of 8.2% for 20241 . This compared favourably to other fixed income asset classes such as investment grade credit and government bonds.

As of December 31st, 2024 | ||||

USD (H) Currency | 2024 Total Return | 3Y Total Return (Ann.) | Yield-to-Worst (Local)* | Option Adjusted Spread (Local) |

S&P 500 Index | 25.00 | 8.93 | 1.27 | N/A |

US High Yield CCC and lower | 18.18 | 5.97 | 11.87 | 746 |

Russell 2000 Index | 11.53 | 1.24 | 1.40 | N/A |

Euro High Yield Index | 10.41 | 4.70 | 5.77 | 316 |

Credit Suisse Lev Loan Index | 9.05 | 6.85 | 8.78 | 376 |

US High Yield Index | 8.20 | 2.91 | 7.47 | 292 |

US High Yield B Rated | 7.55 | 3.10 | 7.54 | 296 |

US High Yield BB Rated | 6.28 | 1.93 | 6.43 | 186 |

US Corporates BBB Rated | 3.55 | -1.57 | 5.56 | 102 |

US Corporate Index | 2.76 | -1.98 | 5.36 | 82 |

US Treasury 10 year | -1.69 | -5.41 | 4.58 | 0 |

* 12M dividend yieldgross

Source: ICE BofA, S&P Dow Jones Indices, FTSE Russell

- U291cmNlOiBJQ0UgQm9mQSBVUyBIaWdoIFlpZWxkIEluZGV4LCBhcyBvZiBEZWNlbWJlciAyMDI0

Beneath the headline numbers, we observed shifting narratives for US high yield throughout 2024. In fact, the one consistent theme in 2024 was the changing narrative around rates. Having initially moved sharply higher in the first few months of the year in response to strong economic data and sticky inflation, US treasury yields fell steadily from their peak in April through the summer and then dramatically through the third quarter as the focus shifted instead to some signs of weakness in the labour market. The Federal Reserve’s (Fed) larger-than-anticipated 50bps rate cut in September provided a further positive tailwind for all fixed income markets, particularly bringing relief to lower quality high yield issuers struggling with elevated interest expense, which partially contributed to another year of outperformance from CCCs.

However, rates reversed again and moved higher in the fourth quarter with markets focusing on the outcome of the US election – which may impact the amount that the Fed is able to cut rates in 2025. In stark contrast to the end of 2023, when the market reacted positively to a more dovish Fed tone, there is a much more hawkish tone to the end of 2024, with uncertainty as to the impact of the incoming Trump administration’s policy agenda and, hence, the future path of inflation and interest rates.

US High Yield key focus points for 2025

Potential impacts of the Trump administration

We envisaged that the outcome of the US election in November would not have a significant direct impact on the US high yield market, irrespective of the winning candidate. However, the fact that the Republicans took the Presidency and have a unified Congress is significant in allowing Trump greater leeway to implement his policy programme. This could lead to stronger market reactions as policy details become clearer than under a divided Congress, given the higher likelihood of gridlock in Washington in that scenario. Below are some of the potential indirect impacts for US high yield:

- Revisions to inflation, Gross Domestic Product (GDP) and rate cut expectations. The market is anticipating that the combined impact of Trump’s agenda – notably around fiscal policy, immigration and trade tariffs – could be inflationary, thereby limiting the Fed’s ability to cut rates to the extent the market was anticipating. Furthermore, with the deficit already running at a significant 6% of GDP2 , the increased borrowing required to support fiscal expansion could lead to further swings in the US Treasury market, thereby impacting high yield spread levels and overall risk premiums.

- Domestic focus insulates US high yield from tariffs and trade wars. A decrease in imports and an increase in domestic demand might initially satisfy Trump’s desire to reduce the trade deficit and strengthen the US dollar. Given that the US high yield market is predominantly domestically focused, it has less reliance on revenue generation from foreign ventures and is less impacted by global FX markets than investment grade, meaning it should be more insulated from the impacts of potential tariffs and trade wars and could benefit from increased domestic demand for goods and services.

- Mergers and Acquisitions (M&A) to pick up? Trump’s desire to reduce corporate tax rates and championing of deregulation should be positive news for companies. Most notably, deregulation should boost M&A activity, which is likely to increase after a muted period also due to Trump’s nomination of Andrew Ferguson as the head of the US Federal Trade Commission (FTC). Ferguson has criticised the incumbent, Lina Khan, for opposing mergers and being “anti-business”. Increased M&A tends to be positive for high yield companies, which are often bought by larger companies, although could lead to new potential supply that might impact on technicals.

- Persistent inflation remains the biggest risk. In our view, the biggest risk to high yield (and all markets) from Trump’s policies in 2025 and beyond is a material and persistent inflationary backdrop. This would mean that the Fed is unable to further reduce rates or even starts hiking rates again, which could have knock-on impacts for interest coverage across the high yield market, a drop in refinancing activities and overall market sentiment. An increase in liability management exercises and outright defaults would likely follow in this scenario.

- U291cmNlOiBBWEEgSU0gUmVzZWFyY2gsIDMxIERlY2VtYmVyIDIwMjQ=

Low(er), positive GDP offers the potential sweet spot for high yield

For now, we continue to believe that the US economy remains on course for a modest slowdown over the next couple of years, whilst avoiding significant decline. Although recessionary risks are not off the table, we consider two simplified scenarios to consider high yield performance in this context:

- Economy continues to grow, but at a slower pace. This remains our central scenario and potentially offers a constructive environment for US high yield. This is because high yield companies should have enough room to operate and grow revenues/EBITDA, but without the extremes of a much hotter economy that can lead to excessive corporate exuberance, or recessionary environment that can lead to balance sheet deterioration and a pick-up in defaults. Trump’s tax cutting and deregulation agenda should provide a boost to GDP in the short term, but further out the picture is less clear. As long as GDP remains in a low but positive range, this should be favourable for high yield returns.

- Economy runs too hot and inflation remains persistently higher. As the Fed acknowledged in December through its upward revision to GDP for 2025, any slowdown is now likely to come from a higher starting point than previously anticipated. If inflation was to spike once more through a combination of a stronger than expected economy and Trump’s policies, then the Fed will have less room for easing. In this scenario, we would expect a reversal of the strong performance of some of the highly levered, lower quality high yield credits that rallied so much in 3Q 2024 on lower rate expectations and a pick-up in dispersion across US leveraged finance once again. High yield should still outperform investment grade based on carry and lower duration, but the extent to which this dispersion feeds through into negative risk sentiment and wider contagion warrants monitoring.

Rate cuts...the ball is rolling, but where does it stop?

All eyes will be on the Fed’s delicate balancing act in 2025. Putting aside the impact of Trump’s agenda, the Fed’s goal will be to ensure that monetary policy is restrictive enough to see inflation return to its 2% target, but not restrictive enough to cause an increase in unemployment. This should still leave some room for some easing in 2025 based on the current outlook, but risks now seem to be skewed towards rates remaining higher for longer.

For most US high yield companies and their ability to service interest expense, the fact that the Fed has got the ball rolling, we believe, is the most important factor, not necessarily the initial size, subsequent pace or extent of rate cuts. However, for a much smaller tail of companies at the lower quality end of the high yield market, who were already struggling with high debt burdens and too much leverage, those factors are much more significant.

We consider three principal impacts of Fed easing on US high yield companies:

- Supports the more rates sensitive BB-rated part of the market, although this is yet to materialise given the subsequent rise in the 10Y Treasury yield since the first cut.

- Provides relief to certain large, distressed capital structures in sectors like Telecom, Media and Healthcare, for whom the initial 50bps cut was more significant. Some of these companies are also benefiting from other positive tailwinds in the form of M&A headlines, leading to strong contributions to the US high yield market return from these issuers in 3Q 2024. These are the issuers that will be most impacted in 2025 by the extent to which the Fed is able to ease further.

- Potential for a stabilisation in recent capex decline across some sectors, particularly in manufacturing/building products, as projects start to come online once more. This could lead to renewed inflationary pressures – a balancing act that the Fed will need to manage carefully.

High yield fundamentals to remain healthy, although the gap between LMEs* and defaults may widen further

Whilst the macro picture remains clouded in uncertainty, we feel the micro continues to offer a much more favourable, albeit nuanced, reading of the high yield market. As bottom-up investors, identifying these trends is our principle focus and we see many of the positive fundamental themes from 2024 continuing into 2025. The topic of distressed exchanges, however, is one that we expect to dominate the headlines throughout 2025. Key themes this year include:

Sector trends to continue to diverge in line with an uneven economy. A lot of emphasis has been placed on the resilience of consumer facing industries (e.g. retail, leisure, hotels, gaming) in supporting a much stronger US economy than many expected over the last two years. In 2025, we expect more nuanced trends for the consumer, particularly in sectors more dependent on lower income consumers which are now showing some signs of weakness, with revenue guidance coming down from many retail/consumer product companies. However, the story is not all bad for the consumer, as larger retailers who can command greater price promotions are faring well, whilst the higher income consumer is seemingly doing fine. Gaming and hotel businesses are maintaining steady growth, despite facing difficult competition and much higher room prices. Parts of leisure, particularly cruiselines, continue to show resilient demand for their products in the post Covid era with strong pricing growth vs. 2019 and a return to pre-Covid occupancies.

One other area of focus in 2025 is the extent to which delayed projects start to come back online in industries related to manufacturing and real estate, as a result of lower rates. This has the potential for a stabilisation in recent capex decline across some sectors. Although this will be largely dependent on the path of rates, if realised then these industries could witness improved earnings momentum as a result. There could also be some inflationary impacts as a byproduct, depending on the extent of the move.

If 2025 does usher in higher rate expectations, then sector trends in the more levered parts of Telecom warrant attention. These companies have direct exposure to higher floating rates through their balance sheet and a higher interest rate environment also decreases the number of large-scale projects they can take on to drive future revenue stabilisation and growth. Conversely, these companies stand the most to gain if rates move lower through a reduction in interest expense, whilst recent headlines around increased capex spend in AI that will require investments in data centres, together with Trump’s desire to drive greater domestic economic activity, could work in their favour. Specific to the Trump administration’s likely policy agenda, we envisage greater direct impacts on certain high yield sectors, notably Healthcare, Energy and Media.

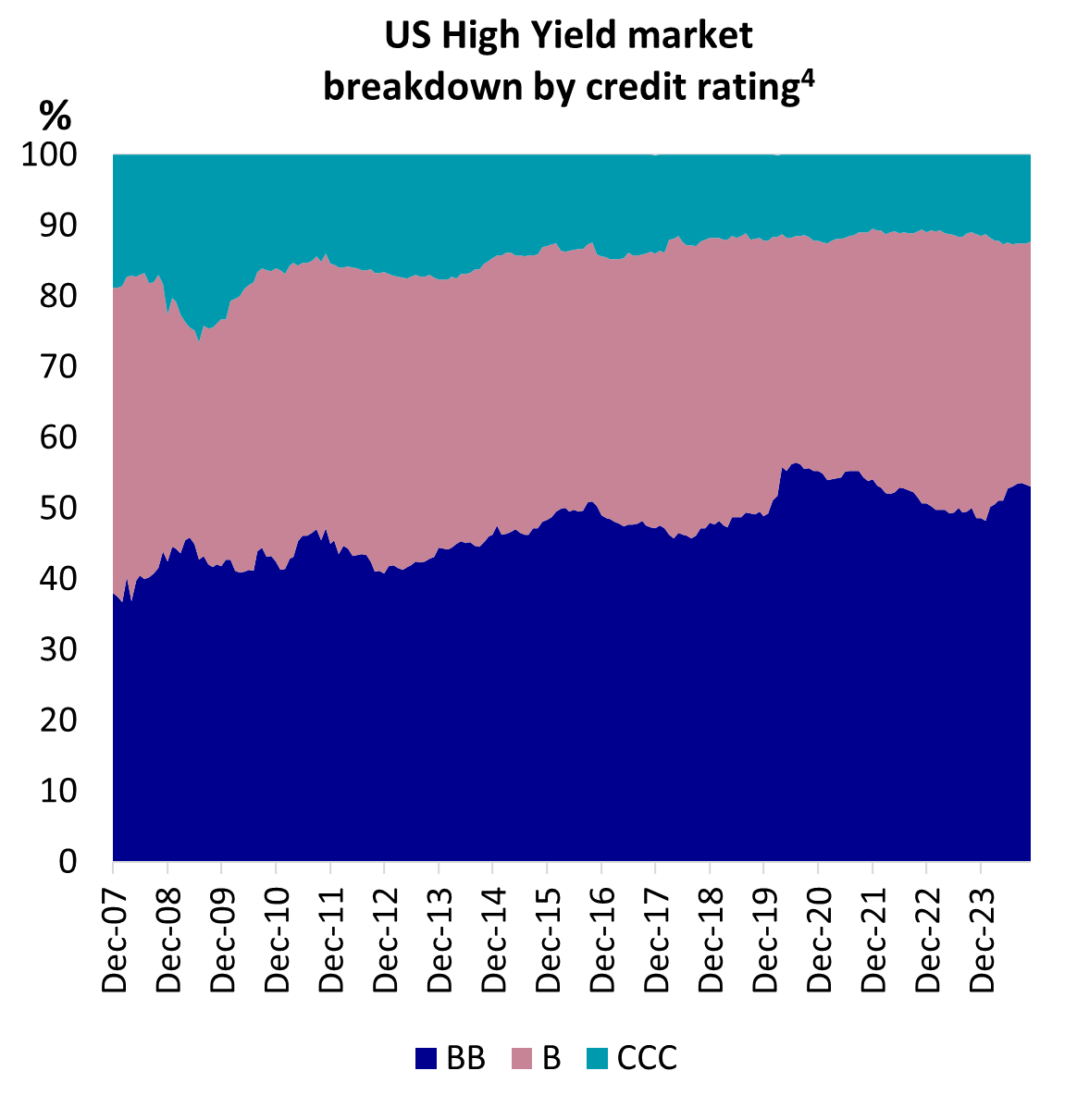

Fundamentals to remain resilient, reflecting multi-year shift towards higher quality high yield bond market. The fact that leverage has not meaningfully picked up and interest coverage has experienced only mild deterioration from its highs in 2021-2022 is testament to the ingenuity that many high yield companies have shown in adapting to a higher interest rate environment. This is also reflected in credit rating trends, with a 2024 high yield bond upgrade-to-downgrade ratio by issuer of 1.22, continuing strong momentum from previous years (1.00 in 2023, 1.35 in 2022 and 2.31 in 2021).3 This is playing out most strongly within BBs and Bs, with CCC credit trends continuing to witness the highest dispersion. As a result, today’s US high yield market consists of 53% in BBs, compared to 38% pre–Global Financial Crisis (see chart).4

Due to the rapid growth of private credit, today’s high yield market is also composed of public companies to a much greater extent, increasing overall transparency as to balance sheet health due to more stringent reporting requirements for public companies. We do, however, expect negative credit trends in the leveraged loan market, which had an upgrade-to-downgrade ratio of 0.60 in 2024 (0.49 in 2023, 0.67 in 2022 and 2.00 in 2021)3, to persist in a higher for longer rate environment. The significant portion of the loan market rated B or lower may continue to pose a threat to all US leveraged finance if a multi-notched downgrade was to occur, as it grapples with the more immediate impact of higher interest expense.

Defaults to remain below long-term averages, although gap between defaults and distressed exchanges likely to increase. The continued decline in the US high yield bond default rate to a three-year low of 1.5% by 2024 year-end (0.36% excluding distressed exchanges), has exemplified the strong fundamental and technical backdrop for high yield. 5 Our consistent focus on fundamentals, rather than macro signals, has given us a more positive reading of default expectations over the last couple of years and we continue to expect defaults to remain in a low range of 1-3%, below long-term historical averages.6 That said, we expect to see more action skewed towards distressed exchanges as companies with inappropriate capital structures for today’s higher rate environment aim to avoid outright bankruptcy through out-of-court settlements. In particular, there are certain large, distressed capital structures in Telecom, Media and Healthcare with the potential to drive both default/LME activity higher and so 2025’s default rate could well hinge on what happens to those companies. It is worth noting that the gap between leveraged loan and high yield bond defaults is currently at a high since July 2000, with distressed exchanges in the loan market driving the largest component of default activity.7

*LMEs - liability management exercises

- SlAgTW9yZ2FuIFJlc2VhcmNoIEJvbmQgQWdlbmN5IFVwZ3JhZGUgdmVyc3VzIERvd25ncmFkZXMsIERlY2VtYmVyIDIwMjQu

- U291cmNlOiBJQ0UgQm9mQSBVUyBIaWdoIFlpZWxkIEluZGV4LCBjb21wYXJpbmcgRGVjZW1iZXIgMjAwNyB3aXRoIERlY2VtYmVyIDIwMjQu

- U291cmNlOiBKUCBNb3JnYW4gUmVzZWFyY2ggRGVmYXVsdCBNb25pdG9yLCBEZWNlbWJlciAyMDI0Lg==

- QWNjb3JkaW5nIHRvIEpQIE1vcmdhbiBSZXNlYXJjaCwgdGhlIDI1LXllYXIgYXZlcmFnZSBoaWdoIHlpZWxkIGJvbmQgZGVmYXVsdCByYXRlIGlzIDMuNCUsIGFzIG9mIERlY2VtYmVyIDIwMjQu

- U291cmNlOiBKUCBNb3JnYW4gUmVzZWFyY2ggRGVmYXVsdCBNb25pdG9yLCBEZWNlbWJlciAyMDI0LCBpbmNsdWRpbmcgZGlzdHJlc3NlZCBleGNoYW5nZXMu

Positive technical across US leveraged finance to continue, supported by renewed investor demand.

- Broader capital market access across leveraged finance to support company financing needs in a wide range of macro scenarios. 2024 was another year in which the strength of technical factors in supporting high yield issuers through a period of tighter financial conditions cannot be overstated. But this theme goes beyond the high yield bond market. The loan market technical has been incredibly strong as demand from US CLO creation, which has seen new issue volumes running at nearly the fastest pace in the last decade, has picked up.8 Similarly, the amount of cross-market refinancing between loans and private credit has picked up materially in 2024 – both loan to takeout private credit and vice-versa. This has particularly helped reduce refinancing risks for stressed credits, benefiting high yield bond issuers too. In fact, B3 or lower-rated bond and loan issuance has risen to a historic high9 .

- Rising star/fallen angel dynamics to remain favourable as the Boeing can is kicked once more and M&A picks up. At one point in 2024, the prospect of whether Boeing would be downgraded one notch to become a high yield issuer became the $54 billion question. In the end, the can was kicked once more as Boeing issued preferred equity and negotiated an end to worker strikes through an improved pay deal. With the risk now of seeing Boeing become the largest fall angel ever reduced, the outlook for rising star/fallen angel dynamics in 2025 looks more positive after continued momentum in 2024. Several large high yield issuers are candidates for upgrade, notably in cruiselines with Royal Caribbean likely and Carnival possibly following suit. As in 2024, overall volumes of rising stars are likely to be less than the bumper years of 2022 and 2023, but the ratio to fallen angels should still provide a positive technical for the high yield market whilst increased M&A activity could further support rising star dynamics.

- High yield fund flows to pick up. After three consecutive years of outflows, high yield flows rebounded in 2024 with +$16.4bn of inflows ($10.2bn ETFs), driven by the Fed easing cycle, low defaults and elevated yields.10 Although this reflects an improvement in investor sentiment towards the asset class, we expect this trend to continue given that it represents only a portion of the net -$68bn of outflows over the previous three years. We expect money market funds to continue to experience outflows as investors deploy cash with the Fed easing, and high yield is well placed as one of the fixed income asset classes offering comparatively attractive yield levels over cash to benefit from this shift in capital.

- U291cmNlOiBCYXJjbGF5cyBSZXNlYXJjaCwgT2N0b2JlciAyMDI0Lg==

- U291cmNlOiBKUCBNb3JnYW4gUmVzZWFyY2ggMjAyNCBIaWdoIFlpZWxkIEFubnVhbCBSZXZpZXcsIGFzIG9mIERlY2VtYmVyIDIwMjQu

- U291cmNlOiBKUCBNb3JnYW4gUmVzZWFyY2ggMjAyNCBIaWdoIFlpZWxkIEFubnVhbCBSZXZpZXcu

Why high yield can still generate attractive total returns despite current spread levels

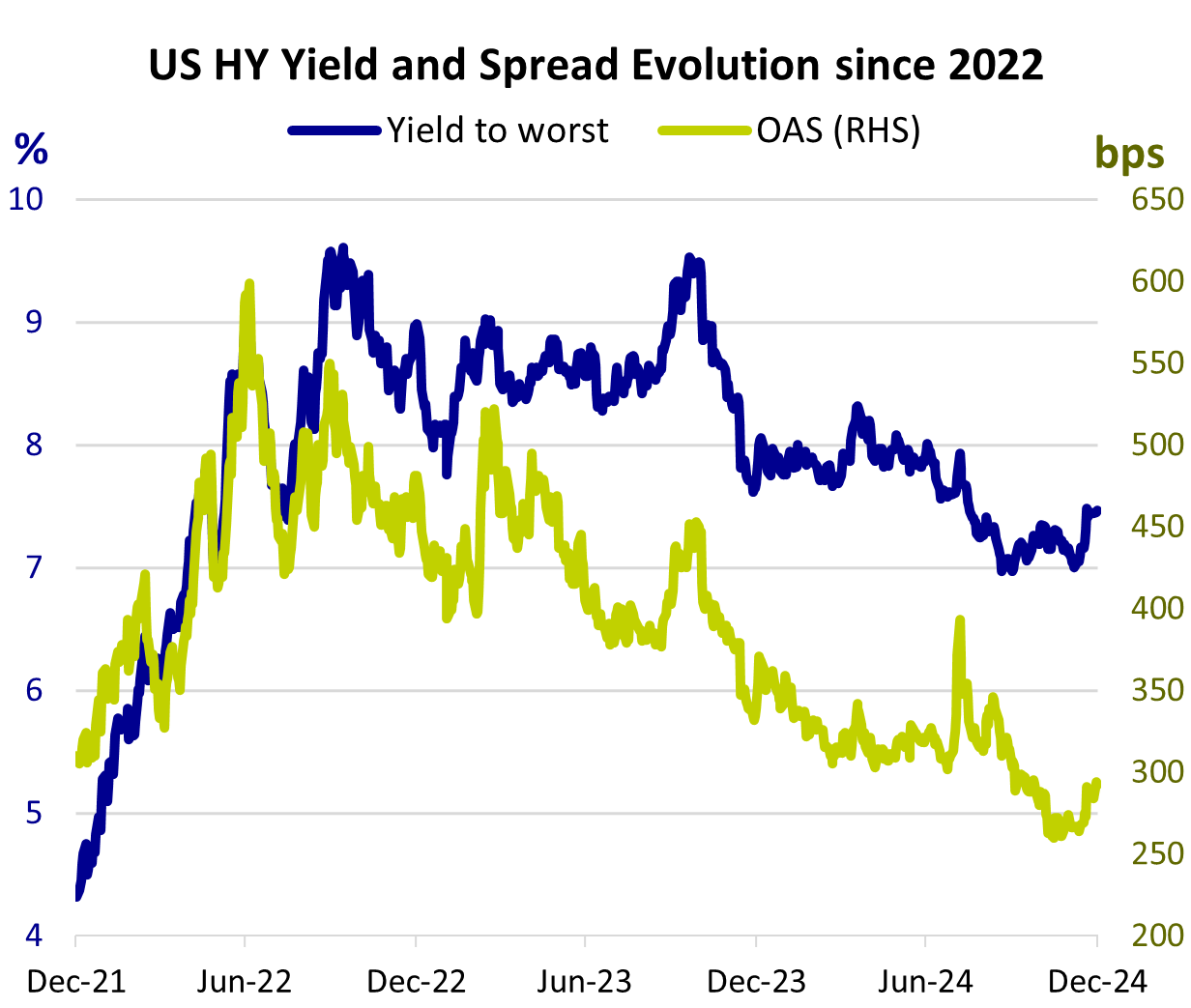

Justifiably expensive. Calls for wider high yield spreads in 2024 did not materialise, just as in 2023. Although there’s no denying spreads are tight relative to long-term averages, we continue to believe that they remain justifiably expensive – given the benign default rate and strong fundamental and technical environment. With these trends still very much in play, we see good reasons why spreads remain supported at current levels and would view any widening because of macro or geopolitical events as a potential buying opportunity. We also note that, due to structural shifts in high yield including improvements in average quality, accessibility to capital and overall liquidity as a result of new trading techniques, together with more recent market shrinkage due to an extremely strong technical environment, the average spread over the next 15 years may well be lower than the previous 15 since the Global Financial Crisis.

Source: ICE BofA US High Yield Index, as of December 2024

- So, what about returns? The last time spreads got this tight (~300bps) was 2021, with the US high yield market posting a coupon-like return of 5.36% in that year11 . However, in contrast to 2021 when yields were also low due to the zero-interest rate environment, today we still have plenty of yield at 7.5% for the market, which we think solves a lot of potential pitfalls and bouts of volatility that are likely throughout 2025. There are therefore good reasons why 2025 return prospects are vastly improved versus 2021: we have been through the painful transition to much higher rates and now have easing under way, inflation has moderated significantly, recession risks have waned in the short term, high yield maturities have been pushed out and the market still trades at a discount ($95 as of Dec-24) compared to a premium back then ($105 as of Dec-20)11. With the market’s average coupon at 6.4% today11, a “coupon-plus” type performance, which results in another high single digit return for 2025 for the market seems plausible, based on current reading. Active management offers investors the ability to access the high yield market in many distinct ways, according to their risk/return appetite and outlook. Moreover, sticking with the asset class as a core holding is rewarded over time, due to the power of carry. The end of the low interest rate era has allowed high yield to return to its previous role in a balanced portfolio.

- U291cmNlOiBJQ0UgQm9mQSBVUyBIaWdoIFlpZWxkIEluZGV4Jm5ic3A7IGFzIG9mIDMxc3QgRGVjZW1iZXIgMjAyNA==

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.