An investor's guide to high yield bonds

- 23 July 2024 (7 min read)

Fixed income is a broad universe where investments come in a variety of guises. Among other factors, fixed income securities – often referred to as bonds - vary in terms of lifespan, yields on offer, and of course risk profile. As with all investments, the higher the potential return on offer, the higher the inherent risk involved, and bonds are no exception. The general rule of thumb dictates that government-issued bonds sit at the lower end of the risk spectrum while so-called high yield, or sub-investment grade bonds, inhabit the riskier end of the credit spectrum.

Here, we explain what bonds are, what drives their value and why investors should potentially consider the high yield sector.

Why invest in bonds?

Bonds are essentially ‘IOUs’ issued by corporations and governments looking to raise money. When you invest in a bond you are lending your money for a fixed period - and in exchange, you earn a regular fixed rate of interest known as the coupon. When the bond’s term reaches maturity, the original investment, or principal is paid back to the bondholder.

Bonds can either be invested directly, or indirectly through a bond fund, which may hold a variety of fixed income assets. Individual investors are less likely to invest directly in individual bonds given the typically prohibitively high minimum investment amounts required, however. As such the vast majority will invest via a fund where a professional fund manager will pick and choose bonds to hold on behalf of investors.

The main risk associated with bond investing is that the borrower may get into financial trouble and subsequently be unable to meet interest payments, or the issuer goes bust and is unable to repay the bond. However, as a rule of thumb, bonds tend to be less risky or volatile than equities (i.e. shares). This is because creditors (bond investors) sit at a more senior level in a company’s capital structure than owners (equity investors). If a firm fails, debt holders are first in the queue for any recovery of the firm’s assets.

Risk assessment

The most common point of discussion around bonds is yields – and whether they’re rising or falling. A bond’s yield describes the return an investor gets from a bond, considering the coupon, the principal and how much an investor paid to invest. Bond prices and yields have an inverse relationship - as the price goes up, the yield decreases, and vice versa. In other words, falling yields are good for investors, as it means the value of their portfolio is rising.

The three primary drivers of bond prices - including high yield bonds - are credit risk (an issuer’s financial profile), interest rates and duration.

Credit risk

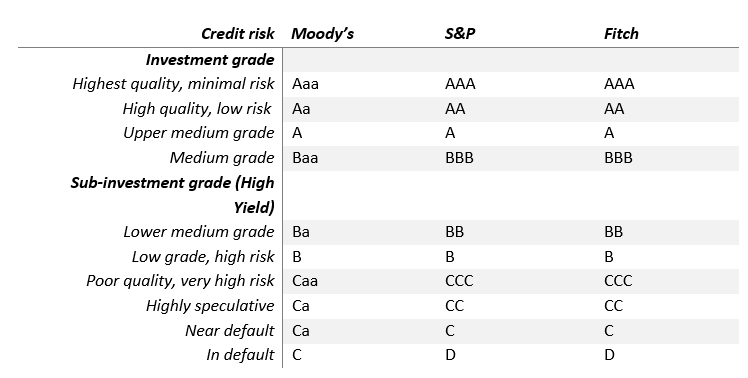

Independent bond rating agencies assign credit ratings to companies and governments based on their financial strength i.e. their ability to repay debt. A high credit rating (e.g. BBB and above for S&P) is labelled investment grade; a low rating is considered non-investment grade i.e. high yield (see chart below).

Financially-sound bond issuers are seen as more reliable than smaller, less well-known ones. Developed market government bonds e.g. those of the US, major European economies and Japan, are seen as most reliable of all. But their perceived ‘safer’ status means they also offer very conservative yields. High yield bonds typically come with greater risk and are generally more volatile with higher default risk among underlying issuers versus investment grade bonds. But high yield issuers need to pay higher interest to incentivise potential investors.

Credit agency investment ratings1

Source: Moody’s, S&P, Fitch. Credit risk definitions are not verbatim and vary slightly between agencies.

- VGhlIHJhdGluZ3MgbWF5IGJlIG1vZGlmaWVkIHRvIHNob3cgdGhlIHJlbGF0aXZlIHN0YW5kaW5nIHdpdGhpbiBjYXRlZ29yaWVzIGJ5IHRoZSBhZGRpdGlvbiBvZiAxLCAyIG9yIDMgb3IgdGhlIGFkZGl0aW9uIG9mIHBsdXMgKCspIG9yIG1pbnVzICgtKSBzaWducywgZm9yIE1vb2R54oCZcyBhbmQgRml0Y2ggcmVzcGVjdGl2ZWx5Lg==

Interest rates

If investors think rates will rise, then bond prices typically fall in value as new bonds coming to the market will offer higher coupons, reflecting the higher interest rate. Equally if interest rates fall the reverse is true – a bond’s value will rise, but its yield will drop. Bear in mind that falling yields are good news for bond investors – it means the value of their portfolio is rising; rising yields are bad news, as the value of the bonds they hold is falling.

Duration

A bond's lifespan – how long until the bond matures - is always a major consideration. Bonds with longer maturities, such as 10-20 years, are considered riskier, as long-term interest rate movements are unpredictable. Their prices are also more sensitive to changes in interest rates. The price of a 30-year bond will move more for a 1% change in interest rates than the price of a three-year bond. (Duration measures the sensitivity of bond prices to changes in interest rates). Additionally, inflation will have an impact on the principal - $100m today will be worth more than $100m in 25 years’ time. High yield bonds come with shorter maturities than many investment grade bonds (typically less than 10 years) and as such tend to have relatively lower duration. This means high yield bonds can potentially be less exposed to interest rate risk than most investment grade strategies.

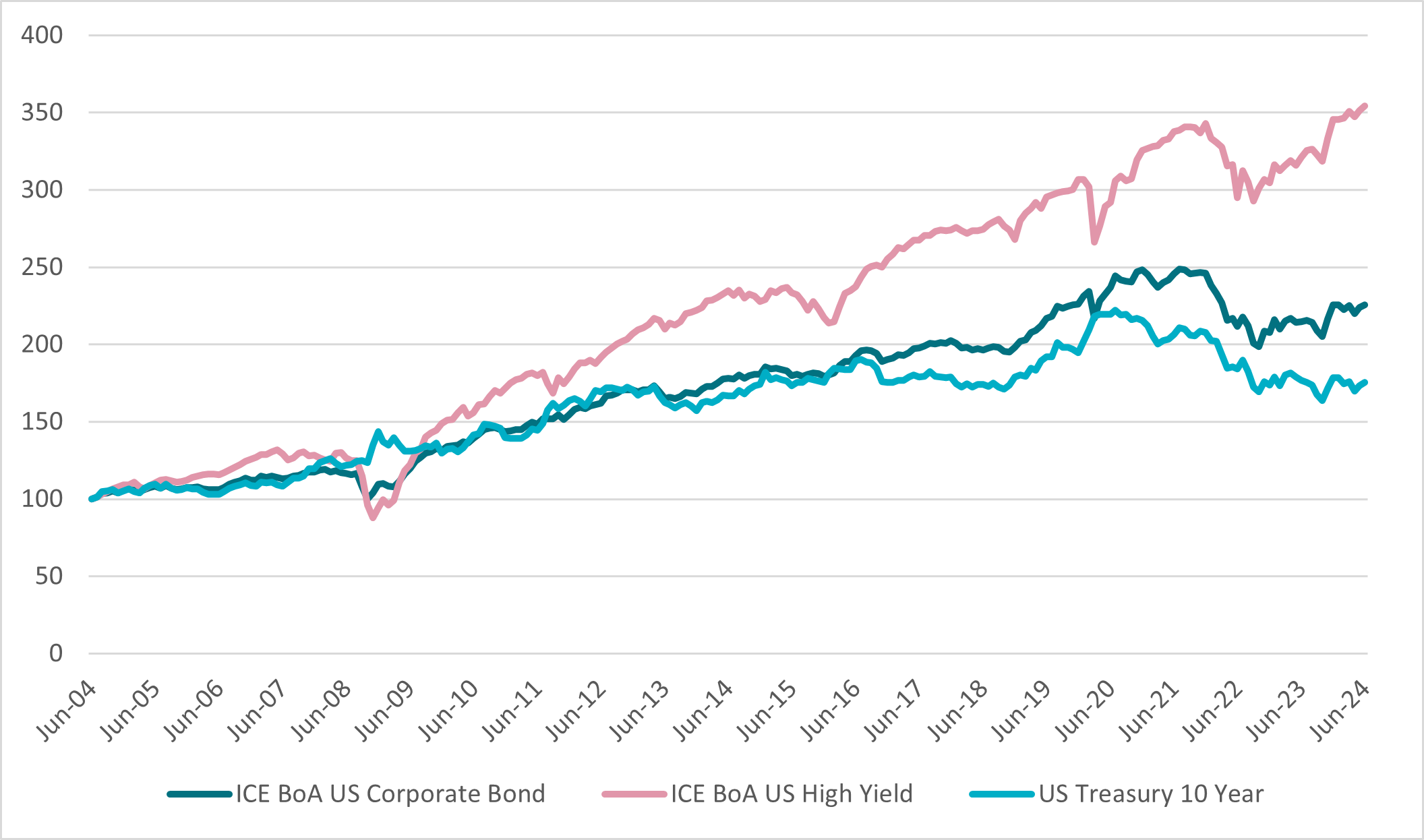

US high yield returns vs. US corporate bonds and US Treasuries

Source: ICE/BofA/Bloomberg

Why investors should consider high yield bonds

High yield bonds are among the higher income investment offerings. They are generally issued by companies which could be more capital-intensive and may have higher levels of debt – and therefore could be seen as a higher credit risk. But while they’re riskier than government and corporate investment grade bonds, they offer investors the potential for much higher rates of income. This higher income stream has the potential to offset the higher risk of principal loss. Active strategies that can minimise principal loss while still maintaining a higher income stream can potentially lead to outperforming results.

The performance of high yield bonds also tends to have lower correlation to other sectors within the fixed income market, so can provide important diversification to a broader bond portfolio and as highlighted, they can be less sensitive to interest rates. In addition, there is also the potential for capital growth. Like equities, high yield bond prices can increase because of the issuing firm’s improved performance or a wider economic upturn. In addition, the typically higher income component of high yield bonds means that they are generally less volatile than equities, but their performance is more correlated with stocks than that of longer-duration less risky investment grade corporate bonds.

The high yield bond market was born in the US and the world’s largest economy remains the largest and most liquid market. But today there is a wider, global high yield market offering potential benefits such as the diversification of Europe or the stronger growth potential of emerging markets.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© 2024 AXA Investment Managers. All rights reserved

Image source: Getty Images